How to Use Municipal-Bond Funds in a Portfolio

Some investors can improve their aftertax returns with munis.

Should you have municipal bonds in your portfolio? Municipal bonds—which provide interest payments that are generally exempt from federal taxes—offer tax advantages that can be compelling, especially for investors in higher tax brackets. In some cases, their coupons are also exempt from state and/or local taxes.

In this series on portfolio basics, I’ll explain some of the fundamentals of putting together sound portfolios. I’ll start with some of the most widely used types of investments and walk through what you need to know to use them effectively in a portfolio.

What Are Municipal Bonds?

Municipal bonds are issued by state or local governments to fund their day-to-day operations or raise funds for public projects, such as bridges, roads, and new schools. The interest paid on these bonds is usually exempt from federal income taxes and may also be exempt from state and local taxes for investors who live in the same state or municipality where the bond was issued.

Municipal bonds often pay out less than taxable bonds but can often be appealing for investors in higher tax brackets, particularly now that fewer people are able to take itemized deductions. The best way to figure out how they stack up is to calculate a taxable-equivalent yield, which allows you to make apples-to-apples comparisons between the aftertax income from taxable and tax-exempt vehicles. To calculate it, take the nominal, or pretax, yield for the tax-advantaged vehicle and divide it by the percentage of income you’ll keep after taxes, or 1 minus your tax rate. The answer represents how much income you would have to receive from a taxable investment to make it more competitive than the municipal choice.

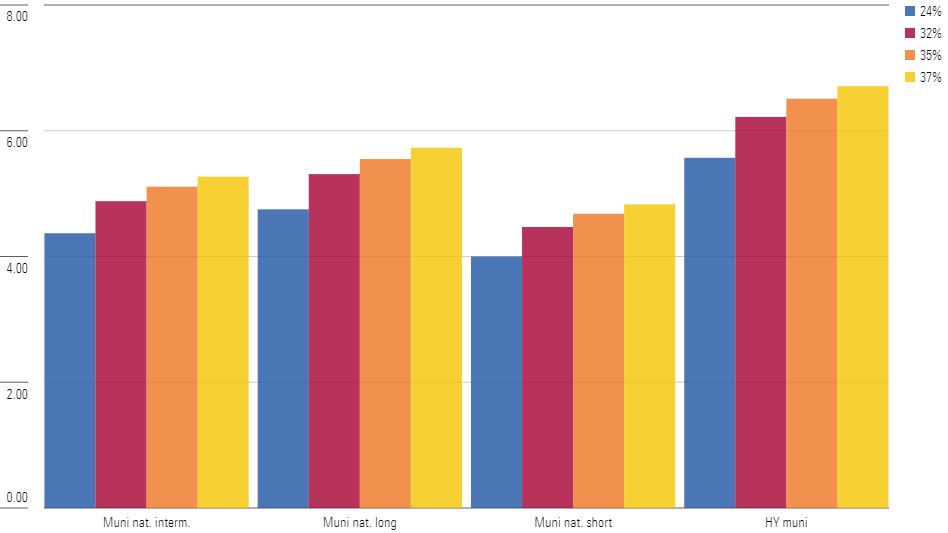

Taxable-Equivalent Yield by Tax Bracket

For example, if you’re in the 32% tax bracket and own a municipal-bond fund with a nominal yield of 3.27%, you’d have to earn more than a 4.81% yield, or 3.27 divided by 0.68, from a taxable investment for the latter to be more attractive after taxes. That calculation doesn’t include any adjustments for state or local taxes, so if you live in a high-tax state, you can garner additional tax benefits by choosing a fund that invests in bonds issued within your home state.

What Are the Advantages and Risks of Investing in Municipal Bonds?

As mentioned above, tax advantages are the main positive for municipal bonds. Like other types of bonds, they also generate current income with relatively low risk.

