Now Available: Morningstar Medalist Rating

How the Morningstar Medalist Rating will simplify strategy search, selection, and workflow monitoring on a broad universe of investments.

The Morningstar Analyst Rating and the Morningstar Quantitative Rating are now combined into a single, encompassing forward-looking rating, the Morningstar Medalist Rating.

The Morningstar Medalist Rating provides a significant simplification of strategy search, selection, and workflow monitoring on a far broader universe of investments. It brings the best thinking across our qualitative and quantitative research functions into one view. The methodology remains unchanged in that it will provide investors with Morningstar’s assessments of each strategy’s ability to outperform its Morningstar Category index after fees.

Evolution of Morningstar’s Ratings

Morningstar has conducted research on active and passive investment strategies and their associated vehicles since 1986. From November 2011, this research was expressed globally through the Morningstar Analyst Rating for funds, which Morningstar’s manager research analysts assigned to strategies and vehicles that they qualitatively analyzed.

In 2017, Morningstar expanded its manager research with the launch of the Morningstar Quantitative Rating for funds, which used algorithmic techniques and inheritance logic to assign ratings to strategies and vehicles that Morningstar’s manager research analysts didn’t cover. The Morningstar Quantitative Rating was designed specifically to mimic analyst decision-making as much as possible via a quantitative approach.

In summary, the Morningstar Medalist Rating will be the full and final expression of Morningstar’s forward-looking view on all rated strategies.

The Need for Simplicity and Scale

The Morningstar Medalist Rating provides investors with a more simplified and expansive rating system to rely upon for strategy due diligence workflows.

A big part of the reason we believe our ratings systems needed to simplify and expand is because investors are faced with more choices than ever before. And the options are not expected to stagnate or dwindle. Over the past 20 years, the number of managed products has grown steadily at 11% per year. On average, during the past two decades, approximately 3,000 new share classes were incepted each month. At the end of 2022, Morningstar databases contained over 750,000 live investment vehicles globally.

Morningstar has one of the largest manager research staffs in the world, with over 150 analysts conducting qualitative due diligence. However, even a staff this large cannot keep pace with the growth of the managed investment universe. The Analyst Rating coverage universe currently sits at 21,400 vehicles globally. The Morningstar Quantitative Rating, on the other hand, currently covers 383,000 vehicles globally. Investors can expect significant simplification by bringing these two rating systems together to search, screen, and monitor strategies more straightforwardly.

The methodology underpinning the Morningstar Quantitative Rating has always been designed to replicate the analyst decision-making process as closely as possible. Indeed, whenever we have an analyst opinion on a strategy, we default to that view in lieu of the algorithmic approach. We never publish multiple views. Increasingly, we have been able to leverage inheritance logic to extend the views of our analyst team to a wider investment universe. In this context, inheritance refers to relationships between strategies where we believe an analyst decision on one fund can port over (or be inherited) by another fund. The most obvious example is our Parent ratings. When a Morningstar analyst rates a Parent, we port over that decision to all strategies offered by that Parent. Similar rules and logic exist to extend analyst decisions across the People and Process Pillars as well.

Today, the Morningstar Quantitative Rating inherits about 55% of its pillar ratings directly from analysts. Approximately 42% of all strategies rated by the Morningstar Quantitative Rating system inherit all three pillars from analysts, and 72% of strategies inherit at least one pillar. In essence, the Morningstar Quantitative Rating is already a hybrid system between qualitative and quantitative inputs.

The reality is that having two segregated forward-looking rating systems in our software and reports has not been the easiest to navigate. If an investor wants to screen for Morningstar’s best ideas, for example, they must juggle multiple signals and methodologies. With the Morningstar Medalist Rating, we expect strategy due diligence workflows to be much simpler and intuitive.

What About Efficacy From the Ratings?

