Financial Services: Amid Uncertainties, We See the Most Value In Banks and Credit Services

Top picks in the sector include PayPal, MarketAxess, and US Bancorp.

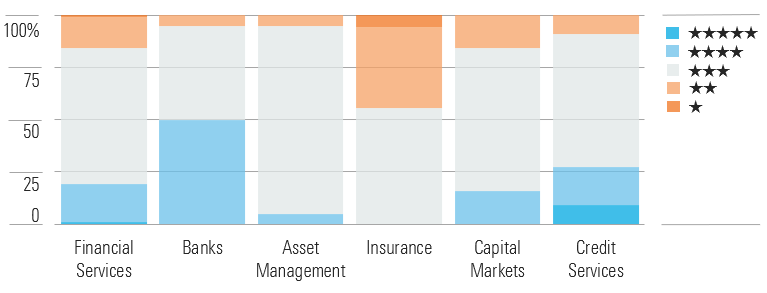

We continue to assess that banks and credit service companies are trading at attractive valuations in the financial sector, due to uncertainty around the timing of the Federal Reserve’s interest rate cuts and the trajectory of loan charge-offs.

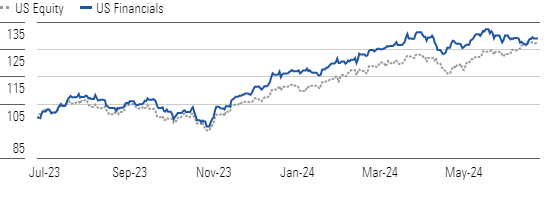

Financials Have Performed Well, With Rate Cuts On the Horizon

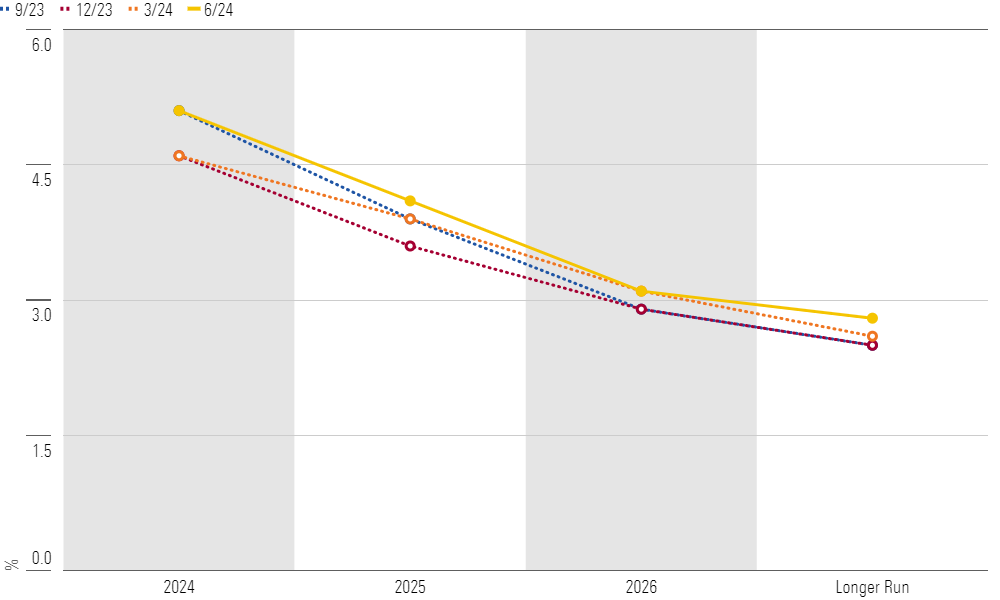

At the Federal Reserve Open Market Committee held in June, the median participant’s projected federal funds rate for the end of 2024 increased to 5.1%, which translates to an expected cut of only 25 basis points, compared with 75 basis points previously. The median federal funds rate projection for 2025 was also higher at 4.1%, compared with 3.9% in the March projections, as recent inflation hasn’t diminished as much as expected. The longer-run median federal funds rate also increased to 2.8%, compared with 2.6% in March, which could incorporate multiple considerations such as a desire to have more room to cut rates if the United States enters a recession.

Banks and Credit Services Are the Most Undervalued

Banks are generally asset-sensitive, meaning the yields they earn on their interest-earning assets increase more when interest rates move higher than the rate they pay on their interest-bearing liabilities, which increases net interest income. Over the previous several quarters, with the federal funds rate remaining steady, deposit costs have continued to rise, putting downward pressure on net interest income.

