The 2 ETFs That Track Congressional Stock Trades

These vehicles shed light on how Democratic and Republican members of Congress invest their money.

It’s long been speculated that our elected representatives successfully trade stocks based on privileged information. Data provider Unusual Whales built a business tracking congressional stock trades and advocating for greater disclosures and restrictions. Data from Unusual Whales, and the public reports for which their data is based, gives the public a window into the trading activity of Congress. While it comes with a laundry list of risks and peculiarities, the data gives individual investors an opportunity to copy the buys and sells of the most successful traders in Congress.¹

The below headlines show why replicating those trades may make for a compelling investment strategy.

- “Members of Congress outperformed the S&P 500—sometimes by huge amounts”—Fortune, January 2024

- “As Covid Hit, Washington Officials Traded Stocks With Exquisite Timing”—The Wall Street Journal, October 2022

- “Personal Profit in Congress”—The New York Times, January 2022

Congress and their families seem to make more money than the rest of us trading stocks. For those wanting a piece of the action, there are two exchange-traded funds that follow Democratic or Republican stock trades:

These ETFs use Unusual Whales’ database to build a portfolio of stocks in which members of Congress and their families chose to put their own money. Christian Cooper, portfolio manager for the ETFs’ sponsor, Subversive, also suggests a “congressional information filter” helps representatives avoid marginal or volatile companies. By this logic, Cooper believes both ETFs should perform better and be less volatile than traditional index ETFs like Vanguard S&P 500 ETF VOO and SPDR Dow Jones Industrial Average ETF DIA.

While the investment merit is questionable, the Subversive Unusual Whales Democratic and Republic ETFs tell interesting stories. Several trends reveal themselves when examining track records, portfolios, and related research.

Are Members of Congress Good at Picking Stocks?

