Consumer Cyclicals: Even With Anxiety Over Spending, We See Attractive Valuations

Top picks in this sector include Hanesbrands, VF Corp, and Polaris.

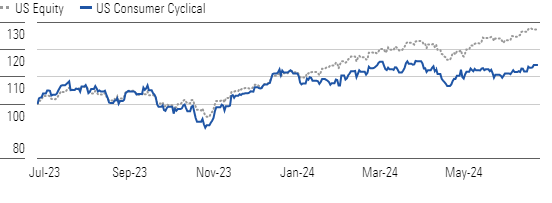

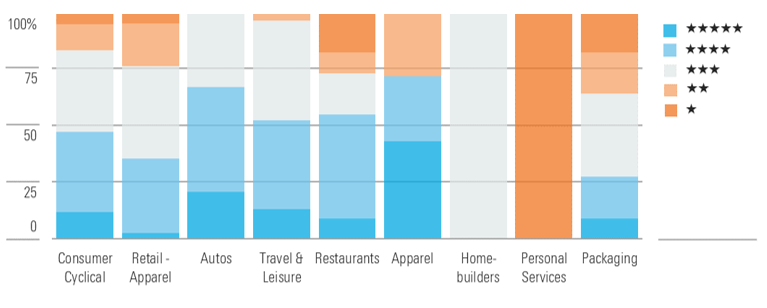

The Morningstar US Consumer Cyclical Index declined 1.2% in the second quarter, lagging the market’s 3.4% rise. Despite the relatively downbeat sentiment, we see compelling investment opportunities, as the median stock in the sector trades at an 11% discount to its fair value estimate, and nearly 50% of our coverage trades within 4- or 5-star territory.

Consumer Cyclical Stocks Stumble Despite Broader Market Gain In Q2

Delving deeper, we think apparel is the most undervalued sector, with the average stock trading 25% below our intrinsic valuation. We suspect investors remain wary of the effects of macroeconomic pressures on consumer spending habits amid depleted personal savings, but we believe these concerns are already more than baked into share prices.

Threads of Opportunity Remain In the Apparel Manufacturing Sector

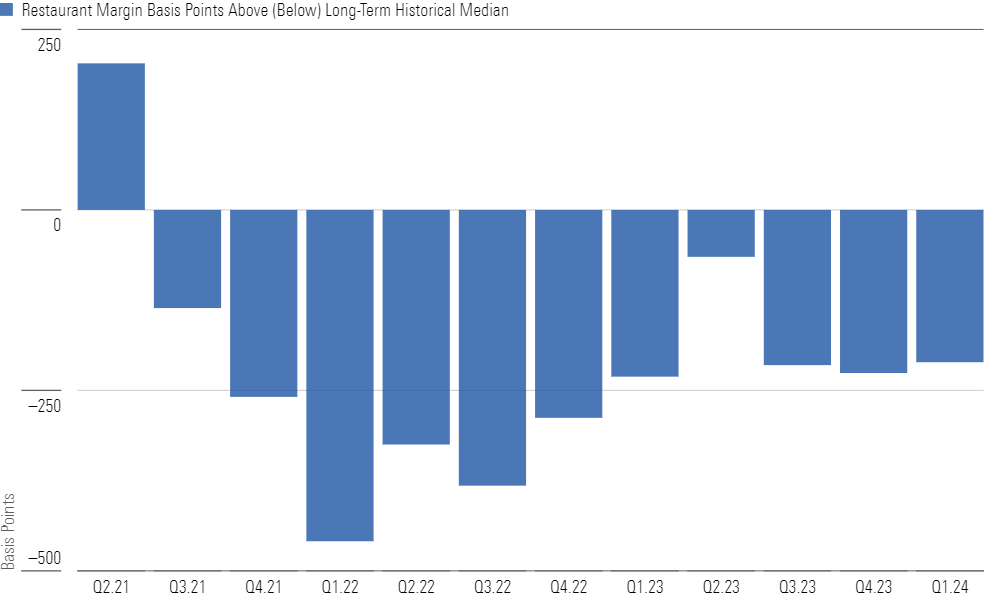

Apparel firms aren’t the only businesses feeling the heat. Restaurant operators have also gotten cooked. This can be seen in dented restaurant-level margins, initially a byproduct of lofty food and labor inflation in 2021. And while some relief arrived in 2023 from cost stabilization and price increases, higher menu prices haven’t been sitting well with financially strained consumers lately. Some restaurants have offered promotions to curb traffic declines, as consumers have opted for at-home meal consumption. As a result, the average margin remains compressed, sitting 211 basis points below the median before the pandemic as of the first quarter of 2024.

