A Cautious Fed Eyes Just One Rate Cut In 2024

We think inflation will improve, allowing the Fed to lower rates twice this year.

The Federal Reserve is now calling for only one interest rate cut in 2024. But their forecast is likely overly cautious, and we think there will be two or more cuts this year.

As was widely expected, the Fed kept the federal-funds rate unchanged at a target range of 5.25%-5.50% at its June meeting. At the start of the year, markets expected rate cuts to be in full swing by this point. However, cuts have been delayed because of inflation’s upward surprise in early 2024.

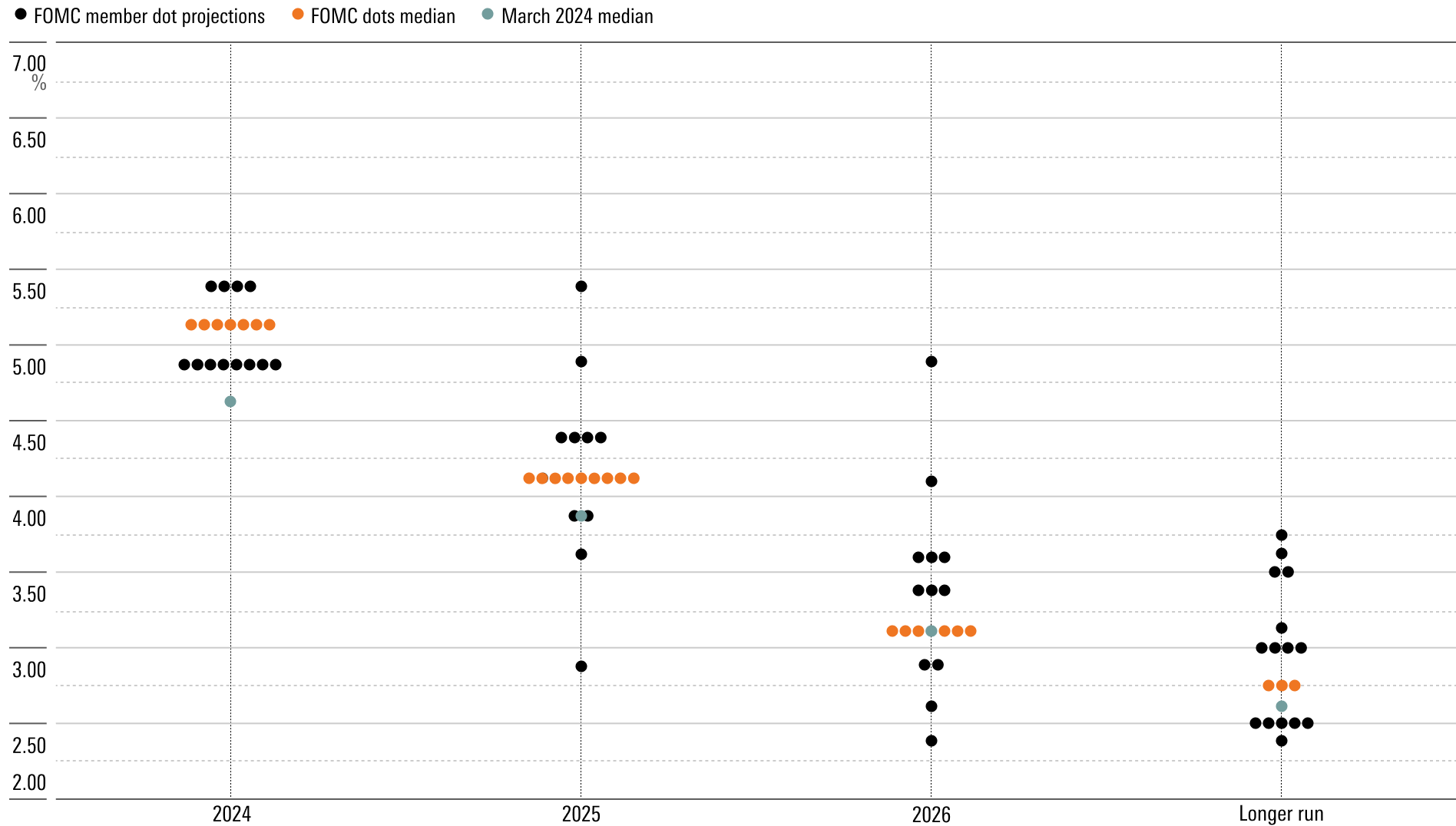

More newsworthy are the new economic projections from the Federal Open Market Committee, last updated at the March meeting. The Fed is now expecting a December 2024 federal-funds rate of 5.1%, implying one 0.25% cut from current levels. By contrast, in March the Fed called for a 4.6% rate, implying three rate cuts.

The Dot Plot: Federal-Funds Rate Target Level

Inflation shot up in the first quarter after being subdued in the second half of 2023. Core PCE inflation reached 4.4% annualized in the three months ending in March 2024, compared with 1.9% annualized in the six months ending December 2023.

More recently, however, inflation has started to cool again, with core PCE inflation falling to 2.8% annualized in the three months ending in May (our estimates for May itself are based on CPI data). Suddenly, a benign environment for inflation could be returning, with the first-quarter uptick an aberration.

Today’s Fed’s press release acknowledged “modest further progress toward the Committee’s 2 percent inflation objective” in recent months—a shift in language from “a lack of further progress” noted in the May meeting’s press release. Still, the Fed upped its forecast for core PCE inflation in the fourth quarter of 2024 to 2.8% year over year, from 2.6% during the March meeting. This largely accounts for why the central bank has shifted to calling for just one rate cut rather than three in 2024.

It’s unclear to what extent today’s CPI news was reflected in the latest Fed projections. Chair Jerome Powell mentioned that FOMC members can alter their forecasts post-release, but “most” generally don’t. The inflation projections imply a roughly 2.5% annualized core PCE inflation rate in the final six months of 2024, by our estimates. That marks no progress compared with the 2.5%-2.6% year-over-year core PCE inflation rate likely for May.

