Energy: OPEC Continues to Operate From a Position of Weakness With Production Cuts Extension

In the energy sector, we highlight ExxonMobil, APA, and Schlumberger.

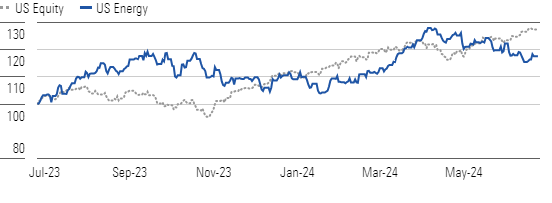

Energy stocks underperformed this quarter. We attribute this largely to weak oil prices, and we expect continued weakness, with $65-$70 a barrel (WTI), if not lower, a likely possibility in 2024. We see the OPEC+ production cut extensions as a sign of weakness, not strength. Most of the extension deadlines were pushed back a year to the end of 2025. Further, Saudi Arabia just sold $11 billion in stock in state-run Aramco, indicating both its need for cash to fund Vision 2030 efforts and its inability to defend oil prices.

Energy Underperforms Due to OPEC Production Cut Extension and Price Weakness

OPEC’s complex meeting outcome from June 2 should not obscure our view that it operates from a position of weakness in an oversupplied market. OPEC has three separate cuts in progress, totaling 5.86 million barrels per day. A groupwide cut of about 2 million barrels per day was originally set to expire at the end of 2024 but was extended to the end of 2025. Similarly, a 1.7 million bbl/d voluntary cut by certain members was also extended to the end of 2025, from the end of 2024. Finally, a second 2.2 million bbl/d per day voluntary cut by certain members was extended in full for another quarter. It was initially due to expire at the end of June, before gradually being phased out by September 2025. Importantly, OPEC’s announcement signaled that the monthly increases phasing out the production cut can be “paused or reversed subject to market conditions.” In other words, we could see the 2.2 million bbl/d reversal placed on hold if the market remains oversupplied.

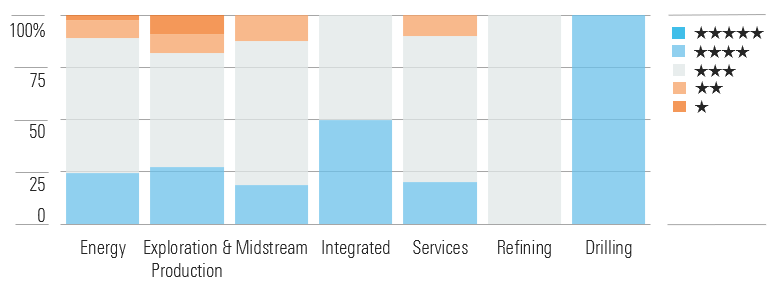

Integrated and Drilling Firms Offer the Most Bargains

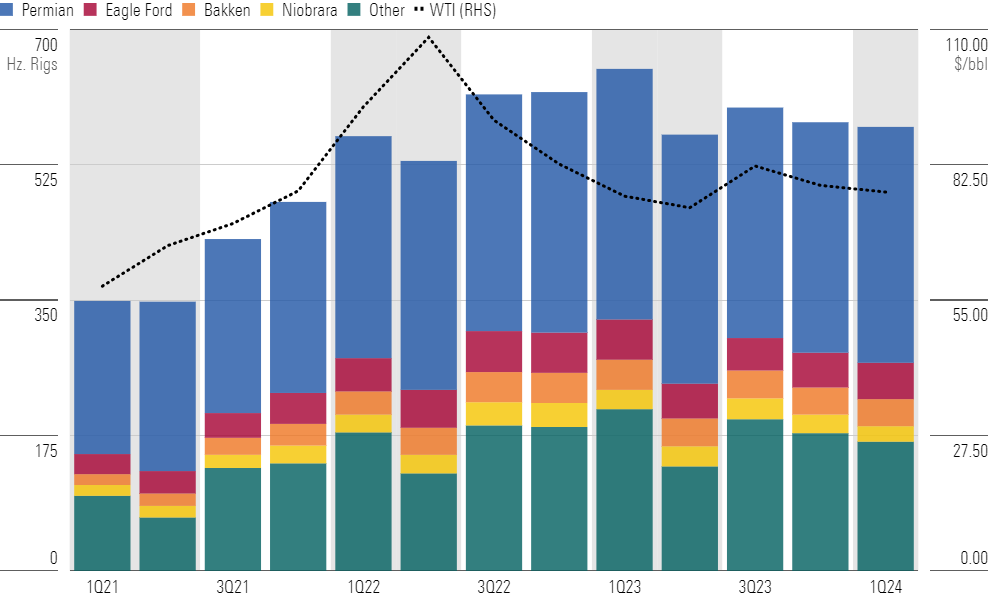

Over the medium term, we expect ongoing oil drilling and oil rig count efficiencies amid continuing industry consolidation, particularly as private operators can no longer pursue growth. ExxonMobil XOM and APA APA each closed deals for Pioneer and Callon, while Chevron CVX and Diamondback Energy FANG are working to close Hess and Endeavor. Of course, the recent Marathon MRO/ConocoPhillips COP deal could add further production efficiencies.

