Investing in Times of Climate Change

We examine the landscape of climate-focused funds, as options for investors balloon across the globe.

Investors are increasingly aware of the risks associated with climate change. Some investments will suffer in the transition to a low-carbon economy because of changes in regulation, technology, and consumer behavior. And if mitigation efforts don’t accelerate as temperatures keep rising and weather grows more extreme, investments will face greater physical risks from flooding, hurricanes, and other events.

At the same time, more investors seek to capitalize on opportunities and invest in companies that are working to mitigate climate change or adapt to it, such as through clean energy, electric vehicles, carbon capture and storage, and flood defenses. Getting the world on track for net zero emissions by 2050 requires clean energy transition-related investment to accelerate from $1.1 trillion last year to around $4 trillion annually by 2030, according to the International Energy Agency. Thus, the number of climate-related funds is jumping, and assets in these funds are climbing, too.

The menu of options for climate-focused investors across the globe has ballooned in the past five years. We identified more than 1,500 mutual funds and ETFs with a climate-related mandate globally as of December 2023, compared with fewer than 200 in 2018.

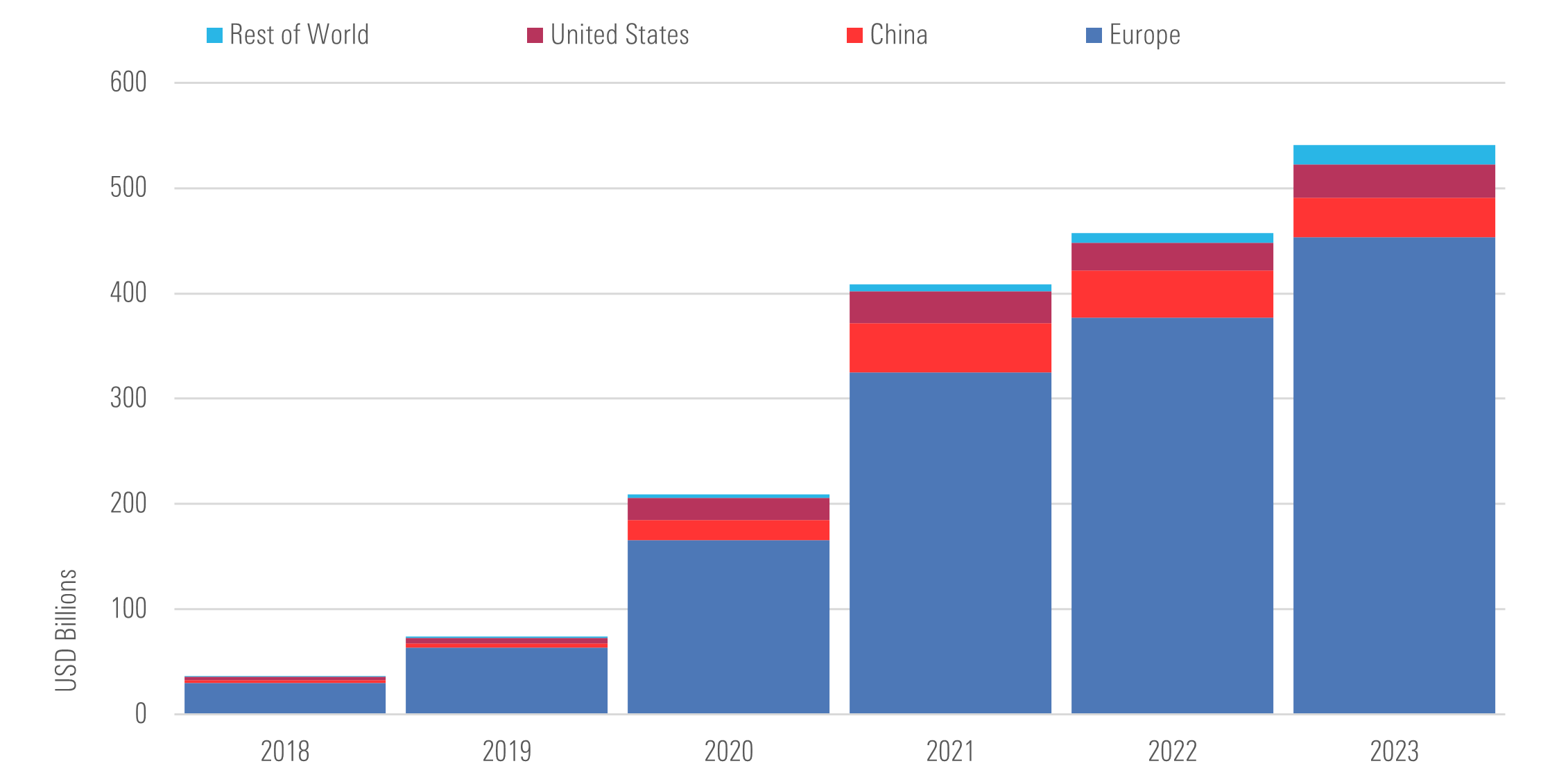

Global demand for climate funds continued climbing too, with assets under management clocking in at $540 billion at the end of 2023, driven by continued inflows, product launches, and market appreciation. The strongest appetite came from Europe. Investors also clamored for climate transition funds, which invest