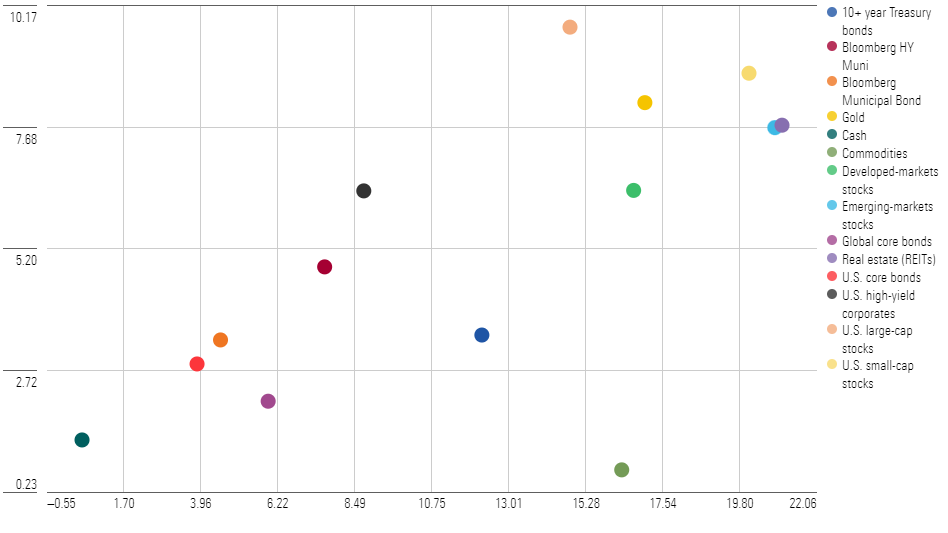

As shown in the graph below, municipal bonds have generated higher long-term returns than cash, but they have less growth potential than stocks. Over the past 20 years, municipal bonds have also generated higher returns than taxable bonds, and the return advantage would look even better after taking taxes into account.

While municipal bonds are less risky than stocks, they’re still subject to two main types of risk: interest-rate risk and credit risk. Because bond prices and market interest rates move in opposite directions, bonds lose value when interest rates rise. Credit risk—that is, the risk that a municipal-bond issuer won’t be able to repay its debt—can also be an issue for municipal bonds.

In practice, this means that municipal bonds typically come with middle-of-the-road risks and returns. The chart below shows annualized returns (y-axis) and standard deviations (x-axis) for municipal bonds as well as other major asset classes over the past 20 years.