Oil Rigs Look Strong for Near Term but Should Decline in Latter Stages of 2024

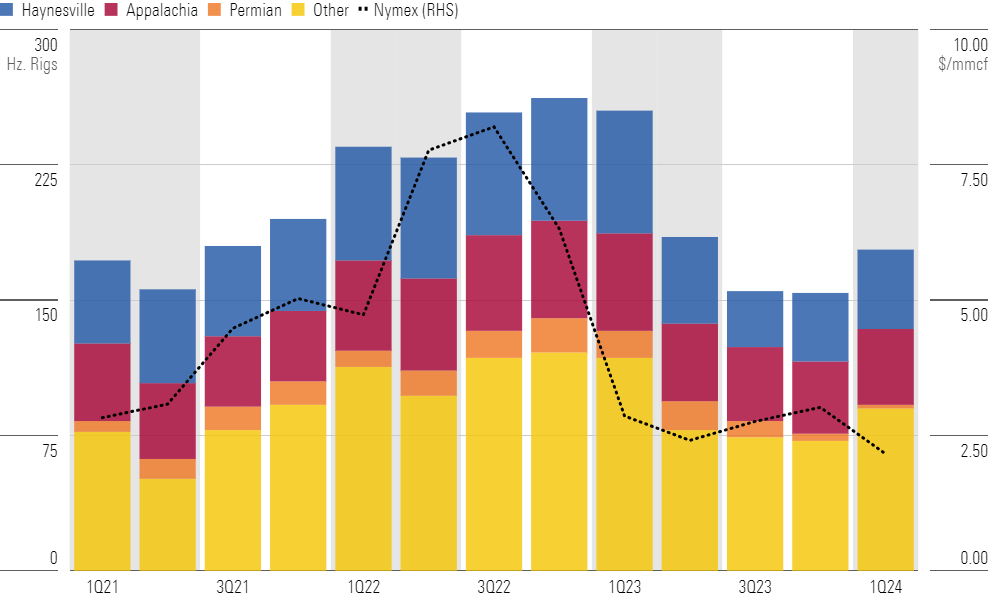

On the gas side, we are more optimistic in the near term, as higher gas prices are incentivizing higher production levels. We expect gas producers will seek to boost production levels after an extremely mild winter and prepare for a larger increase in demand in 2025 with new US LNG export infrastructure coming online.

Gas Rigs Look to Rebound Following Recovery In Natural Gas Prices

Top Energy Sector Picks

Schlumberger

- Fair Value Estimate: $60.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Schlumberger’s SLB leading-edge technological advancements continue to distinguish it from its peers. The firm’s myriad innovations consistently add value for customers, preserving its ability to command premium pricing over and above the currently favorable operating environment. The impending ChampionX acquisition—expected to close by year-end—will add sizable exposure to the chemicals market, further diversifying the company’s already-impressive product catalog.

APA

- Fair Value Estimate: $54.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

APA is hoping for a game-changer with its exploration assets in Suriname. The firm has announced a string of promising discoveries and may have a final investment decision in 2024. We think the project will move forward and the market isn’t giving enough credit. Our fair value estimate assumes three production vehicles with a capacity of 180 thousand barrels per day. That pegs Suriname at a sizable percentage of APA’s equity, so we like the upside as a catalyst-driven name that might outperform in a challenging oil and gas price environment.

ExxonMobil

- Fair Value Estimate: $138.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Exxon plans to double earnings and cash flow from 2019 levels by 2027 on a combination of structural operating cost reductions, portfolio improvement, and growth across its upstream, downstream, and chemical segments. Exxon estimates that under the current plan, it will generate about $100 billion in surplus cash (after funding investments and paying dividends) during the next five years. Combined with higher-than-expected commodity prices, its current repurchase program is $20 billion annually following its acquisition of Pioneer Resources.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-02-2024/t_6b25eabdd47c4e2bb51fbb816a658179_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)