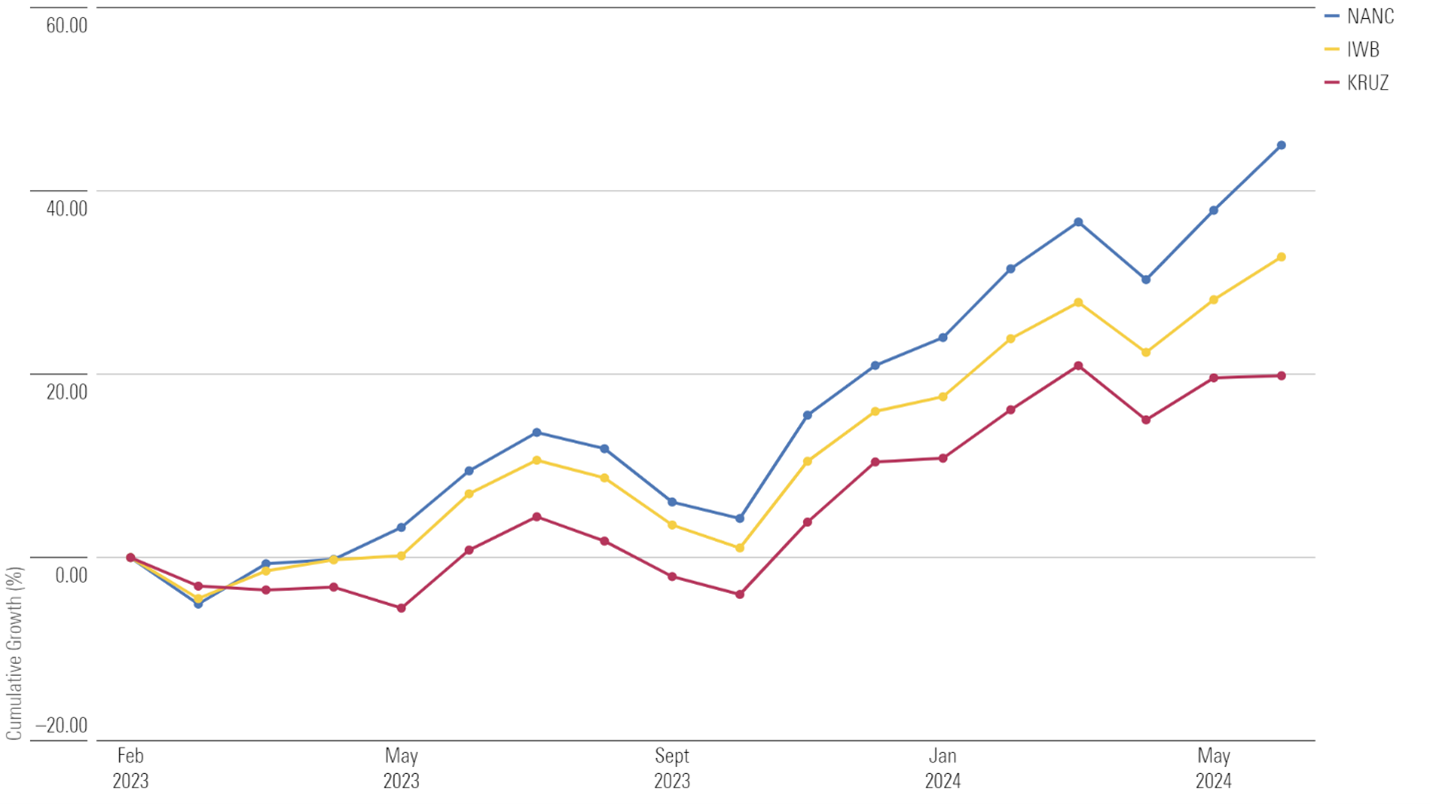

Both are relatively young ETFs, but Subversive Unusual Whales Democratic ETF holds an early advantage. It returned 45%, while Subversive Unusual Whales Republican ETF returned 20% from their February 2023 inception through June 18, 2024. Subversive Unusual Whales Democratic ETF outpaced iShares Russell 1000 ETF by more than 11 percentage points, while Subversive Unusual Whales Republican ETF lagged by 13. Both were more volatile than iShares Russell 1000 ETF, a broad-based US stock index ETF.

Democrats Take the Early Lead

Source: Morningstar Direct. Data as of June 18, 2024.

Academia has also tried its hand at estimating the portfolio returns of various politicians. Findings from these reports are mixed but may give an indication for the long-term viability of the investment thesis behind these two ETFs.

Early research supported the thesis, while recent studies dispute it. A 2004 report found that US senators beat the stock market by an average of 12% per year in the 1990s.² Public interest surrounding congressional stock trading grew following the report, culminating in the Stop Trading on Congressional Knowledge Act of 2012, a bipartisan bill prohibiting insider trading by members of Congress. While Unusual Whales suggests that some congresspeople still outperform the market, Dartmouth College found “no evidence of stock-picking prowess” in its 2022 paper.

The performance of the two ETFs depends on the stock-picking prowess of congresspeople and the ability of each to replicate that prowess. Their success then arguably rests on the effectiveness of the Stock Act [3]. If the law works as intended and congresspeople lose their edge, these ETFs may not endure. And even if they maintain an edge, there’s appetite for harsher legislation that could render the two ETFs obsolete. In 2023, legislation was proposed supporting a total ban on congressional stock trading.

Only time will tell if members of Congress (a) remain good stock-pickers, (b) can still trade stocks, and if (c) the two ETFs prove effective vessels for capturing their outperformance. A lot must go right for these ETFs to reliably outperform the market.

What Stocks Does Congress Own?

Whatever you think of the stock-picking prowess of Congress, or these two ETFs’ ability to capture it, the portfolios represent a useful snapshot into the financial interests of our elected representatives. Each ETF weights its holdings based on total money invested by each party, so they should be a good approximation.