Trailing 20-Year Risk and Returns: Municipal Bonds and Other Assets

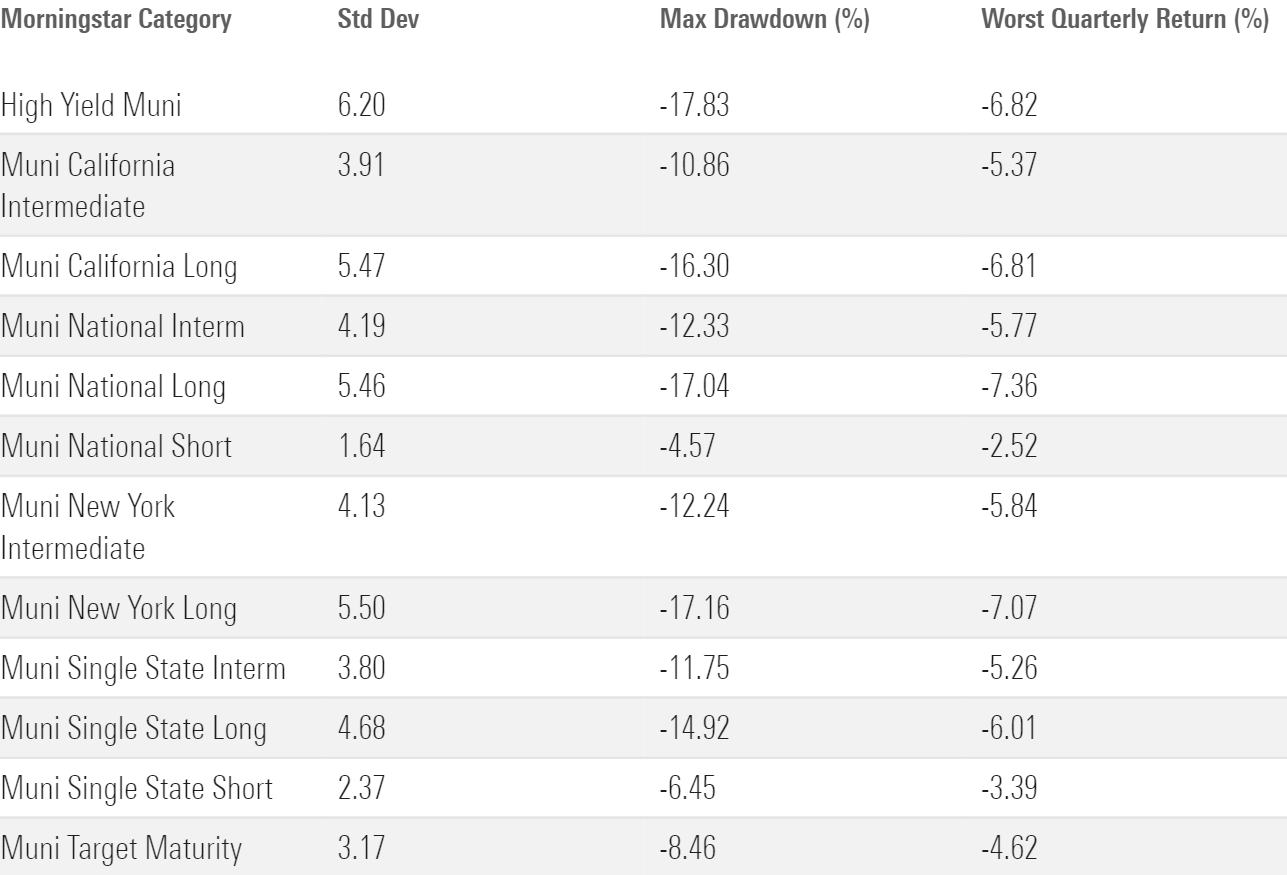

Drawdown risk for municipal-bond funds varies based on the Morningstar Category. As shown in the table below, high-yield muni funds have lost as much as 18% over the past 10 years, while muni-national short-term funds had more limited losses of about 4.6%. Both returns reflect performance during the bear market for bonds that started in August 2021. The bond market has improved since then, but none of the categories below had quite made up all of their losses as of Aug. 31, 2023. Municipal bonds have held up better than taxable bonds because most municipalities are still in good shape financially, but they have still suffered as rising interest rates and stubbornly high inflation have roiled the bond market.

Other Risk and Drawdown Stats (Since Oct. 1, 2013)

How to Invest in Municipal Bonds

There are two main ways to invest in municipal bonds: by purchasing individual bonds or by purchasing a fund.

Purchasing individual bonds can be an appealing option because you simply collect your semiannual interest (known as a coupon payment) until the bond’s maturity date, when you’ll get the bond’s principal value back.

However, this approach has a couple of drawbacks. Based on research from Nasdaq, there are more than 80,000 municipal issuers, and more than 1.5 million municipal bonds have been issued. It can be difficult for individual investors to navigate this market given its size, complexity, and lack of liquidity. Trading costs can be prohibitive, as well. Bid-ask spreads reportedly range between 1% and 4%, and one financial writer found the average spread for holdings he was trying to sell was about 2.85%.

Investors can avoid those pitfalls by getting municipal-bond exposure with a mutual fund or exchange-traded fund. The advantages include:

- Lower trading costs.

- Professional management.

- Broader diversification across many different bonds and bond sectors.

- The flexibility to reinvest proceeds at higher interest rates if interest rates are trending up.

Broadly diversified index funds can be a good way to invest in municipal-bond funds. Lower costs are the primary benefit. Investors in actively managed municipal-bond funds pony up annual expenses of about 65 basis points, on average, but the typical passively managed fund charges about a third of that.

However, some actively managed municipal-bond funds have also been successful. I list some of the better options later in this article.

If you want to own only one municipal-bond fund, I’d focus on a mainstream bond category, such as muni-national intermediate, rather than riskier areas like the high-yield municipal-bond category. Funds that focus on bonds issued in your state can also be a good option if you live in a high-tax state, although they court a bit more credit risk by virtue of their geographic focus.

When Do Municipal Bonds Perform Best?

Like all bonds, municipal bonds fare best during periods of falling interest rates, such as the period that prevailed from 1981 through 2021. Municipal bonds have some performance quirks, though. Because broader economic trends take a while to trickle down to municipal finances, munis sometimes underperform a year or two after recessions, as they did in 1991, 2001, and 2010.

How Long Should I Hold My Investment in a Municipal-Bond Fund?

The concept of asset/liability matching helps to answer this question. For an individual, matching up maturity dates between assets and planned spending helps ensure that you’ll have access to liquid assets when you need them. This approach is easier to implement with individual bonds, where you can match up a bond’s maturity date with when you anticipate needing assets to meet a goal.

Muni target-maturity funds are another option. In contrast to other municipal-bond funds, which typically invest in bonds with a variety of maturity dates, muni target-maturity funds invest in bonds with a set maturity date. When the fund reaches the target maturity date, it then distributes cash back to investors. These funds can be useful for investors who want to match the cash flows from their investments with a specific date, for example, to pay for a wedding, a child’s college education, or a down payment on a house.

