Markets Brief: Inflation Is Back In the Spotlight

Plus: Corporate bonds are in favor, story stocks struggle, and Nvidia shows weakness.

Insights on key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

The Morningstar US Market Index rose 0.67%, with lower-growth sectors such as financials and energy typically outpacing the companies expected to generate faster profit growth.

Investors Keen On Corporate Bonds

The fixed-income markets showed small movements in yields, credit spreads, and expectations for future interest rates. Government bonds continue to offer high real (i.e. net of inflation) yields relative to the recent past. It is not surprising that investors continue to “pile into bond funds,” as Morningstar analysts Adam Sabban and Ryan Jackson observe in their latest fund flow report.

Investors are also enthusiastic about corporate bonds, despite the higher expected correlation with equity prices and unusually skinny credit spreads. As ever with fixed-income investing, it is important to be clear about why you own the investment, as confusion here can lead to expensive mistakes amid market volatility.

Story Stocks Plummet

Some investors recently got painful reminders of what happens when investing is divorced from financial analysis and used as a proxy for a political or cultural view. The owners of both GameStop GME (down 17%) and Trump Media & Technology Group DJT (down 25%) appear to be more focused on supporting a view than maximizing long-term returns. Morningstar Wealth’s Danny Noonan unpacks the challenges of mixing politics and investing.

Beyond Nvidia

Market leader Nvidia NVDA fell 4% over the week after briefly becoming the most valuable company listed in the US markets. The company has become the default way of investing in generative artificial intelligence, which has seen extraordinary growth over the last 18 months. However, technology equity analysts William Kerwin and Brian Colello believe investors wishing to access this industry should also consider other companies.

Inflation In the Spotlight

Inflation is back in the news this week with the release of the Fed’s preferred measure of price changes. The Personal Consumption Expenditures Index is expected to show a further decline in inflation to an annualized rate of 2.6% in May, at both the headline and core levels. If such predictions come true, we can expect investors to become more confident in their consensus for the path of interest rate cuts.

Highlights of This Week’s Market and Investing Events

- Tuesday, June 25: June Consumer Confidence Survey

- Wednesday, June 26: May New Home Sales

- Thursday, June 27: May Durable Orders, earnings from Nike NKE

- Friday, June 28: May Personal Income and Outlays, PCE Price Index

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended June 21

- The Morningstar US Market Index rose 0.65%.

- The best-performing sectors were consumer cyclical, up 2.15%, and energy, up 1.80%.

- The worst-performing sector was utilities, down 0.74%.

- Yields on 10-year US Treasury notes rose to 4.25% from 4.20%.

- West Texas Intermediate crude prices rose 2.78% to $80.63.

- Of the 702 US-listed companies by Morningstar, 477, or 68%, were up, 0 were unchanged, and 225, or 32%, were down.

