5 Steps for Using an AI Strategy in Your Practice

Generative AI can help you defeat financial jargon.

As a financial advisor, you already know generative AI is not going to take your job from you. After all, we’ve seen financial advisors survive the proliferation of robo-advisors, and the job of financial planning is more human-centric than ever.

If anything, generative AI can help make financial advisors better at their jobs.

There’s been a lot of chatter about how advisors can incorporate generative AI into their work, and although many are interested, it may not be apparent where to start or what specific benefits it can provide.

Generative AI Can Help Demystify Jargon to Clients

Financial jargon can often feel like a necessary evil when talking with clients, but when advisors don’t take the time to clarify meaning, it can cause clients to disconnect from the financial planning process. Jargon can also make it difficult for clients to understand what vehicles they are investing in, which may lead to poor decision-making.

However, it’s not easy to interpret jargon for clients. For one, there’s the curse of knowledge, which means that it’s hard for us to remember what it’s like not to know something once we know it. Second, it can be difficult to explain technical concepts to a nonexpert without seeming patronizing.

This is where generative AI (like ChatGPT or Morningstar’s Mo) can help.

Generative AIs are very good at adjusting tone, meaning they can write well for whatever audience you specify. This makes it an invaluable tool for those looking to refine their messaging to a certain audience, such as for clients.

That said, this isn’t a recommendation to simply prompt a generative AI with something like, “Explain value investing to my clients” and then regurgitate it at your next client meeting.

Why? Well, for one, AI is not infallible. It can “hallucinate,” meaning that it can make up information, so AI responses should always be evaluated by a human for accuracy. But also, unless you’ve taken the time and effort to train the AI on a corpus of your own work, it’s not going to have your unique voice that your clients are there for.

For these reasons, it’s important to treat AI as a tool that you supervise, instead of just accepting its output at face value (a practice often referred to as human-in-the-loop). To that end, we have developed a process to help you solicit and revise explanations of jargon to clients.

5 Steps for Using AI to Translate Information for Your Clients

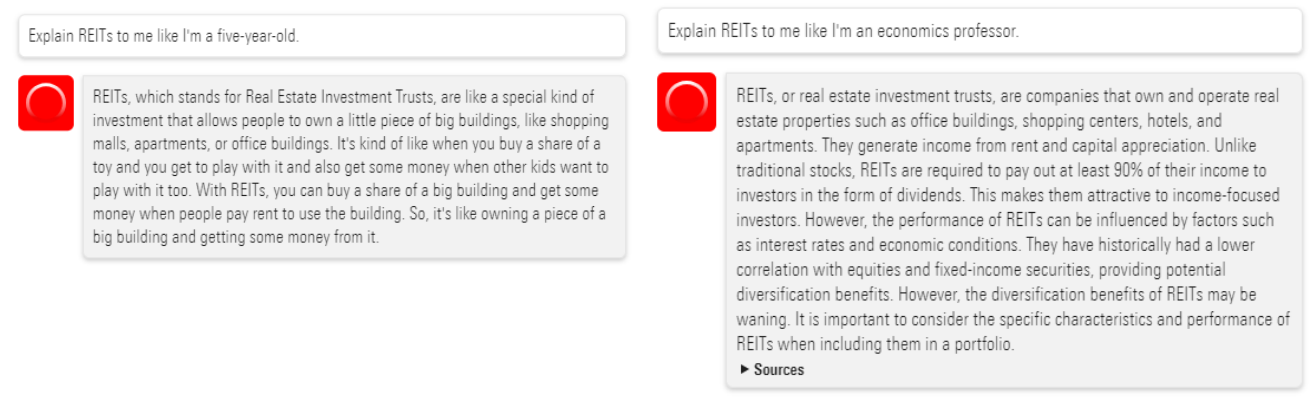

- Step 1: Ask the AI to generate two levels of explanation—one too simple for your clients and one too complex. In our example, we asked Morningstar’s Mo to explain REITs to us in two ways: as if we are five years old (too simple) and as if we are a professor of economics (too complex).

Mo-Produced Explanations of REITs

- Step 2: Check the responses for accuracy. Remember that as good as generative AI is, it will make mistakes from time to time. Review the responses to ensure there are no hallucinations (this also gives you the chance to brush up on your own knowledge, if needed). In this example, we don’t see any hallucinations in either explanation.

- Step 3: Identify the strengths and weaknesses of both explanations. This gives you the chance to take what the generative AI has done well and use it for yourself while leaving the bad behind. For this example, I like that the simple explanation is so succinct and how it uses simile to illustrate REITs in a tangible way, though I’m not a fan of using the immature, child-directed language toward clients. On the other hand, I like that the complex explanation identifies benefits of REITs like diversification, but I don’t like that it provides more detail about these benefits than clients will likely need or want.

- Step 4: Fill in the gaps. After seeing the AI’s responses, you may feel there are points missing from the explanations particular to your clients. I think these explanations could benefit from a few sentences that are client-specific, such as how REITs fit into their financial goals and their risk tolerance, given how important this personalization is for successful financial planning.

- Step 5: Craft your own messaging. Now it’s time to put it all together. Write your own explanation by combining the strengths you identified in Step 3, the gaps you identified in Step 4, and your own voice (after all, your clients hired you for a reason).

After your first foray into using generative AI in practice, you may start to think of other good uses for it. But along the way, ensure you stay deeply involved in the specifics and keep your invaluable human expertise at the forefront.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2TUAYYD4PVBTFEBHVOLROKDOY4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-27-2024/t_2194d771c3f04756b6635f949463d5c6_name_MIC_24_Kunal_Kapoor_Speaker_1920x1080.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)