That’s too pessimistic, in our view. Instead, we see core PCE inflation at 1.7% annualized in the last six months of 2024, setting up for a year-over-year rate of 2.4% in the fourth quarter of 2024. If our inflation forecast plays out, the Fed should cut two or three times in 2024, rather than just once. We expect the first cut in September.

Federal-Funds Rate Target Expectations for September 18, 2024 Meeting

The Fed also upped its projections for the longer-run, or “neutral,” estimate of the federal-funds rate to 2.8% from 2.6% in March. For years, this estimate had been anchored at 2.5%. FOMC members have gradually reconsidered this estimate over the past year. The neutral federal-funds rate is a theoretical concept marking the interest rate that allows the economy to grow in line with its potential. In such a state, both parts of the Fed’s dual mandate (full employment and 2% inflation) should be fulfilled in the long run.

The resilience of economic growth over the past two years in the face of elevated interest rates has led some to speculate that the neutral rate has risen. If the Fed revises its estimate of the neutral rate sufficiently, this could alter the ultimate trajectory for the federal-funds rate. For now, however, the Fed’s projection for the federal-funds rate in December 2026 is still at 3.1%, unchanged from last meeting.

Powell acknowledged there is much debate about whether the recent compatibility of solid economic growth with higher interest rates is temporary or a longer-lasting shift. The neutral rate of interest is thought to reflect slow-moving forces in the economy, such as demographics and long-run projectivity growth. In our view, the neutral rate federal-funds rate is probably still close to its low prepandemic state; we assess it at around 1.75% (in nominal terms), close to the Fed’s erstwhile assessment of 2.5%. Indeed, we expect the federal-funds rate to reach a target range of 1.75% to 2.00% by year-end 2026.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XF7WENSYN5BFBFLPPFH7BJYUHE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)