Is a Wide Moat Better Than a Well-Managed Company? Here’s What the Data Says.

A look at which wins out based on recent stock performance.

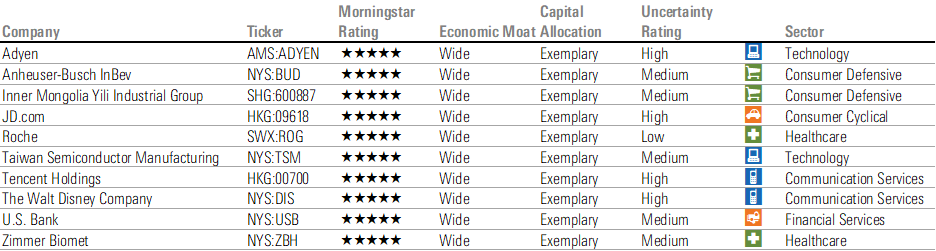

At Morningstar, we often preach about finding stocks with durable competitive advantages, or economic moats, along with exceptional management teams. But an investor has to frequently choose between the two. After all, among the more than 1,500 companies Morningstar equity analysts cover, only 8%—fewer than 130 companies—have both carved a wide Morningstar Economic Moat Rating and enjoy an Exemplary Morningstar Capital Allocation Rating (a measure of management quality), and only 10 of those companies have a Morningstar Rating of 5 stars. Hardly enough to build an entire portfolio (though each are potentially worth exploring further):

10 Undervalued Wide-Moat Stocks With Exemplary Capital Allocation

When forced to choose between management and moats, based on recent stock performance, moats win out. Of course, having smart people running a company is preferable to the alternative. But it can be difficult for even the best corporate leaders to outmaneuver competitors in industries where durable cost advantages, brand power, network effects, or other drivers prevent most firms from carving an economic moat.

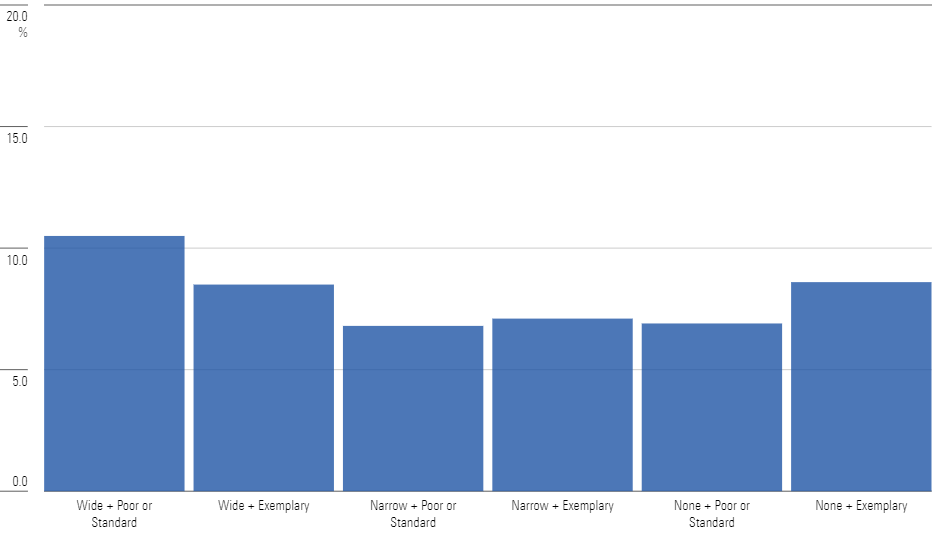

Let’s look at the data. In a sample of nearly 1,000 companies that Morningstar equity analysts have covered from 2017 through today, only 13 stocks were assigned an Exemplary Morningstar Capital Allocation Rating alongside no moat. But despite the rarefied air, these firms saw their median performance underperform wide-moat stocks with Standard- or even Poor-rated capital allocators at the helm.

Wide-Moat Stocks, Even With Poor or Standard Morningstar Capital Allocation Ratings, Have Outperformed All Others

I’d rather invest in a business run by mediocre managers, but operating in a higher-quality end market, than in the best C-suite managing a lower-quality firm. Of course, past performance does not guarantee future results, and valuation is another important overlay. But if forced to choose, give me a moat over management anytime.

Be Wary of Acquisitions, but Not All M&A Is Destructive

Another reason to focus on a moat rather than management is the mixed track record of mergers and acquisitions. Plenty of research suggests that these purchases have tended to destroy value for shareholders. Even back in 1996, Warren Buffett wrote, “I would say that more dumb acquisitions are made in the name of strategic plans than any other.” It’s reasonable to be cautious about announcements of large acquisitions among stocks you own, particularly if there’s not already a moat protecting the economic business’ economic profits.

But not every acquisition is a complete disaster. Data from Morningstar’s equity coverage shows that acquisitions don’t necessarily spell doom for a company’s economic moat.