in companies that consider climate change in their business strategy. Those gains came even as demand slackened for sustainable funds broadly. Climate funds focus on climate-related topics, ranging from decarbonizing portfolios to investing in climate solutions like clean energy.

In the fifth annual edition of our report “Investing in Times of Climate Change,” we examined the global landscape of climate-focused funds, grouped these into five mutually exclusive categories, uncovered the growth in climate funds across markets, and drilled down to understand the characteristics of different strategies.

Assets in Climate Funds Surge by 16% to $540 billion in 2023

The global coverage of open-end funds and ETFs with a climate-related strategy surged by 16% in 2023 to $540 billion, driven by continued inflows, product development, and market appreciation. Climate fund assets have grown at a faster clip than the global sustainable funds landscape and now represent almost 20% of that coverage.

Europe Dominates, China and the US Far Behind

Unsurprisingly, given the regulatory push toward climate neutrality, Europe remains the largest market for climate funds, accounting for 84% of global climate fund assets. Assets in Europe-domiciled funds with a climate-related strategy grew by 20% last year to $453 billion. As of December 2023, we identified 875 climate funds in Europe, compared with 253 in China and 135 in the United States.

Global Landscape of Climate Funds

Global Landscape of Climate Funds

Morningstar Direct, Morningstar Research. Excludes funds of funds, feeder funds, and money market funds. Data as of December 2023.

China and the US rank far behind at second and third, with market shares of 7% and 6%, respectively.