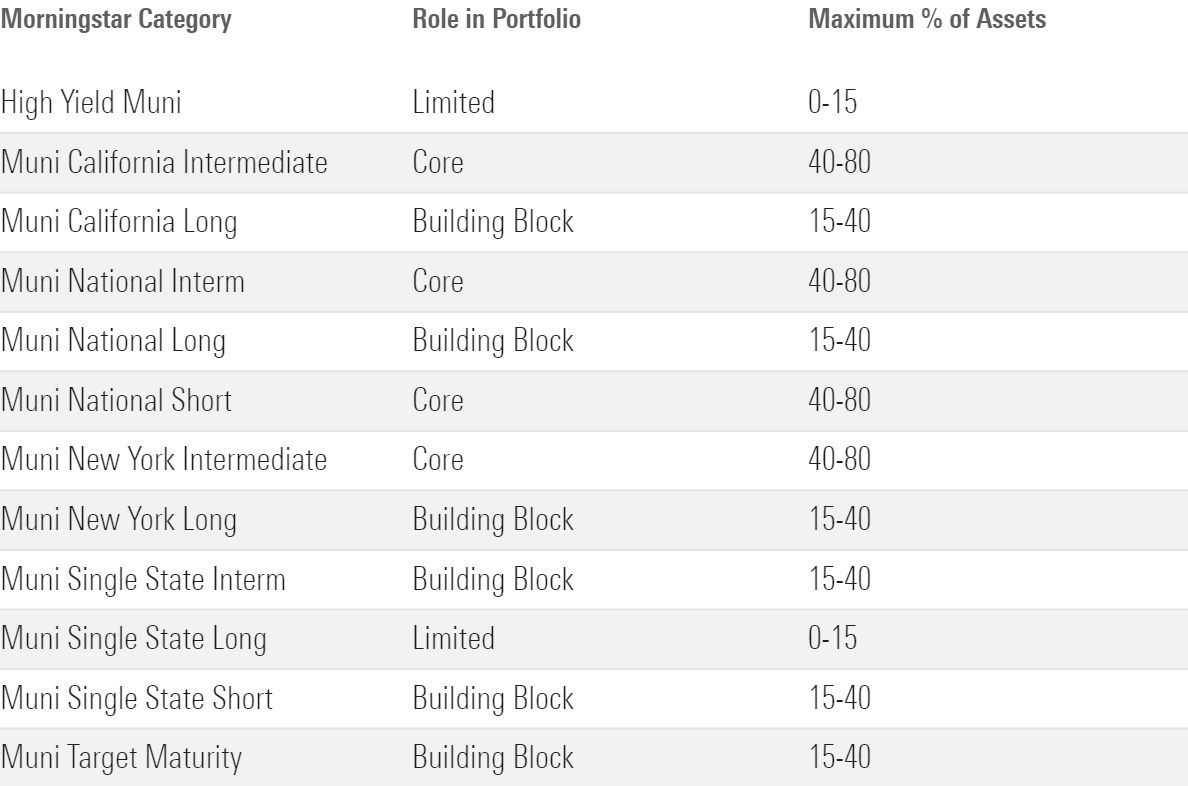

For other types of muni-bond funds, Morningstar’s Role in Portfolio framework recommends the minimum holding periods shown in the table below.

Recommended Time Horizons for Municipal-Bond Funds

We came up with these guidelines mainly by looking at the level of interest-rate sensitivity and downside risk within each category. The higher the risk, the greater the chance of incurring a loss over shorter periods. To minimize the odds that an investment is in the red when you need to access the money to fund a goal, it makes sense to plan a longer holding period for municipal-bond funds with higher levels of risk.

How Much of My Portfolio Should Be in Municipal-Bond Funds?

The answer to this question mainly depends on your overall mix of stocks and bonds, as well as what type of account you’re investing in. If you’re investing in a tax-deferred account, such as a 401(k) or IRA, you don’t need municipal bonds. For a taxable account, Morningstar’s Role in Portfolio framework recommends the upper limits in the table below.

Recommended Role in Portfolio for Municipal-Bond Funds

What Are the Best Municipal-Bond Funds?