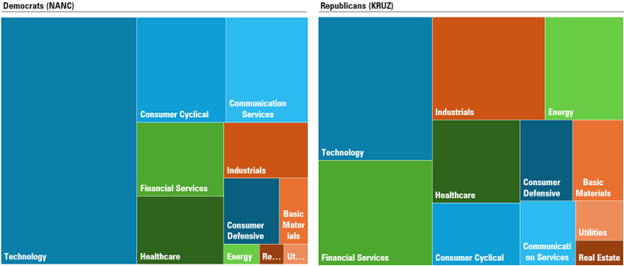

Democrats favor technology and other high-growth stocks, while Republicans also own technology stocks but generally favor energy, industrial, or financial companies. Below is a snapshot of the sector allocations for each portfolio.

Financial Interests of Congress, Visualized

Source: Morningstar Direct. Data as of May 31, 2024.

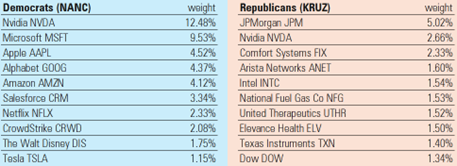

Allocations by party line are largely predictable, but overlap in the portfolios is notable. Neither Democrats nor Republicans can stay away from market darling Nvidia NVDA, which is a top-two holding in each. In fact, by May’s end, nine of Subversive Unusual Whales Democratic ETF’s top 10 holdings were also owned by the Republican-focused ETF.Democrats’ heavier stake in high-growth stocks like Nvidia, Microsoft MSFT, and Apple AAPL helped fuel the Democrat-focused ETF’s early lead.

Top Stocks Owned by Democrats and Republicans

Source: Morningstar Direct. Data as of May 31, 2024.

Portfolio tendencies of each ETF will help steer returns. Subversive Unusual Whales Democratic ETF leans growth, and Subversive Unusual Whales Republican ETF leans value. The largest technology stocks in the market will determine the Democratic-focused ETF’s fate, while the Republican-focused ETF’s performance will be shaped by a more even allocation of financial, industrial, and some technology stocks. Still, with these ETFs, there’s much more to consider than just portfolio characteristics.

ETF Investing Considerations

These ETFs are just two pieces of the puzzle when it comes to untangling the web of congressional stock trades and their financial interests. Their portfolios are useful for understanding where members of Congress choose to invest their money, but the jury is out on their long-term investment merit. Here are a few key takeaways for ETF investors considering one or both:

- Members of Congress may or may not outperform the market, depending on whom you ask. In the early innings of these ETFs, Democrats appear to be savvier traders.

- Portfolio changes in these ETFs are not driven by market forces or a rules-based investment process, but rather on the unknowable motives of 535 people in Washington—these motives could be economic or not, or lawful or not.

- If Congress has an edge, it may be impossible to replicate. Data used to construct these portfolios is imperfect. Trading disclosures are self-reported and delayed and lack exact amounts.

- Congress is under pressure to ban stock trading by its members. If signed into law, these ETFs could be no longer.

The two ETFs are fascinating case studies. But I caution investors who look at them as anything more. These are thematic investments. While the theme is unique, and an argument could be made for its economic rationale, the same is often said of other thematic investments. Morningstar research repeatedly shows that investors rarely realize the full benefit of thematic funds and ETFs.

Speculating in either of these ETFs is risky for the reasons outlined above. If taking one or both off the shelf, be sure to understand its portfolio characteristics, performance drivers, and the limitations of its investment process.

¹Trading data is based on Periodic Transactions Reports, which may be up to 45 days delayed. Unusual Whales does not recommend trading on any political-based portfolios.

²An updated report, published in 2011, still found that House members outperformed the market, though their advantage shrunk to around 6% annualized.

³The theory goes: Members of Congress are too busy with their day jobs to moonlight as stellar investment managers. Therefore, if an edge exists, it exists on a violation of the STOCK Act. Without inside information, members of Congress should be no better at picking stocks than an amateur investor. Morningstar research shows that even professional investors do well to outperform the market half the time.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UEU7ZJHEKBDGBHFL6N73M24EYY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)