Assets Rise on the Back of Fresh Inflows

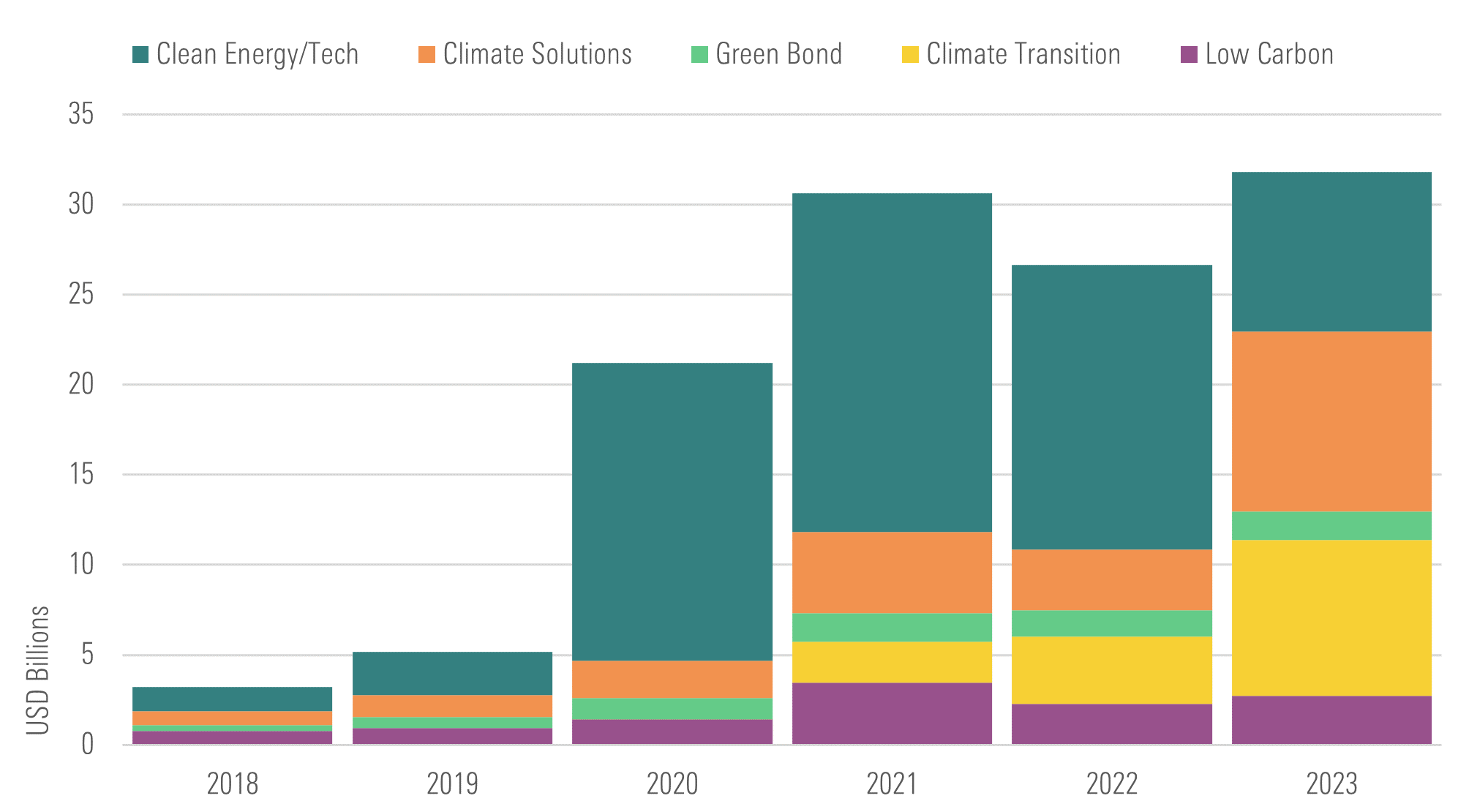

In stark contrast with Europe, assets in US climate funds increased marginally (by 0.6%) over 2023. Assets shrank in 2022 on account of the global energy crisis and rising interest rates. In this environment, renewable energy stocks suffered the most. But strong flows into Climate Transition funds and market appreciation sent assets to a record of USD 31.9 billion at the end of 2023.

Clean Energy/Tech Funds Suffer From Poor Performance

While Clean Energy/Tech funds remain dominant among US climate funds, they have lost assets, and other categories have gained ground. As of December 2023, Clean Energy/Tech funds accounted for almost $10.2 billion in assets, or 32% of the total, down from a record 78% of market share at the end of 2020. Although these funds have suffered outflows, the decline is mostly attributable to falling valuations. Clean/Energy Tech funds tend to have high exposure to growth stocks, which often suffer in a rising-rate environment.

Meanwhile, assets in Climate Transition funds—which seek to invest in companies that consider climate change in their business strategy and are therefore better prepared for the transition to a low-carbon economy—have grown a whopping 133% over the past year to reach USD 8.8 billion at the end of December. These funds netted USD 3.7 billion in flows over that time.

Assets in US Climate Funds

Assets in US Climate Funds

Morningstar Direct, Morningstar Research. Excludes funds of funds, feeder funds, and money market funds. Data as of December 2023.