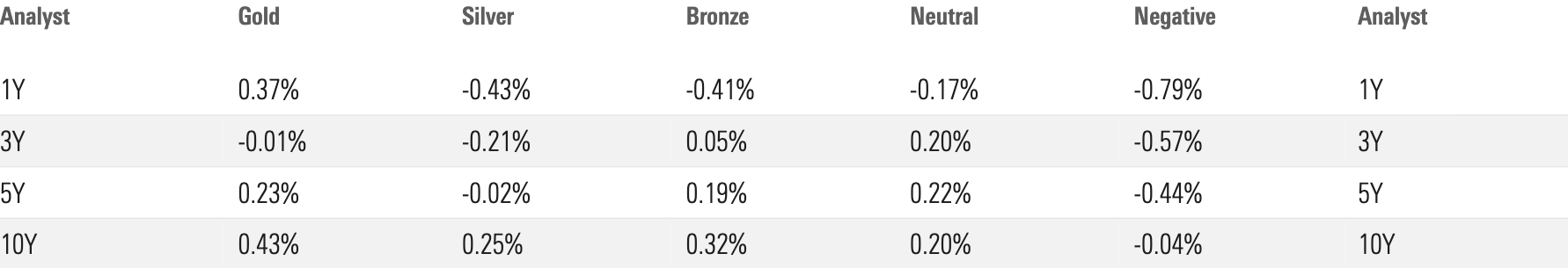

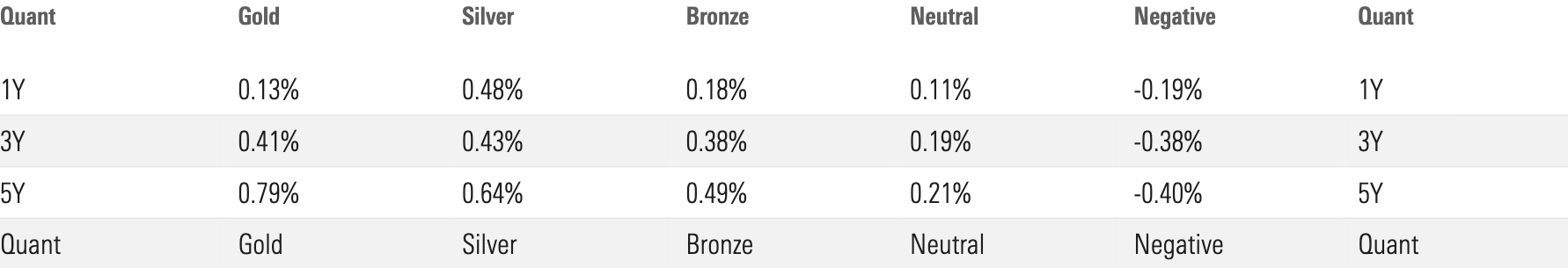

Another reason we brought together the Analyst Rating and Quantitative Rating is because we see very similar efficacy between them. Both rating systems have demonstrated an ability to identify outperforming funds over the long term. Generally speaking, the ratings sort forward excess returns in a consistently monotonic fashion across time.

Taking the five-year period ended September 2022, we find the average excess return for strategies with Morningstar Analyst Ratings of Gold to be 0.23%. Similarly, strategies with Morningstar Quantitative Ratings of Gold have averaged 0.79%. Negative-rated strategies, on the other hand, have shown excess returns of negative 0.44% and negative 0.40% for Analyst Ratings and Quantitative Ratings, respectively.

While the Analyst Rating has a longer track record than the Quantitative Rating, both systems have a substantial sample to base conclusions on. Since their respective launches in 2011 and 2017, the Analyst Rating and Quantitative Rating have issued approximately 2 million and 10 million ratings.

Putting this all together, we observe great alpha sorting on a large sample of strategies over a reasonably long period of time with multiple market cycles in between. As such, we have a high degree of confidence that these systems can be relied upon to deliver better outcomes to investors, especially when these ratings systems are brought together.

What Will Change With the Morningstar Medalist Rating?

The Morningstar Medalist Rating doesn’t change the methodology. We do not expect any upgrades or downgrades for either Analyst Ratings or Quantitative Ratings.

The primary change relates to the display of the ratings on our platforms. Specifically, the data point names will change from Morningstar Analyst Rating and Morningstar Quantitative Rating to Morningstar Medalist Rating.

Additionally, we’ve removed the superscript “Q” from the overall rating levels—Gold, Silver, Bronze, Neutral, and Negative—for all strategies currently rated by the Morningstar Quantitative Rating. The superscript “Q” is retained at the pillar level in instances when an algorithmic technique was used to assign that pillar rating. In these cases, authorship is attributed with the following byline: Autogenerated by Morningstar Manager Research.

Finally, we’ve introduced two new data points to provide additional transparency on how ratings are derived. The first data point, called “Analyst Assigned %,” denotes the extent that analysts were involved in the assignment of individual pillar ratings. The second data point, called “Data Availability %,” denotes the extent to which underlying data inputs were available for the algorithmic approach to pillar ratings at the time of the rating assignment. Both data points will be available for all rated vehicles.

The Morningstar Medalist Rating further simplifies and harmonizes how we display our ratings, keeping our analyst views at the center while taking full advantage of the scale benefits from the Morningstar Quantitative Rating. The result is a far simpler and straightforward rating system to power strategy search, selection, and workflow monitoring.

Learn more about the history of our forward-looking ratings in this video.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c74d4d3f-815a-4572-abc0-0c5949833461.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c74d4d3f-815a-4572-abc0-0c5949833461.jpg)