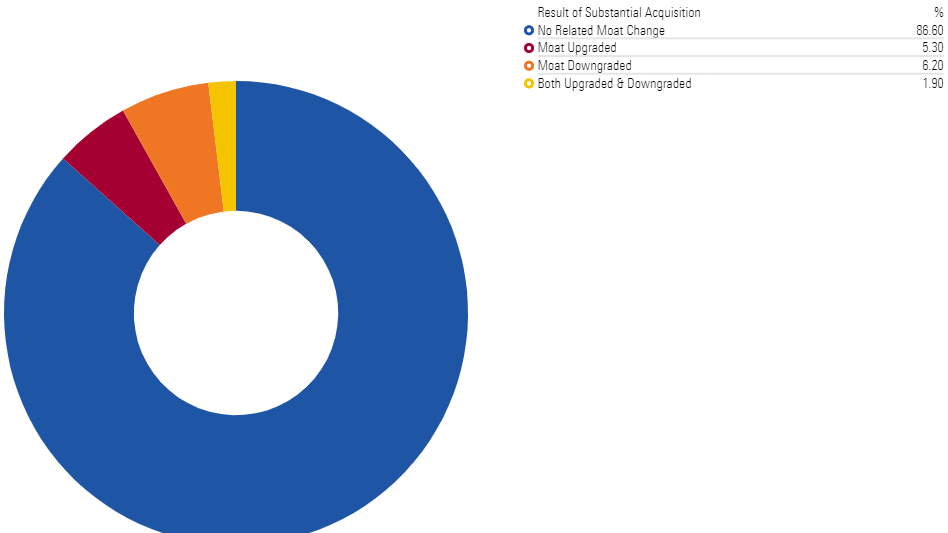

Going back to our sample of nearly 1,000 companies, there doesn’t seem to be much indication of which way a moat is likely to move after a big acquisition. Within this group, more than 200 made a substantial acquisition from January 2017 through July 2023 (as defined by purchases that were more than 10% of the company’s market cap at the beginning of the relevant year). About 75% didn’t see any change to their moat rating, while another 11% had moat changes that were unrelated. That leaves just 28 companies with their competitive positions substantially reassessed after a major acquisition.

Among these firms, the moat results were split: 13 were downgraded, 11 upgraded, while another four saw offsetting changes that left them where they started. In my view, this highlights that each acquisition case is unique.

Firms With Major M&As Show Varied Moat Changes

Take the case of Thermo Fisher Scientific TMO, for instance. In March 2021, the stock was upgraded to a wide moat, with our equity analyst noting that “the firm’s acquisitions have been an enormous boon for its competitive positioning.” While these purchases for years diluted returns on invested capital—our gold standard for measuring companies’ competitive advantages—the firm’s one-stop shop approach affords it pricing flexibility and results in strong customer relationships.

Conversely, our analyst downgraded JM Smucker’s SJM moat to none from narrow in early 2019, in part because of poor acquisitions of pet-food providers Big Heart (in 2015) and Ainsworth (in 2018). The high prices for these purchases led to sluggish returns on invested capital and destroyed shareholder capital. And even after Smucker’s offloaded the bulk of these assets to Post POST in early 2023, our analysts retained a no-moat rating, arguing that any financial firepower gained from the sale could be used for further value-destroying acquisitions. Clearly, Smucker’s Poor Morningstar Capital Allocation Rating has been well-earned.

One universal takeaway: Like everything else in investing, price matters. Just like investors need to avoid overpaying for even the highest-quality stocks, management teams need to avoid letting the promise of spreadsheet-driven math tantalize their taste buds.

Beware especially massive “revenue synergies” promised by acquiring companies. While there may be some opportunity for cross-selling or increased distribution after the merger, many revenue expectations are missed due to overestimating customers’ willingness for cross-selling and underestimating competitors’ responses.

Lessons From Dual Share Classes

One final cautionary point about management: Not all dual share classes are created equally.

Publicly traded companies operate for the benefit of their shareholders, and typically every share of stock has an equal say in a firm’s direction. But occasionally—and lately with large tech companies in particular—firms issue stock with limited voting rights, so public shareholders can capture the economic benefits from being an owner but without the typical associated voice. This is the reason that Mark Zuckerberg and other insiders at Meta Platforms META control more than 60% of the company’s votes despite holding just 14% of shares.

Normally, these insider shares are not publicly traded, offering potential outside investors limited choice on the matter. But in the few cases where multiple classes of shares are available on the market, each with different voting power, the relative pricing of each may offer some important insight on how other investors view management.

For instance, Canadian miner Teck Resources’ Class A and B shares trade at a similar level; clearly, Class B investors aren’t too fussed about their shares holding a hundredth the voting power of each Class A stock.

Compare this with aerospace parts supplier Heico HEI, whose HEI shares hold 10 times the voting power of HEI.A and trade at a 25% premium. The market seems to be pricing in some concern that minority shareholders’ limited influence could weigh on the company’s success. But by the same token, shareholders willing to live with this risk may be capturing some margin of safety, given HEI shares currently trade roughly in line with our fair value estimate (alongside a Standard Morningstar Capital Allocation Rating).

Depending on your view of management quality and desire to vote in company matters, owning nonvoting shares may be acceptable, particularly if they’re heavily discounted. But be careful; sometimes you get what you pay for.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-02-2024/t_6b25eabdd47c4e2bb51fbb816a658179_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)