Do Sector Funds Merit a Place in Investors’ Portfolios?

Other than energy stocks, most sectors haven’t brought much to the party.

Investors have been pulling money from sector-specific equity funds in recent years, notwithstanding a recent influx of assets into technology-specific mutual funds. Yet despite those outflows, sector funds still held roughly $1.4 trillion at the end of March.

Many investors who own sector funds hold them alongside broadly diversified equity funds. The question is, does holding investments focused on individual sectors confer any diversification benefits, above and beyond what comes along with investing in the broad market? The short answer? Not really. While the energy sector’s correlation with the US market has recently plummeted, at other points in time its performance has been closely correlated with the broad market’s. Meanwhile, some of the most popular sector-fund groups—technology and real estate—have exhibited a tight correlation with the US market.

The Why of Sector Funds

Sector-specific investments focus on a single economic segment, such as technology, healthcare, or real estate. Because they’re often weighted by market capitalization, sector indexes are usually heavily tilted toward the biggest players in that segment. Many investors do not use sector funds at all, relying on broadly diversified equity funds instead. Some investors might employ sector funds to capitalize on industries that they believe are beaten down but due for a recovery or that they think will benefit from secular growth trends, such as healthcare. Alternatively, investors might add sector exposure to provide their portfolios with a higher stream of income (for example, utilities or real estate) or to counterbalance overweightings elsewhere in their portfolios.

Recent Performance Trends

The Morningstar US Market Index soared by 26% in 2023, but performance was widely dispersed. The technology and communications services sectors both notched gains of more than 50%, while the utilities and energy sectors posted losses. That was a reversal from 2022. In that year, energy stocks logged gains of more than 60%, and utilities also landed in the black. But technology and communication services stocks sagged, dragging the Morningstar US Market Index to a 19% loss.

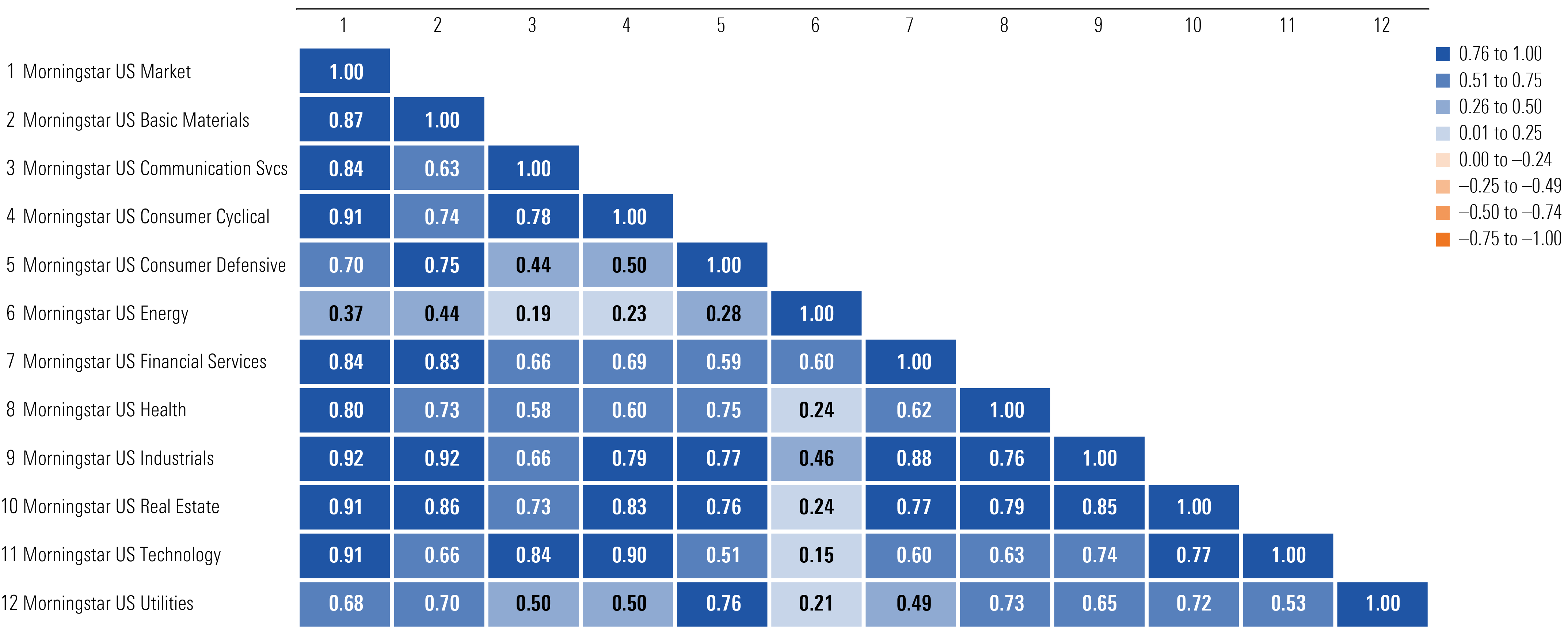

Three-Year Correlation Matrix: Sector Equity

The Morningstar US Energy Index exhibited the lowest correlation with the Morningstar US Market Index over the past three years, and that correlation has continued to decline. The sector had a correlation of 0.79 with the US market at the end of 2021, but it dropped to 0.65 by the end of 2022 and to just 0.37 by the end of 2023. Meanwhile, the utilities sector—the diversification champ among sectors at the end of 2021—saw its correlation with the US market increase in 2022 and 2023. That’s likely because utilities, prized for their dividend yields, are sensitive to interest-rate changes. In a rising-interest-rate environment, investors often swap into the safety of higher-yielding bonds rather than seek yield from equities, which have more risk.

