Avoid RMD Shortfalls With These 5 Top Rules on Life Expectancy

How to use the right life expectancy table to calculate RMDs for inherited IRAs.

Beneficiaries must take required minimum distributions from their inherited IRAs. When the RMD is an annual obligation, the Single Life Expectancy Table must be used to identify the denominator for the RMD calculation. In some cases, adjustments must be made to determine the life expectancy factor for a year. Beneficiaries must know when adjustments are required and ensure they are applied.

Please note: These rules also apply to employer plans.

When the Life Expectancy Rule Does Not Apply

There is no calculation if the IRA owner dies before their required beginning date and the five-year or 10-year rule applies. Instead, the only requirement is that the inherited IRA be fully distributed by the end of the applicable period (five or 10 years). There is no RMD calculation because there is no annual RMD requirement. Therefore, the life expectancy table would not be used in such cases.

For IRAs inherited before 2020 from an IRA owner who died before the RBD, the five-year rule would apply if the beneficiary were not a designated beneficiary, such as an estate or charity, or if the beneficiary is a designated beneficiary who is subject to the five-year rule under the terms of the IRA agreement.

For IRAs inherited after 2019 from an IRA owner who died before the RBD, the five-year rule would apply if the beneficiary were not a designated beneficiary, such as an estate or charity. The 10-year rule will apply if the beneficiary is a designated beneficiary or an eligible designated beneficiary who is subject to the 10-year rule under the terms of the IRA agreement.

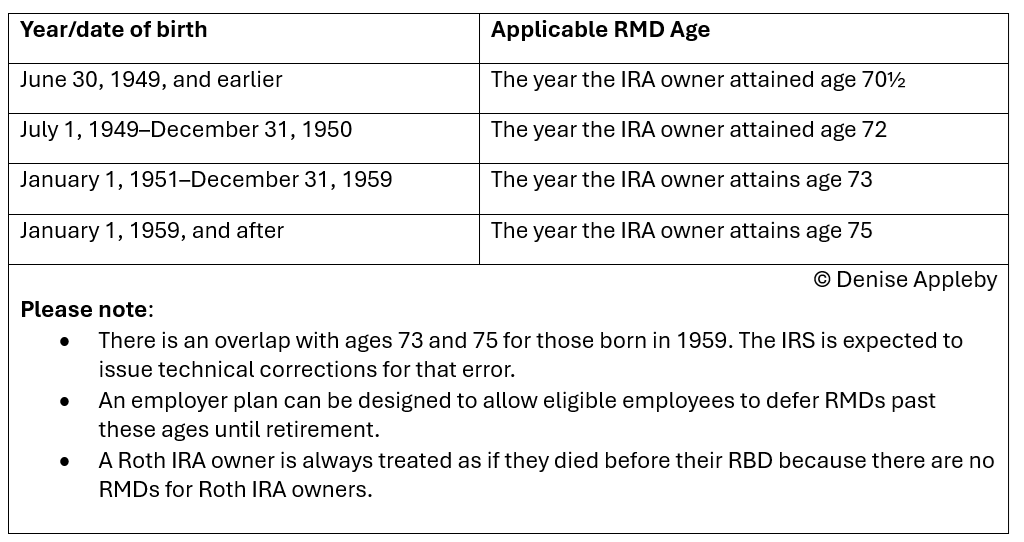

The RBD is April 1 of the year, which follows the year the IRA owner reaches their applicable RMD age. The applicable RMD ages are as follows:

Applicable RMD Ages

Let’s review the top five rules for the Single Life Expectancy Table.

1. The Single Life Expectancy Table Is Used for Beneficiary Accounts

While there are three Life Expectancy Tables (See Appendix B of IRS Publication 590-B), the Single Life Expectancy Table is the one that must be used to calculate RMDs for beneficiary IRAs.

2. The Life Expectancy Is Recalculated Only for Certain Spouse Beneficiaries

If the IRA owner’s spouse is the sole primary beneficiary of their IRA, the life expectancy for the surviving spouse is recalculated by visiting the table each year to determine the life expectancy. For example, if the spouse beneficiary is 57 years old this year, her life expectancy would be 29.8. To determine her life expectancy for next year, the table will be revisited to find her life expectancy factor for age 58.

In all other cases, the life expectancy is not recalculated. Instead, one is subtracted for each year after the year of determination of the life expectancy factor. For example, if a nonspouse beneficiary’s life expectancy in the year of determination (see below) is 41.9, the life expectancy for the following year would be 40.9 (but see number four below for an exception).

3. The Year of Determination Depends on Whose Life Expectancy Is Used

When determining the life expectancy factor for a beneficiary account, one must know the year in which the life expectancy factor is first determined. The year of determination is based on whose life expectancy is used. The following is a high-level summary:

- The IRA owner died before their RBD: The eligible designated beneficiary (“designated beneficiary” for IRAs inherited before 2020) who takes distributions over their life expectancy would determine their life expectancy in the year that follows the year in which the IRA owner died. And one would be subtracted for each subsequent year.