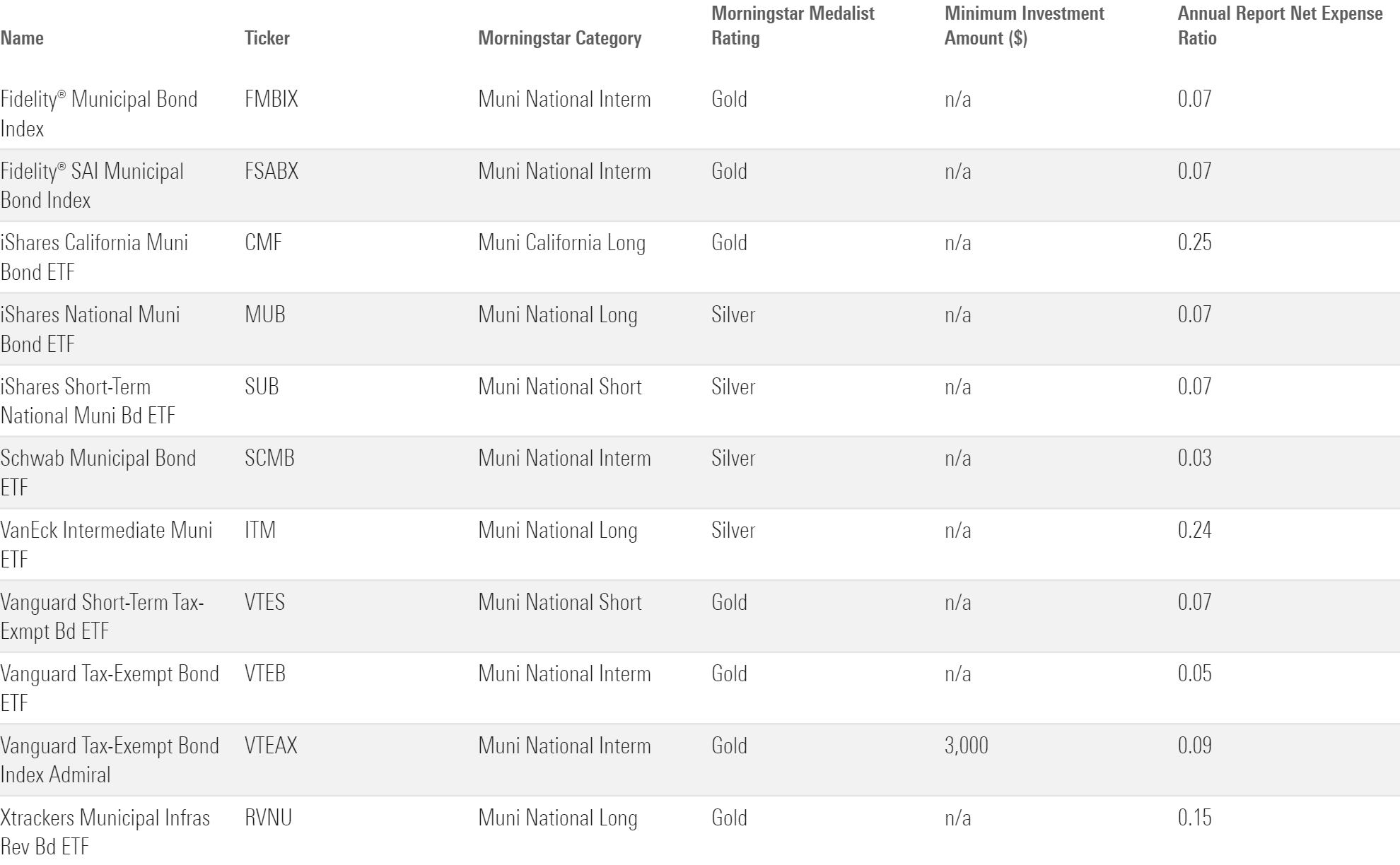

The table below shows several highly rated municipal-bond funds that follow a passive investment approach. I’ve focused on funds that are widely available through major brokerage platforms and have below-average expense ratios.