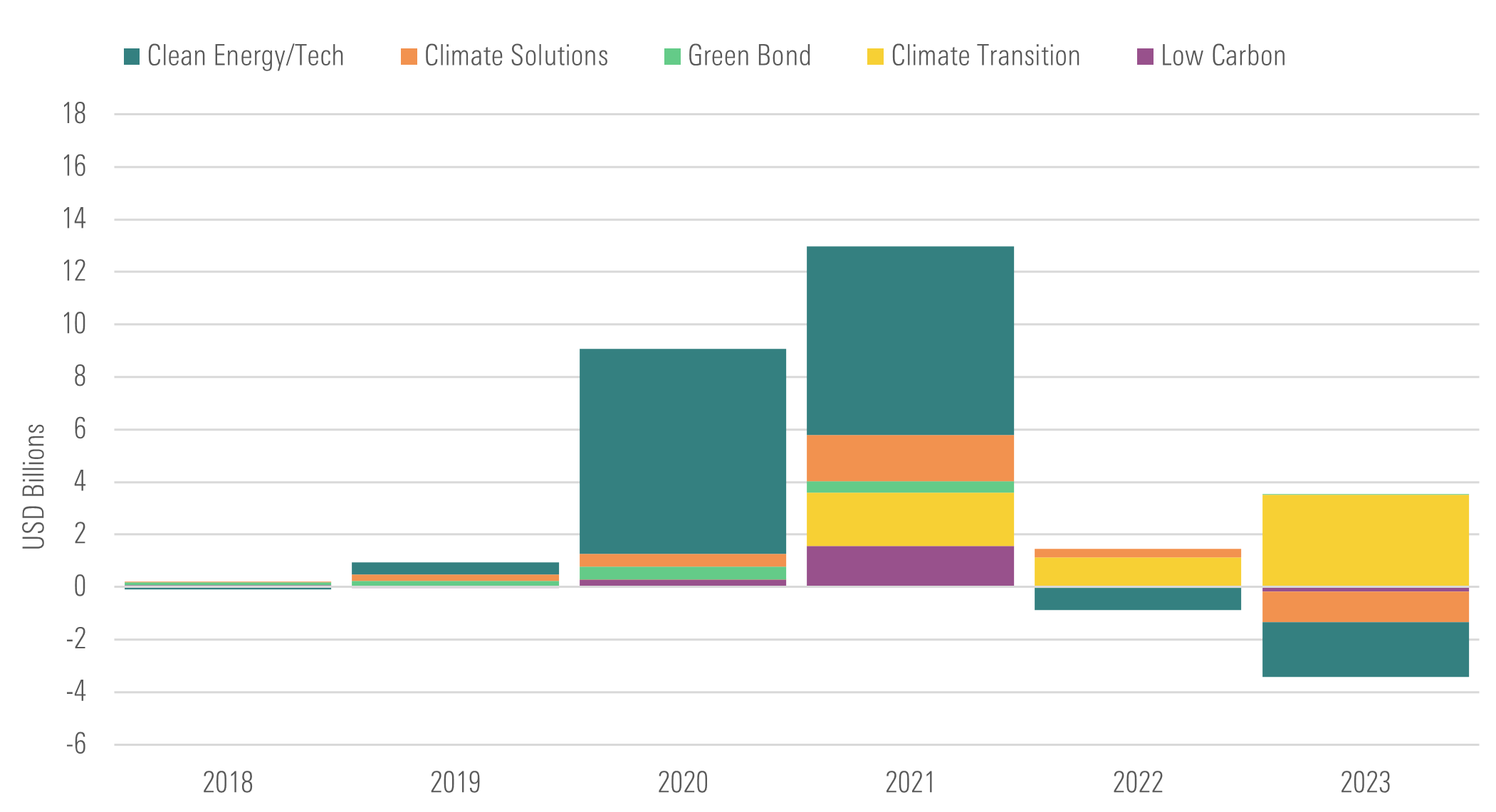

Climate Transition Funds Attract Most of the Flows

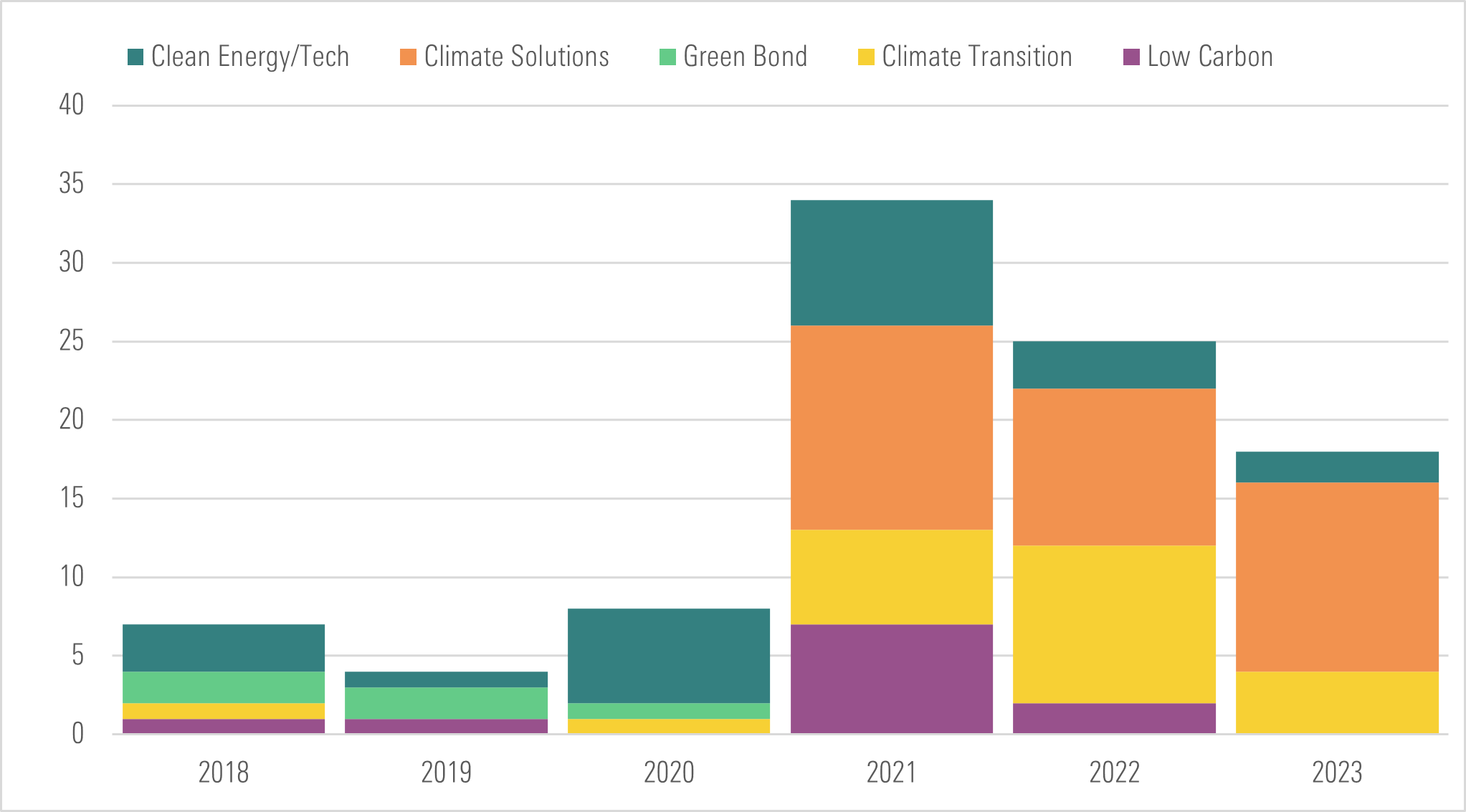

Except for Climate Transition funds, attracting new money hasn’t been easy. Flows into US climate funds fell significantly compared with the segment’s record USD 16 billion collection in 2021. Still, flows into climate funds were more resilient than in the rest of the US sustainable funds landscape, where 2023 annual flows sank to their lowest level in seven years, and sustainable funds shed more than USD 13 billion. Climate funds, on the other hand, gained USD 330 million in net new money in 2023.