- The IRA owner died on or after their RBD: The beneficiary’s life expectancy is used if the beneficiary is a designated beneficiary or an eligible designated beneficiary younger than the IRA owner. It would be determined in the year that follows the year in which the IRA owner died. If the beneficiary is an eligible designated beneficiary who is older than the IRA owner or a beneficiary who is not a designated beneficiary or a nondesignated beneficiary, the life expectancy of the IRA owner would be used. It would, therefore, be determined in the year of the owner’s death.

4. The New Life Expectancy Table Must Be Used as of 2022 and Adjusted for Nonrecalculating Beneficiaries

The life expectancy tables were updated for calculations done for 2022 and after. Except for spouse beneficiaries who recalculate their life expectancies, those who inherited IRAs before 2021 must adjust their life expectancy factors to catch up to the new life expectancy table.

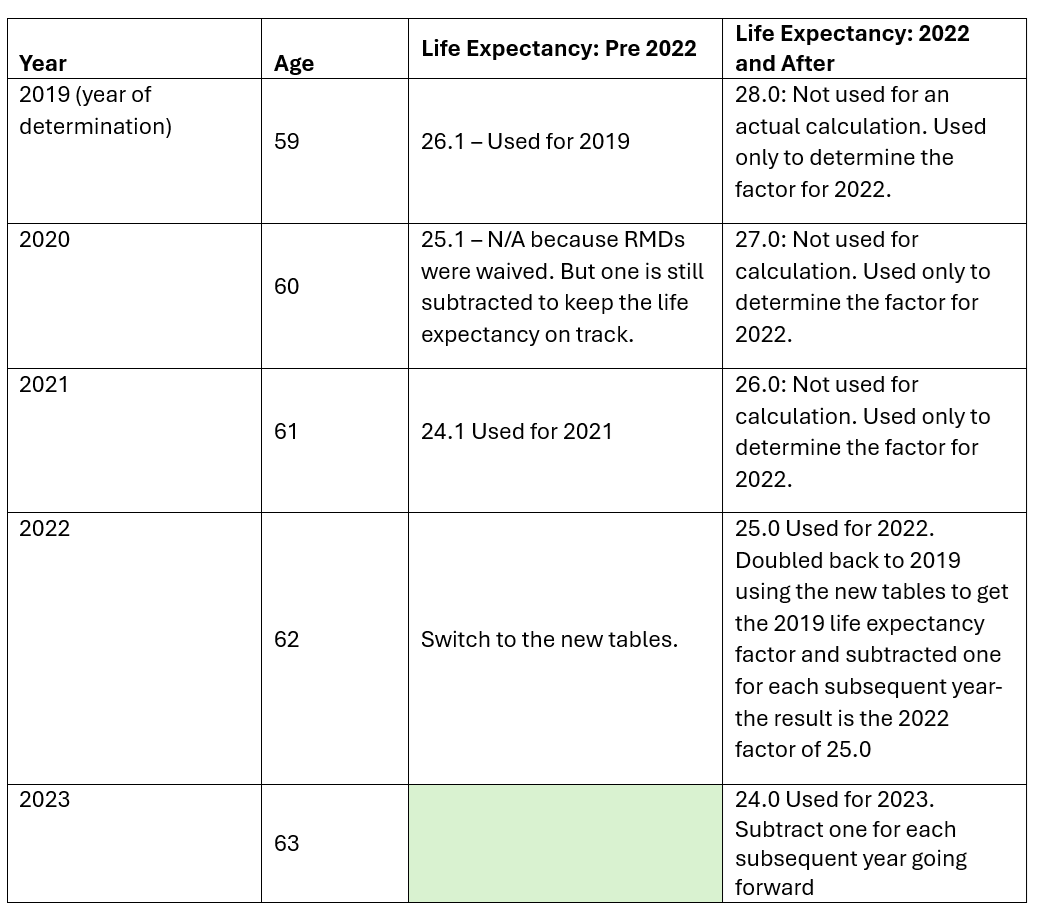

Example:

John inherited a traditional IRA from his sister in 2018. John, having been born in 1960, was age 58 in 2018. John’s sister, Sally, was age 68 when she died, which means she died before her RBD.

John’s distributions were based on his single life expectancy.

Because John is a nonspouse beneficiary, his life expectancy is nonrecalculated. His life expectancy would be determined in 2019—when he was age 59—the year after Sally’s death, and one will be subtracted for each subsequent year. At age 59, John’s life expectancy would have been 26.1 (see Page 46).