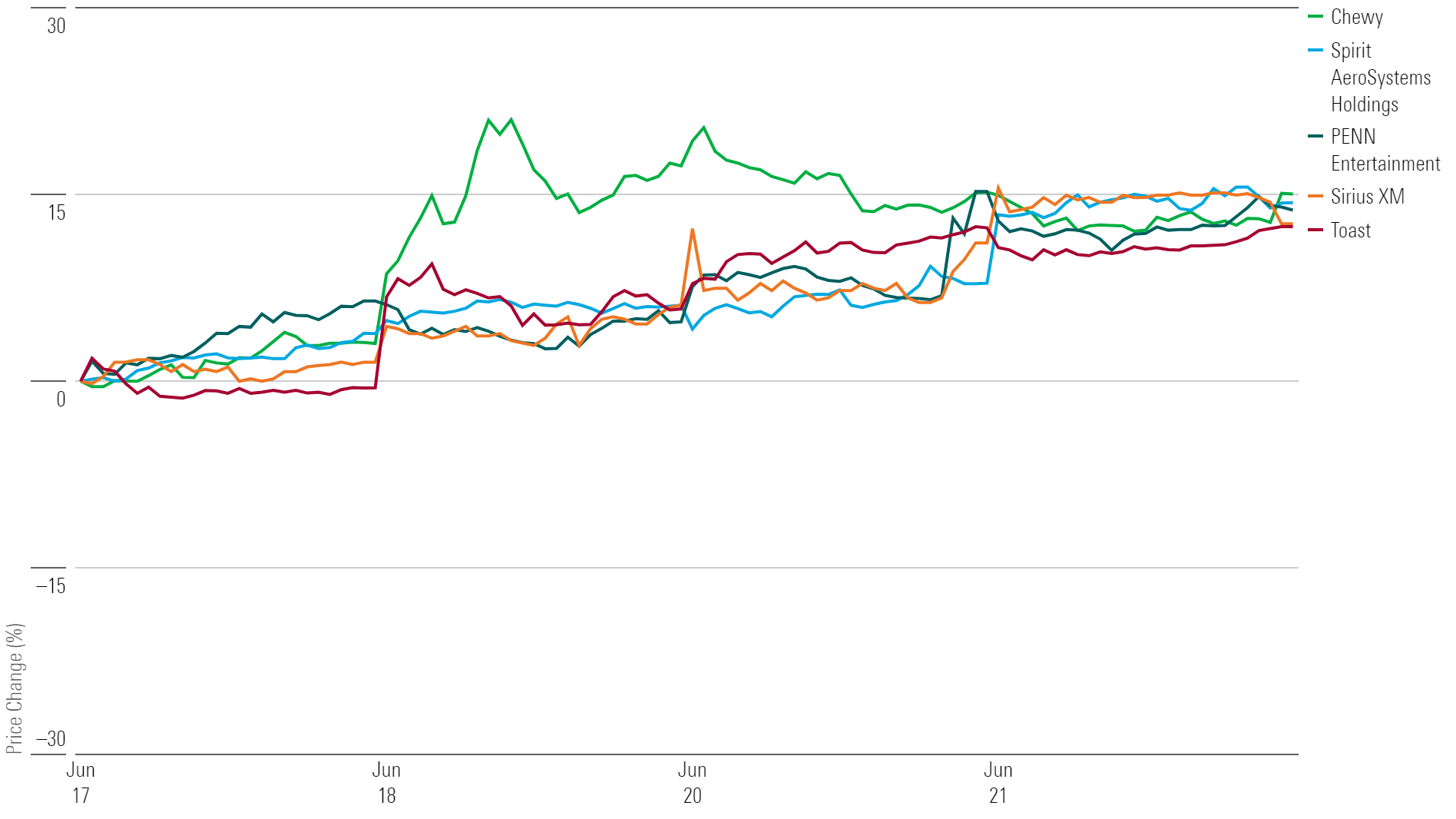

What Stocks Are Up?

Chewy CHWY, Spirit AeroSystems Holdings SPR, PENN Entertainment PENN, Toast TOST, Sirius XM Holdings SIRI.

Best-Performing Stocks of the Week

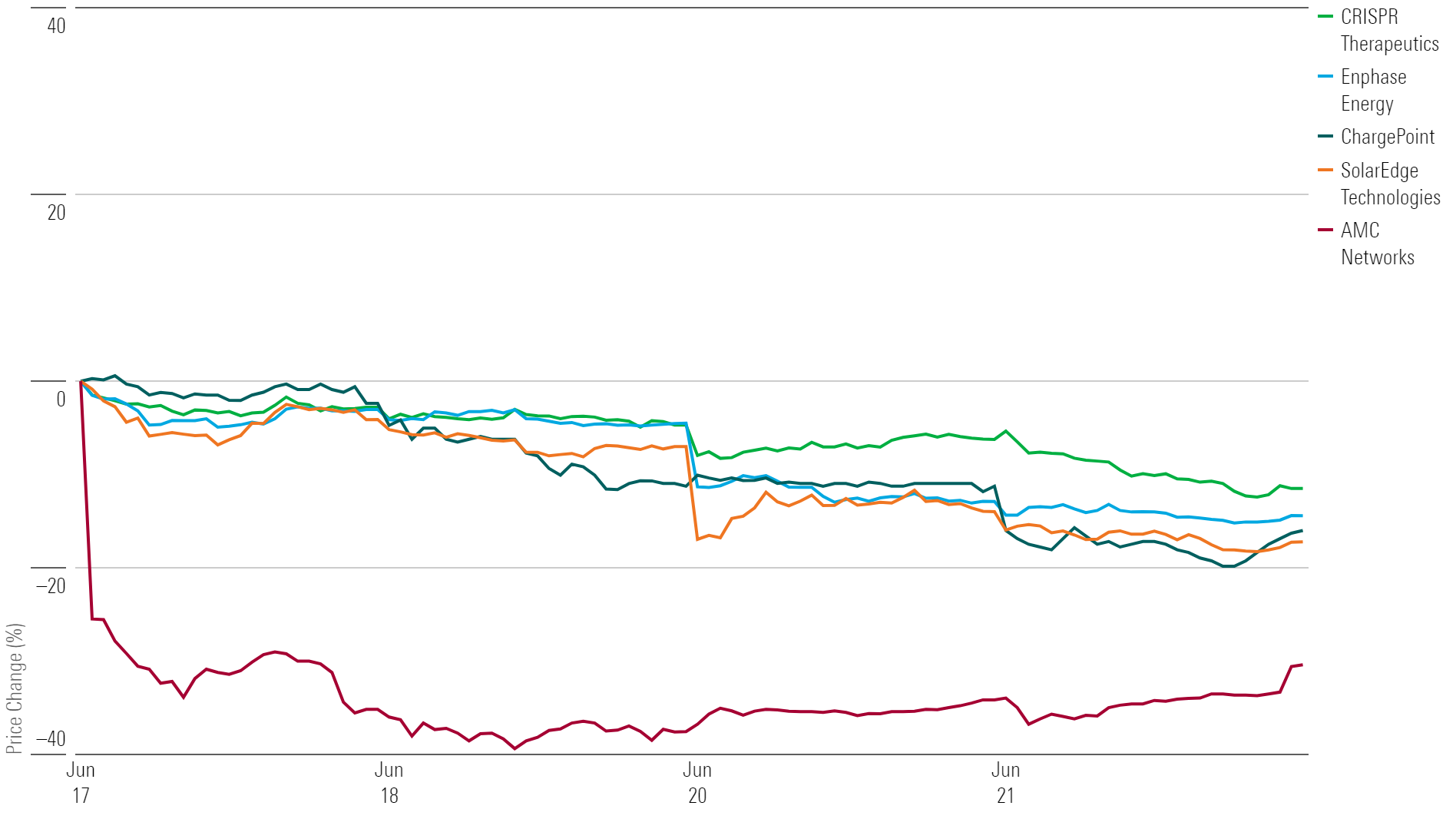

What Stocks Are Down?

AMC Networks AMCX, SolarEdge Technologies SEDG, ChargePoint Holdings CHPT, Enphase Energy ENPH, CRISPR Therapeutics CRSP.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-08-2024/t_faa4cc76d44c4a4592915852ca96bed4_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RMBMMBAVABHL5O5JI2WDI44I3U.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)