On the flip side, the technology sector has been a notably weak diversifier for investors who already have broad US market exposure in their portfolios. That’s not too surprising when you consider that tech stocks consume roughly 30% of the Morningstar US Market Index. Moreover, technology sector indexes tend to be dominated by a handful of companies. Apple AAPL and Microsoft MSFT, for example, make up 37% of the Morningstar US Technology Index. Consumer cyclical stocks and industrials have also shown a tight correlation with the broad market.

Longer-Term Trends

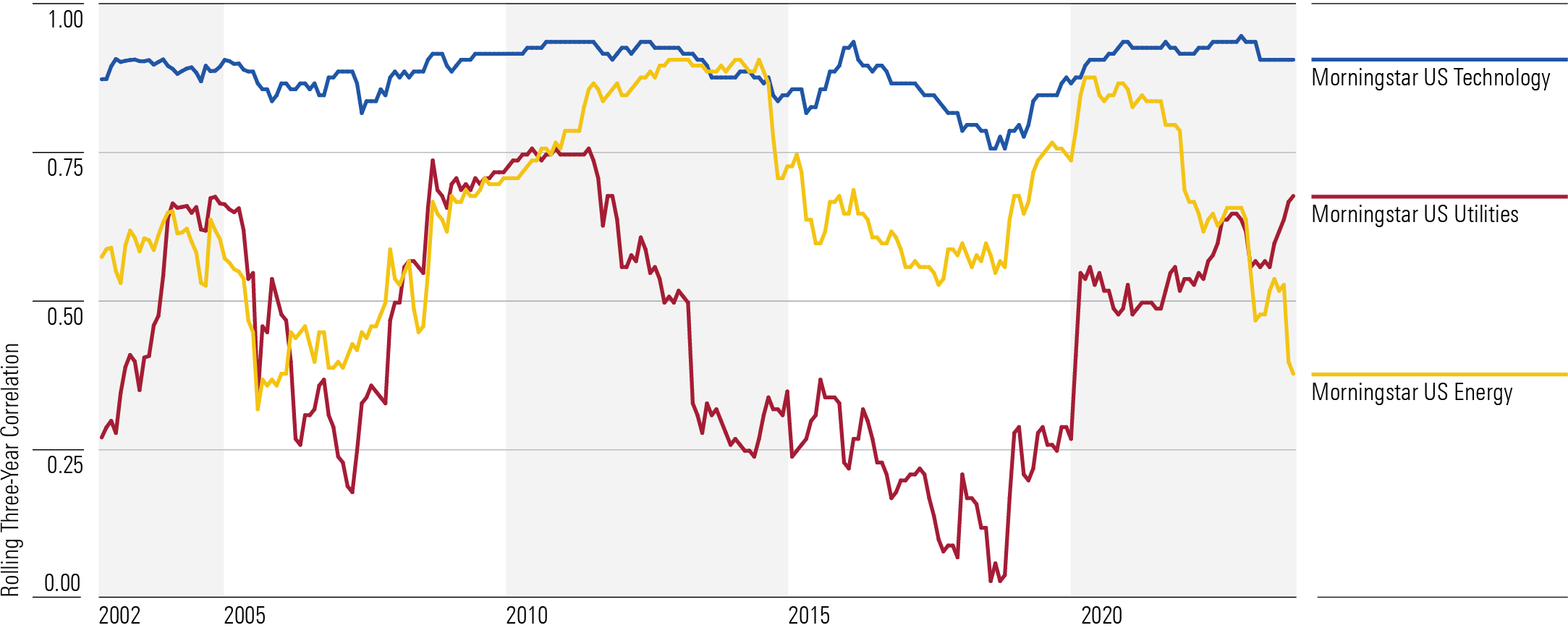

Over the past few decades, utilities and energy have been the sectors that have performed most differently from the broad US market. In 2022 and again in 2023, energy stocks decoupled from the broad US market. The consumer defensive sector has also had a somewhat lower correlation with the US market than other sectors. Meanwhile, the technology sector’s performance movements have been consistently correlated with those of the broad US market about 90% of the time.

Rolling Three-Year Correlations vs. the Morningstar US Market Index: Sector Equity

Some advisors recommend that investors carve out a separate allocation to real estate stocks with an eye toward boosting yield and diversification. The anticipated yield on the Morningstar US Real Estate Index is currently more than double that of the US Market Index, but the Morningstar US Real Estate Index has been an underwhelming diversifier over long-term periods, with correlations typically hovering around 0.70 and over 0.90 recently.

Portfolio Implications

With the exception of utilities and energy, sector-specific indexes have generally exhibited performance that was closely aligned with the broad market. Thus, there doesn’t appear to be a strong portfolio construction case for layering on sector-specific exposure in a diversified equity portfolio that also includes exposure to that sector. (Investors may wish to emphasize them for valuation or other factors, but that is a separate issue.)

Utilities have exhibited the lowest correlation with the overall market of any of the sectors over longer time frames. More recently, however, energy stocks have been the best diversifier for a broad US stock portfolio. Both sectors have significantly underperformed the US market over the past 10- and 15-year periods, however. (The Morningstar US Energy Index’s 15-year return is the lowest of all sectors.)

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)