As required by the final regulation that updated the life expectancy tables, John’s life expectancy was adjusted as of 2022. This adjustment is accomplished by using the new Single Life Expectancy Table to determine his life expectancy in 2019 and subtracting one for each subsequent year. This adjustment affects only his RMDs for 2022 and after. The following is a demonstration.

Demonstration of New Single Life Expectancy Table

5. There Are No Adjustments When RMDs or the Excise Tax Is Waived

Congress waived RMDs for 2009 and 2020. As a result of these waivers, there were no RMDs for those years. Beneficiaries subject to the five-year rule had their five-year period extended to six years if 2009 or 2020 would have been counted in the five years. There are no adjustments for beneficiaries who must take annual RMDs.

Example 1: Carey inherited an IRA from her 65-year-old uncle, Tom, in 2018. Under the terms of the IRA agreement, Carey was subject to the five-year rule, which means distributions were optional until the end of 2023 when the account had to be fully distributed.

Because the Cares Act waived RMDs for 2020, Carey’s five-year period got an extension of one year, giving her until the end of 2024 to fully distribute her inherited IRA.

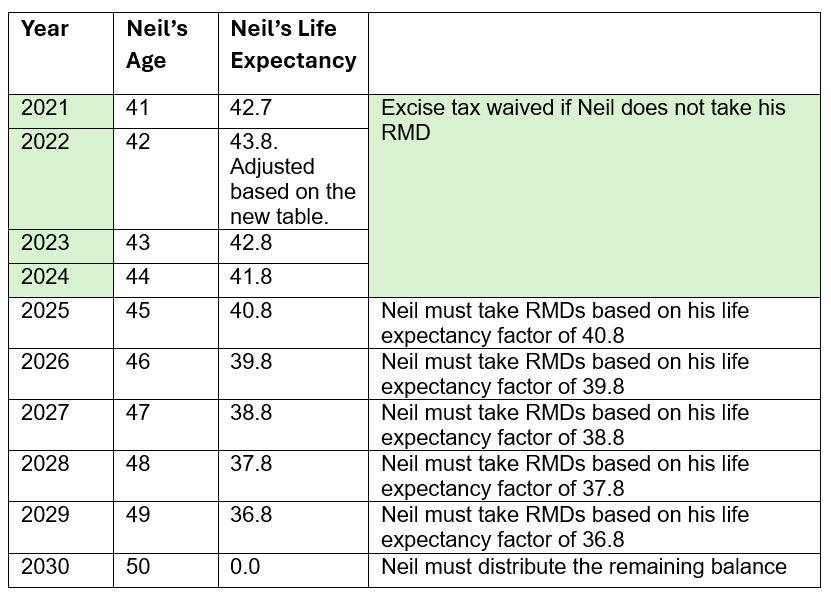

Example 2: Neil inherited a traditional IRA from his 74-year-old aunt, Ethel, in 2020 when he was 40. Neil is not disabled, chronically ill, and is more than 10 years younger than Ethel, which makes Neil a designated beneficiary who is not an eligible designated beneficiary. Neil is, therefore, subject to the 10-year rule (he’s a 10-year beneficiary). Under the 10-year rule, Neil must fully distribute his inherited IRA by the end of 2030. Additionally, because Ethel died after her RBD, Neil must take annual RMDs over his single life expectancy beginning in 2021.

- Neil was 41 in 2021, making his life expectancy 42.7 under the old Single Life Expectancy Table.

- In 2022, Neil’s life expectancy was switched to the new table (see above), making it 43.8 instead of 41.7.

The IRS waived the excise tax on RMD failures from 2021 to 2024 for beneficiaries like Neil. Neil takes the opportunity and does not take RMDs for 2021 to 2024.

Neil cannot adjust to his life expectancy because there is no adjustment allowed regardless of whether the RMD excise tax is waived.

When Neil resumes his RMDs in 2025, he must use his life expectancy of 40.8, determined as follows.

Neil's Life Expectancy for RMDs

The Life Expectancy Table Is a Guide to the Minimum, but Sometimes More Is Better

The Single Life Expectancy Table is used to determine the denominator used when calculating an RMD for a year. The numerator is the fair market value of the inherited IRA for the end of the preceding year. These rules are just five of the many that apply when calculating RMDs for inherited IRAs and employer plan accounts, and beneficiaries must work with advisors proficient in this area so as to avoid RMD shortfalls.

While identifying the RMD amount helps to ensure that the beneficiary avoids the 25% excise tax by meeting their minimum obligations, a beneficiary’s tax advisor may recommend that more than the RMD is taken for a year when it is tax-efficient to do so. Regardless of the distribution strategy employed, care must be taken to ensure that the correct denominator is used when calculating any RMDs.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Denise Appleby is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-25-2024/t_f8ae5dc770f14b3d8f21379e20cb1857_name_file_960x540_1600_v4_.jpg)