Restaurateurs Struggle as Traffic Dips and Promotions Squeeze Margins

Despite this, we believe operators are taking steps to extract efficiencies, enhance value offerings, and juice innovation, leading to a reversion to pre-pandemic margins in 2025. We favor brands with robust loyalty programs that can personalize offers rather than resort to indiscriminate discounting to lead the recovery.

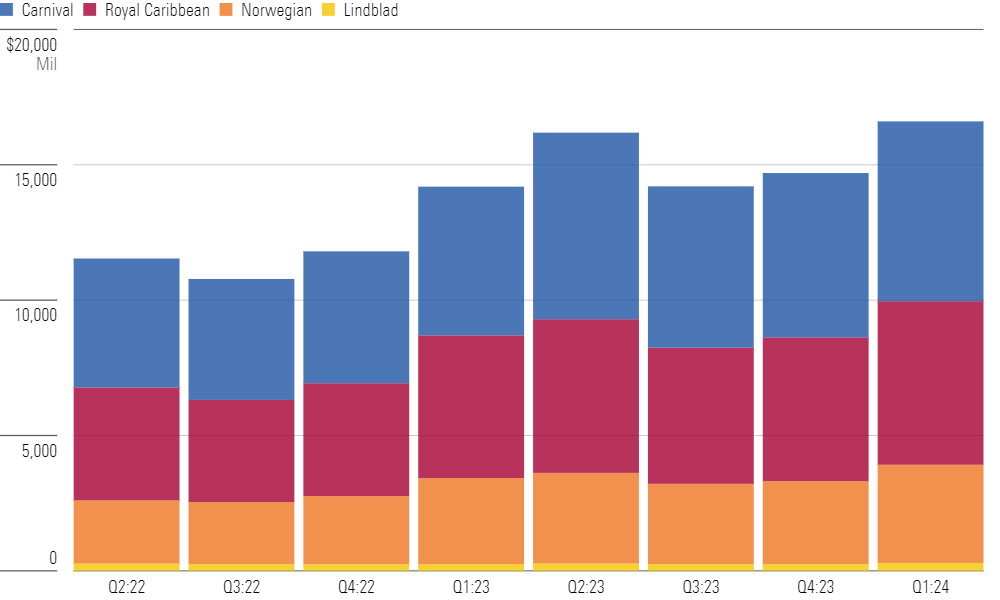

Cruise Lines Sail Smoothly With Robust Advance Ticket Sales

But even as consumers shun restaurants, we believe travel demand remains healthy as they continue to compensate for past constraints and adapt to remote work flexibility. Specifically, we expect growth from business and group trips, international visits, and leisure excursions by sea. As evidence of persistent demand, cruise advance deposits for four public operators soared to nearly $17 billion in the first quarter—a 17% rise from last year and surpassing fourth-quarter 2019′s $10 billion. We posit the booking growth speaks to cruise lines’ appeal across generations and the perceived value due to its all-inclusive nature and proximity to metropolitan ports.

Top Consumer Cyclical Sector Picks

Polaris

- Fair Value Estimate: $145.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

Trading at a roughly 45% discount to our $145 fair value estimate, we posit that Polaris PII is undervalued. Cautious consumer sentiment toward big-ticket discretionary goods and high financing rates are leading to increased promotions and fewer shipments as dealers manage existing inventory, hurting near-term sales growth. As dealer inventories fall, we expect shipments to align more closely with consumer demand, with inventory only 5% higher than in 2019 at the end of 2023. Beyond 2024, we foresee demand and profit growth driven by new product launches, supported by nearly $2 billion in research and development over the next five years.

VF Corp

- Fair Value Estimate: $48.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

VF’s VFC shares trade at a roughly 70% discount to our $48 fair value estimate, as its results have deteriorated over the past few quarters and its dividend has been cut. Despite the firm’s problems, we think the market is overlooking its prospects for improved profitability, as we forecast its operating margins will rise to 13% by fiscal 2028 from the mid-single digits at present. In October, CEO Bracken Darrell introduced a strategy focusing on Vans innovation and management, a new platform in the Americas, cost cuts, and debt reduction. The firm is also likely to sell at least one underperforming brand to raise capital.

Hanesbrands

- Fair Value Estimate: $15.80

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

We believe Hanesbrands HBI, trading at a nearly 70% discount to our $15.80 fair value estimate, presents an attractive investment opportunity. Hanes has leading brands in innerwear in North America and Australia, but it has struggled to generate sales growth. In June, Hanes announced the sale of Champion to Authentic Brands Group for an attractive price of $1.2 billion plus the possibility of an additional $300 million in earn-outs. While this disposition will reduce future cash flow, we think it also reduces risk, as the proceeds will be used for debt reduction. Moreover, we think it will have a positive effect on profit margins.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-02-2024/t_6b25eabdd47c4e2bb51fbb816a658179_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)