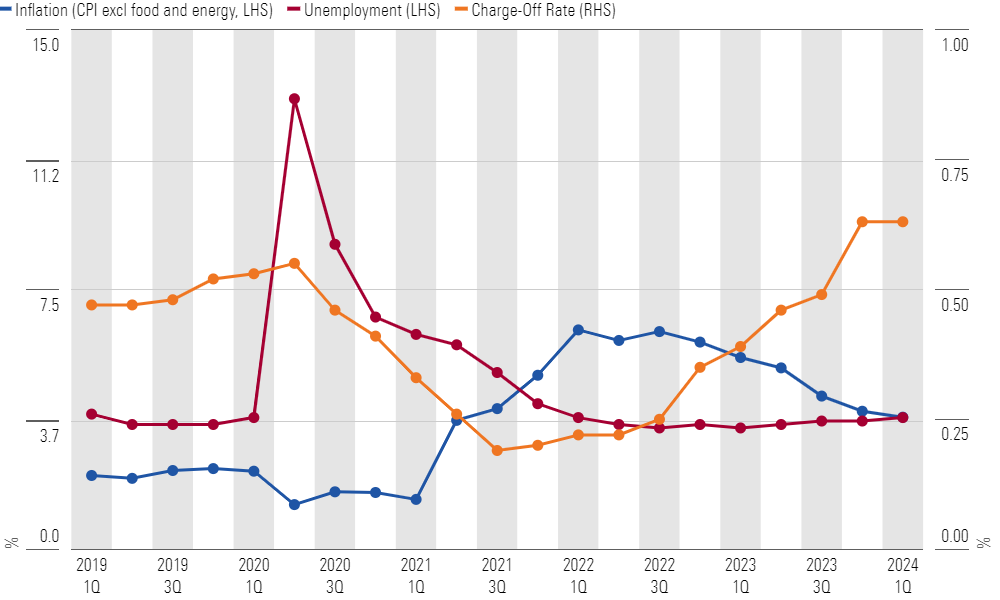

Inflation’s Decline Slowing and Charge-Offs Rising

Over the next couple of years, the idiosyncratic characteristics of banks will affect earnings. Banks that are more liability-sensitive or have neutralized their balance sheets to falling interest rates are relative outperformers. Banks that locked in low rates on fixed-income securities several years ago should also outperform, since those securities are now maturing and being reinvested at higher rates.

US Treasury Yield Curve: Rates Expected to Remain Somewhat Higher for Longer

There’s been a modest increase in the unemployment rate, and loan charge-offs have climbed from unusually low levels seen several years ago. Absent a spike in unemployment, we believe consumer charge-offs will remain manageable. Exposure to troubled property types, such as office, is also fairly low for national and regional US banks.

Top Financial Sector Picks

MarketAxess Holdings

- Fair Value Estimate: $300.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

We expect 2024 to be a better year for growth for MarketAxess MKTX. Last year, the company faced dual headwinds from low corporate bond issuance levels and an unfavorable mix shift creating downward pressure on its average fees. While these are still factors, the company is benefiting from higher trading volume industrywide, and if interest rates fall, it will see some relief for its average pricing. That said, MarketAxess continues to face significant competition in the electronically traded US corporate bond market from both Tradeweb Markets TW and the smaller Trumid, which has led its investment-grade bond market share to be relatively stagnant in recent years. We still see meaningful secular growth drivers for MarketAxess, but competition will be a headwind to volume growth.

PayPal Holdings

- Fair Value Estimate: $104.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

PayPal’s PYPL shares have fallen about 80% from their pandemic peak to be materially below their pre-pandemic price. With market confidence in the stock at a low ebb, we see a potentially good long-term opportunity. While we recognize the headwinds PayPal faces in the near term, in the long term, the company’s fate remains tied to the high-growth e-commerce space, with Venmo providing some additional upside option value. Historically, PayPal has demonstrated it can take shares in this area, and we think it continues to do so overall. We believe the company retains a strong competitive position.

US Bancorp

- Fair Value Estimate: $53.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

We believe the banking sector is relatively undervalued. The biggest risk to our top banking picks would be surprises on deposit and funding costs or the realization of a recession. US Bancorp USB has sold off, like some regionals, but we see relatively lower risk for the company since it’s the largest regional. The bank does have slightly higher-than-average unrealized losses on securities, but we view this more as an earnings problem (lower-yielding assets stuck on the balance sheet) and not a capital problem.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-02-2024/t_6b25eabdd47c4e2bb51fbb816a658179_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)