Tax-Deferred ESG Retirement-Saver Portfolios for ETF Investors

These low-cost ETF portfolios are designed to deliver potent asset-class exposures to ESG-conscious investors saving for retirement.

Editor’s Note: A version of this article appeared on Jan. 4, 2024.

Interest in sustainable mutual funds—also called environmental, social, and governance funds—has soared over the past decade.

Those assets are coming from investors at all life stages, but younger investors appear to have a particular affinity for ESG investing. According to Morgan Stanley research, 87% of millennials (people born between the early 1980s and 2000) say a company’s track record on ESG matters is an important consideration when deciding whether to invest in it.

My model Retirement Saver ESG portfolios are geared toward ESG-minded investors who are still working and accumulating assets for retirement: 20-somethings, 50-somethings, and everyone in between. I’ve created a suite of traditional mutual fund portfolios geared toward retirement savers, and I’ve also created ESG Retirement Saver portfolios composed of exchange-traded funds.

As I put the ETF portfolios together, I was struck by the quality, breadth, and low costs of the ETFs available with ESG mandates. Indeed, passive products have been a particularly high-growth pocket of the ESG arena, gathering assets and spawning new fund launches.

Moreover, ETF investors can now find low-cost products in all the major asset classes, making it fairly simple to create a well-diversified, low-cost portfolio consisting of securities with good ESG attributes. I’ve created four suites of ESG portfolios: ETF portfolios geared toward retirees as well as retirement savers, and traditional mutual fund portfolios created toward those same groups.

About the Portfolios

I’ve used Morningstar’s Lifetime Allocation Indexes to inform the portfolios’ asset allocations and the exposures to subasset classes. To populate the portfolios, I employed ETFs that receive higher-conviction Morningstar Medalist Ratings from Morningstar’s analyst team. Most of the funds earned Medalist Ratings of Gold, though I’ve used Silver- and Bronze-rated funds in cases when suitable Gold-rated, no-load options that are accepting new investments are unavailable.

The portfolios are geared toward investors’ tax-sheltered accounts, so I didn’t consider holdings tax efficiency when populating the portfolios.

How to Use Them

My goal with these portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot the lights out with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and sub-allocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios. As with the Bucket portfolios, I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they no longer rate as higher-conviction Morningstar Medalists.

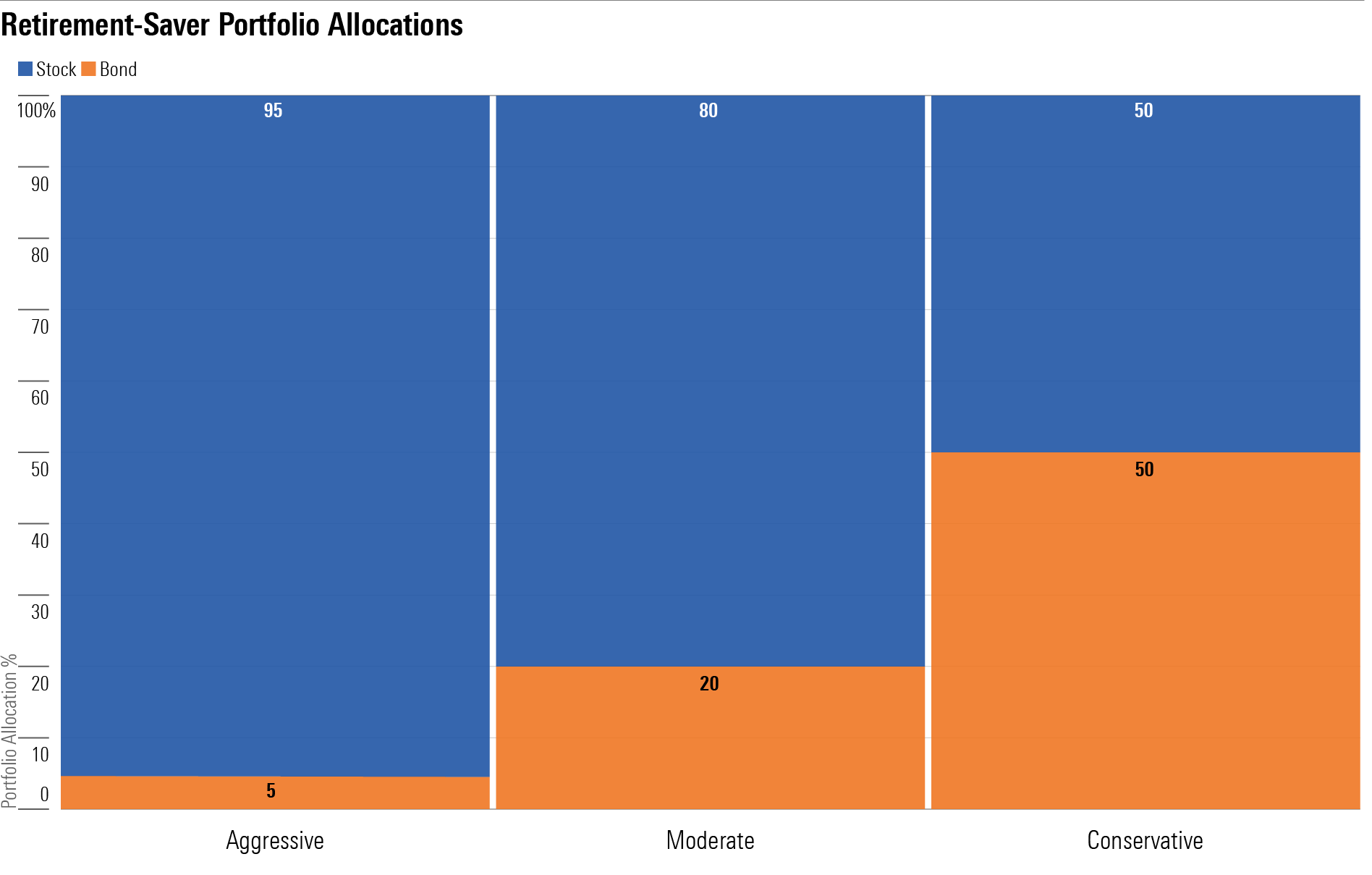

The portfolios vary in their amounts of stock exposure and, in turn, their risk levels. The Aggressive Portfolio is geared toward someone with many years until retirement and a high tolerance/capacity for short-term volatility. The Conservative portfolio is geared toward people who are just a few years shy of retirement. The Moderate portfolio falls between the two in terms of its risk/return potential.

Retirement-Saver Portfolio Allocations

Aggressive Tax-Deferred ESG Retirement Saver Portfolio for ETF Investors

Anticipated Time Horizon to Retirement: 35–40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 45%: iShares ESG MSCI USA ETF ESGU

- 10%: iShares ESG MSCI USA Small-Cap ETF ESML

- 30%: iShares ESG MSCI EAFE ETF ESGD

- 10%: iShares ESG MSCI Emerging Markets ETF ESGE

- 5%: iShares ESG U.S. Aggregate Bond ETF EAGG

Moderate Tax-Deferred ESG Retirement Saver Portfolio for ETF Investors

Anticipated Time Horizon to Retirement: 20–25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 42%: iShares ESG MSCI USA

- 6%: iShares ESG MSCI USA Small-Cap ETF

- 22%: iShares ESG MSCI EAFE ETF

- 10%: iShares ESG MSCI Emerging Markets ETF

- 20%: iShares ESG U.S. Aggregate Bond ETF

Conservative Tax-Deferred ESG Retirement Saver Portfolio for ETF Investors

Anticipated Time Horizon to Retirement: 2–5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)