Basic Materials: Following Index Decline, We See Many Long-Term Opportunities

Our top picks in this sector are Albemarle, Nutrien, and International Flavors & Fragrances.

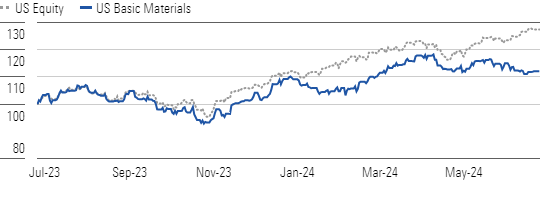

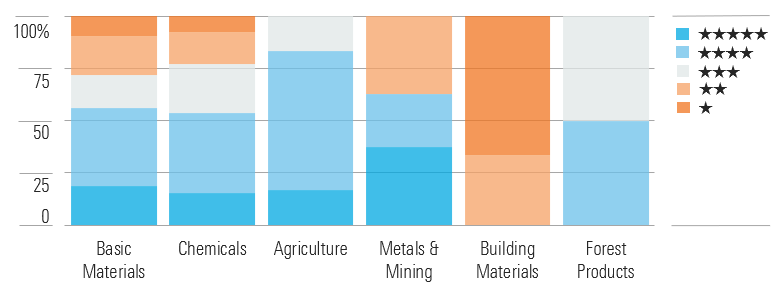

The Morningstar US Basic Materials Index fell 500 points during the second quarter of 2024, underperforming the market by over 800 basis points. In metals and mining, as well as agriculture, we attribute the decline to falling commodity prices. In chemicals, the decline was due to slow demand recovery following inventory destocking in 2023 and early 2024. However, we see opportunities across the sector, with 60% of the stocks trading in 4- or 5-star territory.

The Basic Materials Index Fell, Underperforming the Rising Broader Market Index

Nearly 60% of Our Basic Materials Stocks Trade In 5-Star or 4-Star Territory

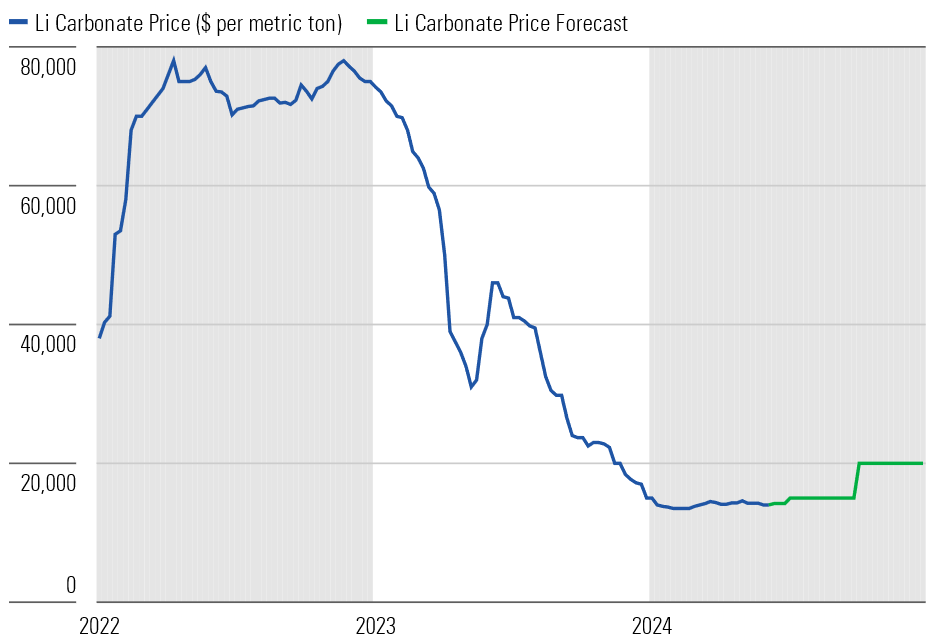

Lithium demand will grow over 2.5 times from 2023 to 2030 as electric vehicles rise from 12% to 40% of global auto sales. Over the long term, we view lithium as one of the best ways to invest in rising EV adoption, as all EV batteries require the metal. Since late 2022, lithium prices have fallen over 80% because of inventory destocking among battery producers, as well as supply growth. Prices have stabilized, and lithium currently goes for around $14,000 per metric ton. However, as destocking ends, sales volumes will match solid end-market demand. We expect EV sales growth in 2024. Combined with supply cuts, we bprices will rise in the second half of 2024.