Flows Into US Climate Funds

Flows Into US Climate Funds

Morningstar Direct, Morningstar Research. Excludes funds of funds, feeder funds, and money market funds. Data as of December 2023.

Within the climate funds landscape, Climate Transition funds were the clear winners, attracting $3.7 billion last year. More than three fourths of this haul went to Xtrackers MSCI USA Climate Action Equity ETF USCA and iShares Climate Conscious & Transition MSCI USA ETF USCL alone. Both funds track indexes that lean into companies that are well-positioned for the transition to a low-carbon economy or that are actively engaging in the climate transition relative to peers. These processes consider the companies’ carbon-emissions intensity and emissions-reduction targets, among other factors.

While Climate Transition funds topped the chart of flow recipients in 2023, Clean Energy/Tech funds experienced outflows of USD 2.1 billion in 2023. Worth highlighting on the withdrawals side is iShares Global Clean Energy ETF ICLN, the largest fund in our climate fund coverage, which suffered more than USD 1 billion in outflows last year.

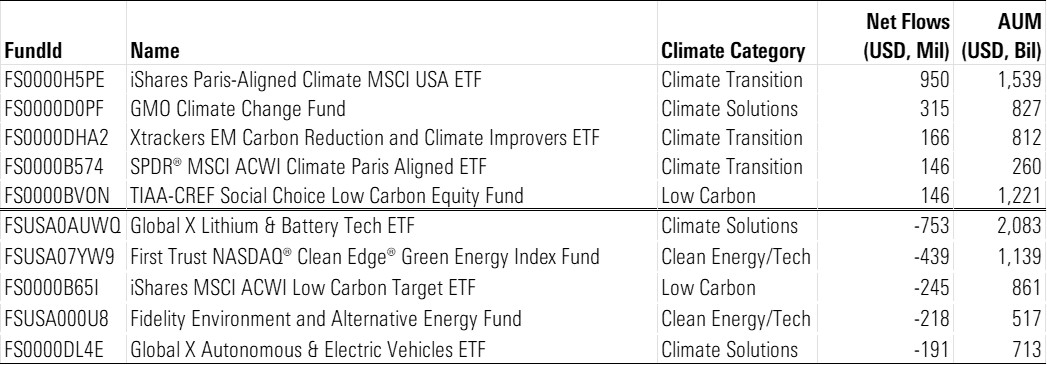

Below we list the five bestselling and five worst-selling climate funds last year.

2023 Flow Leaders & Laggards US Climate Funds

2023 Flow Leaders & Laggards US Climate Funds

Morningstar Direct, Morningstar Research. Excludes funds of funds, feeder funds, and money market funds. Data as of December 2023.

Product Development Activity Declines

In line with the broader fund market, product development in US climate funds has dropped since the peak in 2021. In 2023, only 18 new climate strategies were launched, roughly half of the total seen in 2021.

More than half of new climate funds focus on climate solutions, or those companies that focus on the infrastructure necessary to support the energy transition. For instance, John Hancock Global Climate Action JLFSX invests in companies defined as climate leaders and derive at least 20% of revenue from renewable energy, energy efficiency, or electric vehicles.

New launches in 2023 bring the total number of climate funds in the US to 135. New to last year’s top 10 climate funds are iShares Climate Conscious & Transition MSCI USA ETF, Xtrackers MSCI USA Climate Action Equity ETF, and iShares Paris-Aligned Climate MSCI USA ETF PABU. The first two launched in 2023′s second quarter but quickly shot up the ranks of the largest US climate funds.

Launches of US Climate Funds

Launches of US Climate Funds

Morningstar Direct, Morningstar Research. Excludes funds of funds, feeder funds, and money market funds. Data as of December 2023.

To download the full report, click here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWOIHC3SK5CHJPXXNSL3RJ7VPQ.png)