Morningstar Awards for Investing Excellence: Outstanding Portfolio Manager Nominees

Consistency, longevity, discipline, and temperament are the hallmarks of these three funds’ managers.

Morningstar has unveiled the nominees for its 2024 Morningstar Awards for Investing Excellence: Outstanding Portfolio Manager. They are the Loomis Sayles Global Allocation team, Fidelity Total Bond’s Ford O’Neil, and JPMorgan Equity Income’s Clare Hart.

We selected the nominees from investment strategies that earn Morningstar Medalist Ratings of Gold or Silver for at least one vehicle or share class. Long, impressive track records, well-ordered but still adaptable philosophies and processes, and a willingness to put investors’ interests above their own distinguish them. All three are worthy of recognition, but Morningstar will announce one winner later this month.

Here is what sets each nominee apart.

The Loomis Sayles Global Allocation Team

Originally conceived as an internal investment option for firm employees, Loomis Sayles Global Allocation LGMAX has become a solid portfolio anchor for almost any common investor.

The strategy limits its diet to global stocks and bonds, but its approach is not rigid. Its veteran managers—David Rolley, Eileen Riley, Lee Rosenbaum, and Matthew Eagan—meet monthly to discuss and debate the best opportunities among global stocks, and US and global bonds. They then decide, based on their experience running other Loomis strategies, how to shift among the asset classes. Stocks have ranged from 35% to about 70% of assets over time, but equities have done most of the heavy lifting here over the past decade as historically low interest rates led the fixed-income managers to hunker down in short-term Treasuries and Loomis’ best credit ideas. The equity team has done an excellent job picking 30 to 50 stocks of competitively advantaged companies that offer solid profit and free cash flow growth at reasonable valuations.

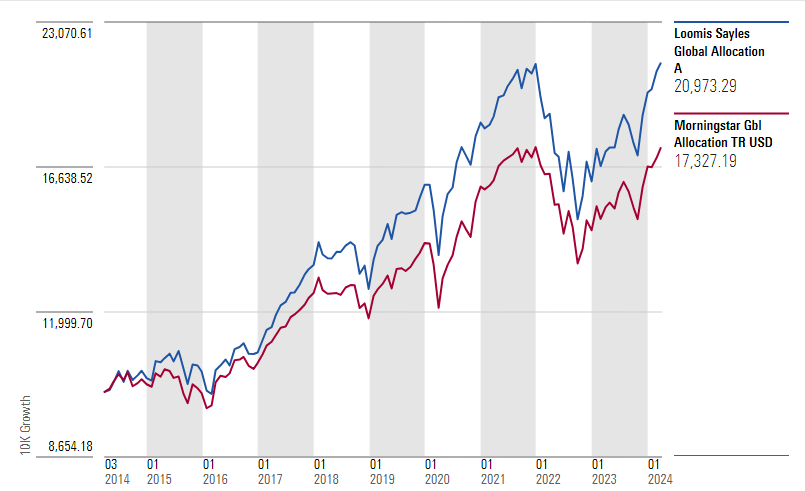

The strategy has delivered excellent diversification and risk-adjusted returns. Since the September 2000 start of its longest-tenured manager, Rolley, the fund’s 7.7% annualized gain through the end of March 2024 beat the average global allocation Morningstar Category fund by more than 3 percentage points with better Sharpe and Sortino ratios, measures of risk-adjusted results. The fund has really come on since Riley and Rosenbaum took charge of its equity sleeve a decade ago; its 10-year returns through the end of March beat 99% of its peers.

The Loomis Sayles Global Allocation Team's Record

Ford O’Neil, Fidelity Total Bond

Fund manager Ford O’Neil won the award formerly known as Morningstar Fixed-Income Manager of the Year in 2016 but remains accolade-worthy for his body of work running, at last count, about $130 billion across a variety of Fidelity mutual funds and exchange-traded funds. Ford also has been instrumental in making Fidelity, a family that built its reputation as a home for prominent stock-pickers, into a fixed-income powerhouse, too.