Lithium Prices Have Stabilized, but We Expect a Rise In the Second Half of 2024

Demand for specialty ingredients fell in 2023 because of customer inventory destocking, leading to revenue declines. This led to lower plant capacity utilization and generated negative operating leverage, creating outsize profit declines. For flavors and fragrances (a business with some of the strongest pricing power in ingredients), we expect a solid profit recovery in 2024.

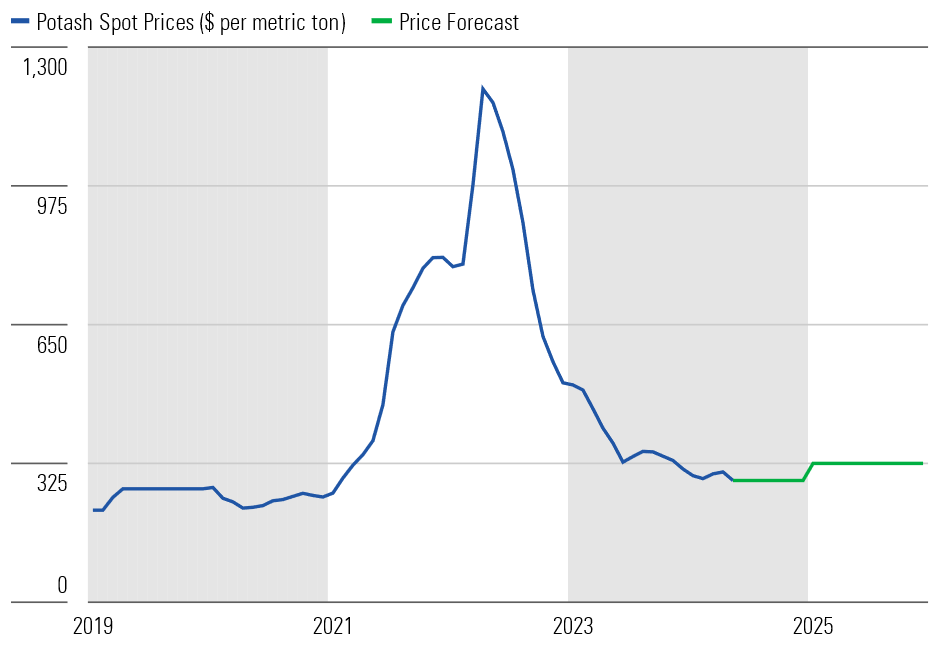

Potash prices have fallen over 75% since reaching an all-time high in April 2022. The rapid rise was driven by a supply shock from the temporary disruption of exports from Belarus and Russia due to US and EU sanctions. As global potash trade shifted, supply returned, but farmers also temporarily reduced potash application in response to the lack of supply. As supply returned faster than demand, prices overcorrected. While we forecast potash prices will reach a cyclical low in 2024, we see prices rising in 2025.

Potash Prices Are Back to Historical Levels; We Forecast Prices Will Rise In 2025

Top Basic Materials Sector Picks

Albemarle

- Fair Value Estimate: $275.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Albemarle ALB is our top pick to play strong lithium demand and rising prices from growing EV adoption. The stock trades at less than 60% of our $275 fair value estimate. Albemarle’s main business is lithium, which generated roughly 90% of profits in 2023. The company produces lithium from three of the best resources globally, which creates the cost advantage that underpins our narrow moat rating. While the company did issue equity earlier in the year to bolster its balance sheet, it should now be able to maintain a solid financial position even as lithium prices are at a cyclical low. We point to rising lithium prices in the second half of the year as a catalyst for shares.

Nutrien

- Fair Value Estimate: $70.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Nutrien NTR is our top pick to invest in higher potash prices. The stock trades at a little over 80% of our $70 fair value estimate. Potash is Nutrien’s largest business, generating nearly 40% of companywide EBITDA in 2023. The company also sells nitrogen and phosphate, and it’s the largest agricultural retailer in the US and Australia. As potash prices recover and retail profits rebound, we forecast Nutrien will see long-term profit growth.

International Flavors & Fragrances

- Fair Value Estimate: $130.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

International Flavors & Fragrances IFF is our top pick to invest in recovering demand for specialty ingredients. The stock trades at a little more than 70% of our $130 fair value estimate. The firm saw profits decline in 2023 because of inventory destocking across its specialty ingredient end markets, including flavors, fragrances, enzymes, and culture. However, all the specialty businesses have started to see recovery, driving improved sales and profits. We point to recovering profits as a catalyst for shares in 2024.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-02-2024/t_6b25eabdd47c4e2bb51fbb816a658179_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)