Healthcare: Valuations Look Attractive In Most Industries

Our top healthcare sector picks are Moderna, Humana, and Baxter.

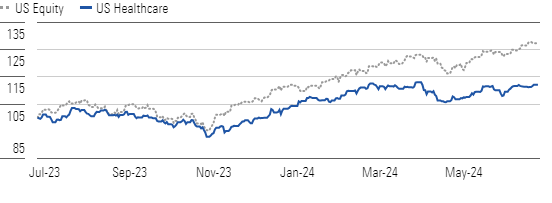

Over the past 12 months, overall equity has outperformed the Morningstar US Healthcare Index by over 15%. This is likely due to the healthcare sector’s defensive nature, as concerns about recessionary pressures appear to have decreased, making more market-sensitive sectors perform stronger.

Healthcare Underperformed the Equity Market Over the Past 12 Months

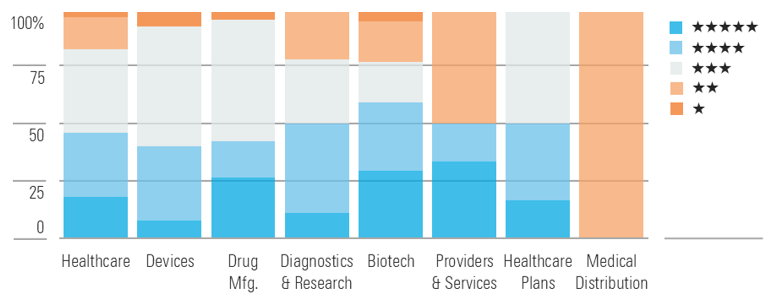

We view the sector as undervalued, with just under 50% of stocks rated as 4 or 5 stars and less than 20% rated as 1 or 2 stars. In aggregate, healthcare stocks under our coverage trade below our overall estimate of their intrinsic value. Besides medical distribution, the industries look largely undervalued.

We expect healthcare stocks to perform better when the market appreciates the steady drivers of the sector, regardless of macroeconomic factors. Within the biotech and drug manufacturing group, the market is not fully appreciating innovation in several therapeutic areas. In the healthcare plan industry, we believe the short-term headwinds of potential pharmacy benefit reforms, Medicaid determinations, and Medicare Advantage deceleration are creating undervalued opportunities. In the device and diagnostic industries, we see compelling valuations after the over-optimism during the peak of the covid-19 pandemic.

Healthcare Industries Look Largely Undervalued Besides Medical Distribution

As perceptions normalize across healthcare, we believe the overall sector will increase in value. From a regional perspective, we believe the industry’s largest market in the United States will likely face some volatility during the 2024 election cycle and related political rhetoric. Still, we are not expecting major fundamental changes for most healthcare industries.

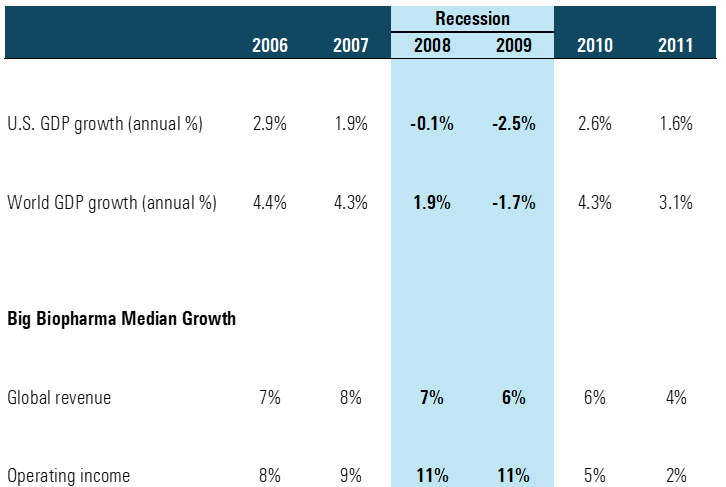

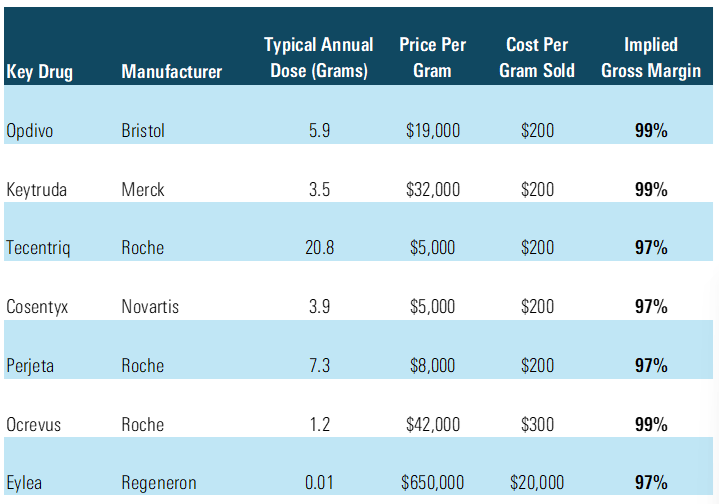

While investors appear to be more focused on faster-growing, more market-sensitive sectors, if any disruptions occur, healthcare tends to hold up well regardless of macro pressures. Amid the global recession of 2009, the drug and biotech industries posted steady results, with limited impact on sales and profits. The need for healthcare stays relatively stable, regardless of the state of the economy. Further, most biopharma drugs carry high gross margins, reducing inflationary impacts.

Biopharma Sales Were Largely Unaffected by Last Major Recession In 2008-09

Estimated Underlying Cost of Goods Sold for Key Biopharma Drugs

Top Healthcare Sector Picks

Baxter International

- Fair Value Estimate: $67.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Baxter BAX looks attractive, with shares trading at just half of what we think they are worth, while investors are getting paid a 3.5% dividend yield to wait for an improvement in market sentiment. Also, demand is improving in most of its medical supply businesses because of rising medical utilization, and new product introductions like the Novum IQ pump platform could boost demand soon. Baxter also represents a margin improvement story, as most inflationary challenges in its supply chain are easing and key new group purchasing organization contracts should take effect in 2025, which should help boost its product pricing.

Humana

- Fair Value Estimate: $473.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Humana HUM reflects a significant discount to our fair value estimate, and it holds a strong competitive position in Medicare Advantage and the potential to boost profits substantially after a weak year. The company’s 2024 outlook includes severely deflated profits due to mispriced Medicare Advantage plans that may not fully cover surging medical utilization. We expect Humana to push that higher medical utilization onto clients and end users by increasing prices and/or reducing benefits somewhat. While near-term uncertainty surrounds the company’s typically strong outlook, we think its longer-term prospects remain bright.

Moderna

- Fair Value Estimate: $227.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

Moderna’s MRNA shares were on a roller coaster in 2021. We think investors were at first overly enthusiastic about the potential of the company’s technology, then too bearish on its post-covid-19 growth. While we have modest expectations for sales of the firm’s covid-19 vaccine following massive pandemic-fueled demand in 2021 and 2022, we think Moderna’s pipeline of mRNA-based vaccines and treatments is advancing rapidly across multiple therapeutic areas. We’re increasingly confident in the long-term sales trajectory of the firm’s diversified pipeline.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-02-2024/t_6b25eabdd47c4e2bb51fbb816a658179_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)