Highly Rated Municipal-Bond Funds (Index Funds)

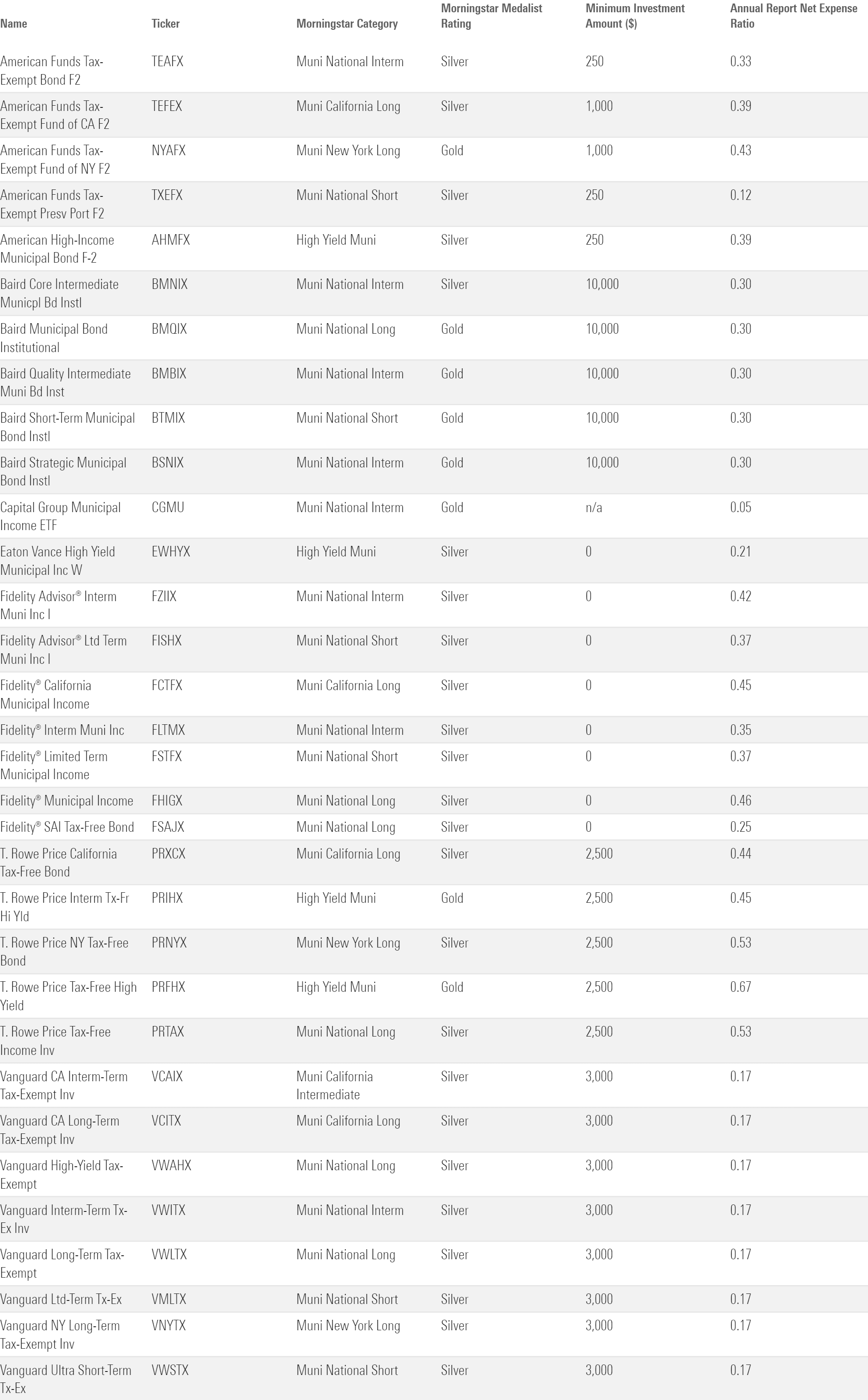

There are some great choices available among actively managed muni funds, too. In fact, active managers of municipal-bond funds have a higher success rate in beating their benchmarks than managers of many other fund types.

Highly Rated Municipal-Bond Funds (Actively Managed Funds)

What Funds Pair Well With Municipal-Bond Funds?

Taxable-bond funds can be a good complement to municipal-bond funds as long as you hold them in a tax-sheltered account. And you’ll probably want some equity exposure, too. Large-cap stock funds and international-stock funds are the best places to start for the stock portion of your portfolio.

Are Municipal Bonds a Good Investment?

Municipal-bond funds can be a good investment, but only if you’re in a higher tax bracket and are investing in a taxable account. While buying individual bonds can be a good strategy for investors who plan to buy and hold until the bond’s maturity date, investing in a mutual fund or ETF is the easiest and most cost-effective way to build a diversified portfolio of municipal bonds.

What Rising Bond Yields Mean for Investors

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)