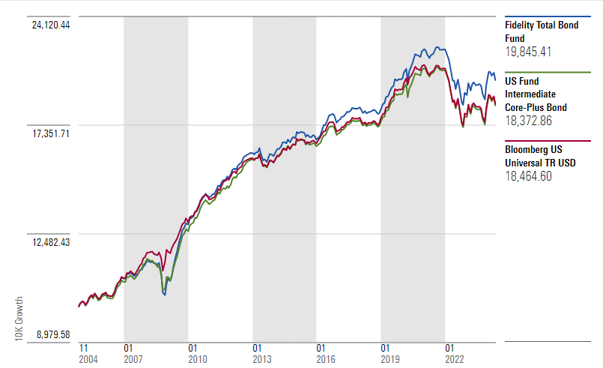

Fidelity Total Bond FTBFX, O’Neil’s largest and longest assignment, exemplifies his competence and accomplishments. Since O’Neil’s December 2004 start at Fidelity Total Bond through the end of March 2024, the fund’s 3.7% annualized gain beat the typical intermediate core-plus bond Morningstar Category fund’s 3.3% and the Bloomberg U.S. Aggregate Bond Index’s 3.1%.

What really sets O’Neil’s record apart, though, is its consistency. Fidelity Total Bond not only has beaten its peers and benchmark in many of the calendar years on O’Neil’s watch, but it has done so with less volatility, as measured by standard deviation, and with shallower drawdowns. O’Neil and the comanagers who have joined his team in recent years accomplished this by avoiding large interest-rate bets and judiciously weaving high-yield corporates and loans, collateralized loan obligations, nonagency mortgages, and emerging-markets bonds into a portfolio of more usual core bond fund holdings: corporate credit, mortgages, and US Treasuries.

Ford O'Neil's Record at Fidelity Total Bond

Clare Hart, JPMorgan Equity Income

Clare Hart took the road less hyped at JPMorgan Equity Income OIEIX, and it has made all the difference. Since taking over this fund in August 2004, Hart has avoided high-flying disruptors that tend to get lots of attention and lofty valuations and has favored established and often unappreciated companies that pay reliable dividends and can sustain yields of at least 2%. The portfolio of about 100 stocks has given its shareholders exposure to yield-rich, value-leaning sectors, such as financials and industrials, but it has been no yield-chaser. Hart often has steered the fund away from areas and stocks that have enticing yields but deficient business models, such as utilities or basic materials. That speaks to her competitive advantage. There’s nothing special about Hart’s process—many rivals claim to practice similar dividend-focused approaches—but her steady discipline and temperament in applying it has made the fund a compelling core holding.

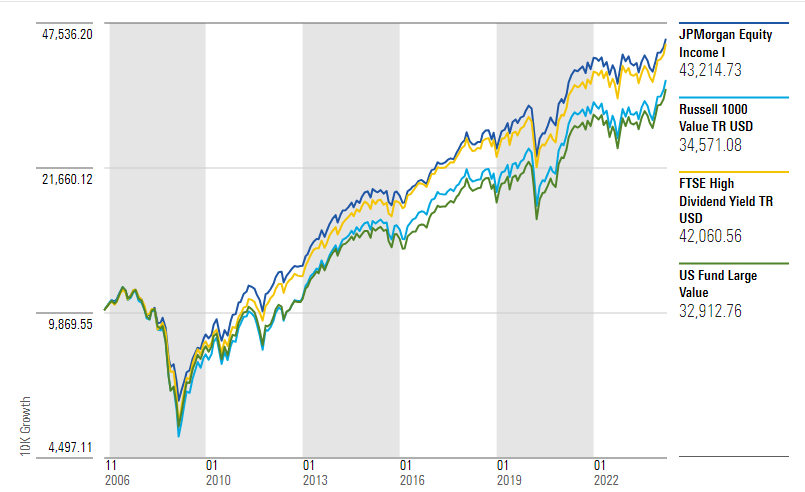

Hart plans to retire in the fall of 2024 but has instilled successors Andrew Brandon and David Silberman, her comanagers since 2019, with the same philosophy and ethos. And she’ll leave behind a sterling record in a very competitive part of the market. Since the August 2004 start of Hart’s tenure through the end of March 2024 the fund’s 9.4% annualized gain beat the large-value category and the Russell 1000 Value Index by more than a percentage point. Since the November 2006 start of the FTSE High Dividend Yield Index through March 2024, JPMorgan Equity Income’s 8.8% return edged that dividend-yield-focused benchmark by about 17 basis points.

Clare Hart's Record at JPMorgan Equity Income

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UEU7ZJHEKBDGBHFL6N73M24EYY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)