Exchange-traded funds are still relatively new, but they’ve quickly surged in popularity.

ETFs trade on stock exchanges such as the New York Stock Exchange, in the same way that stocks do. This is different from mutual funds, for which trades are conducted through brokers or with the investment companies themselves, and for which orders are only processed once a day.

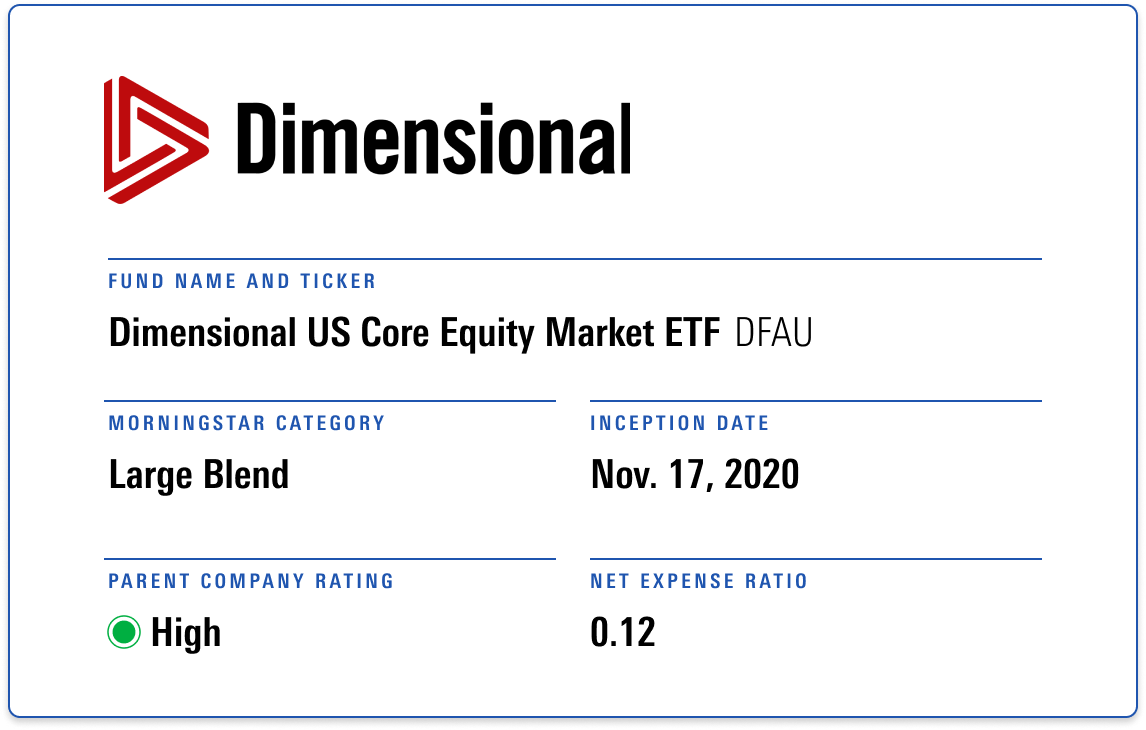

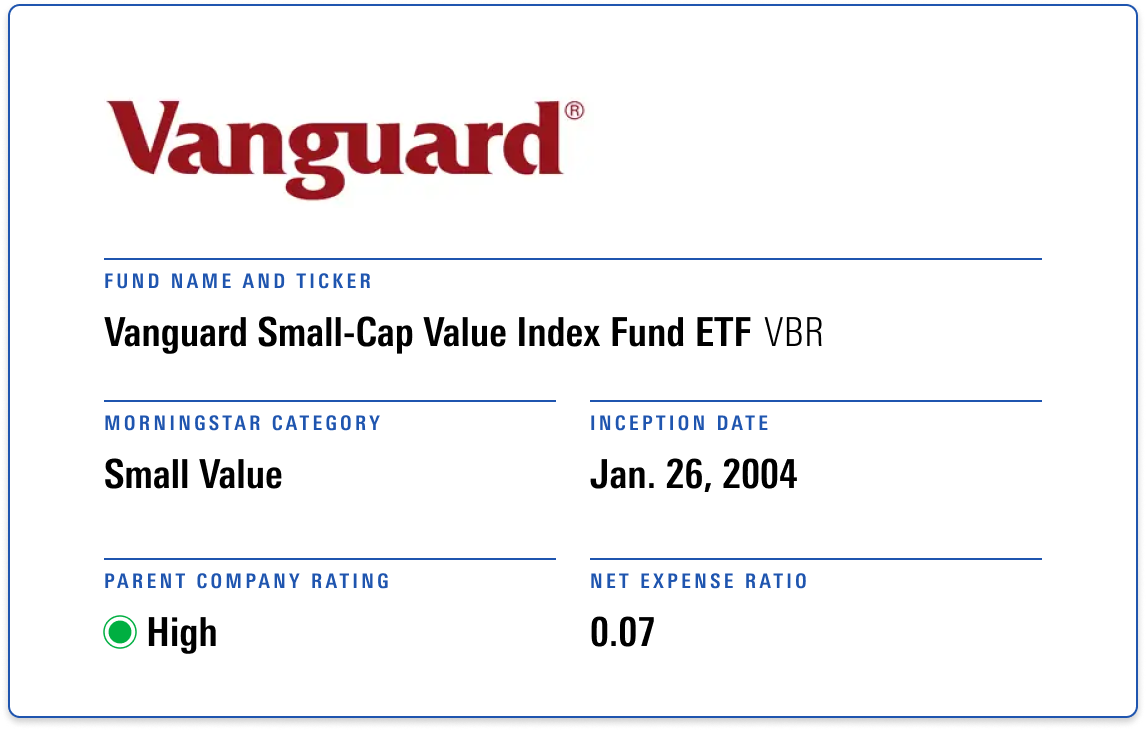

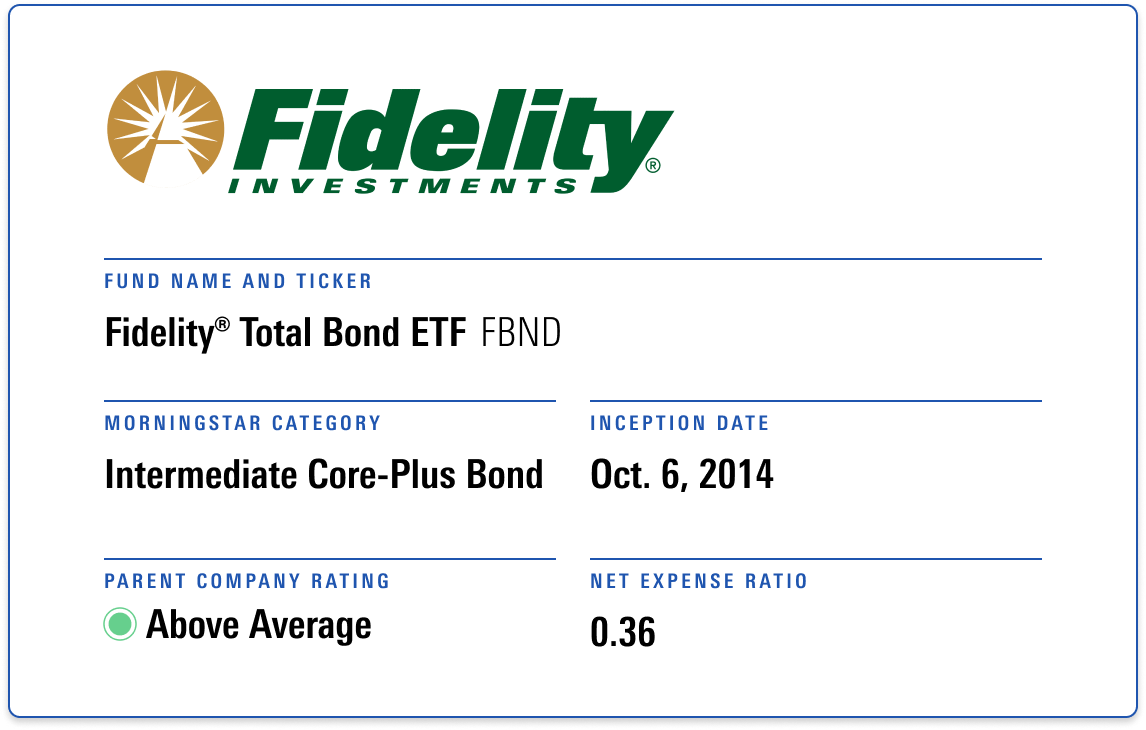

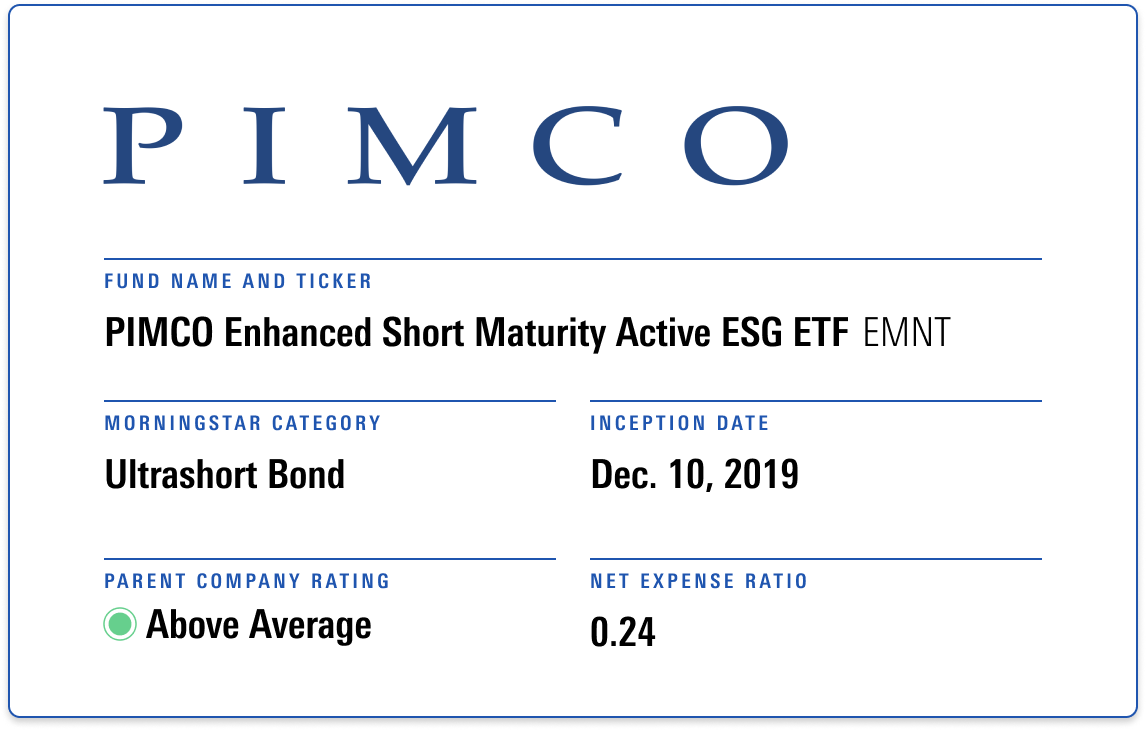

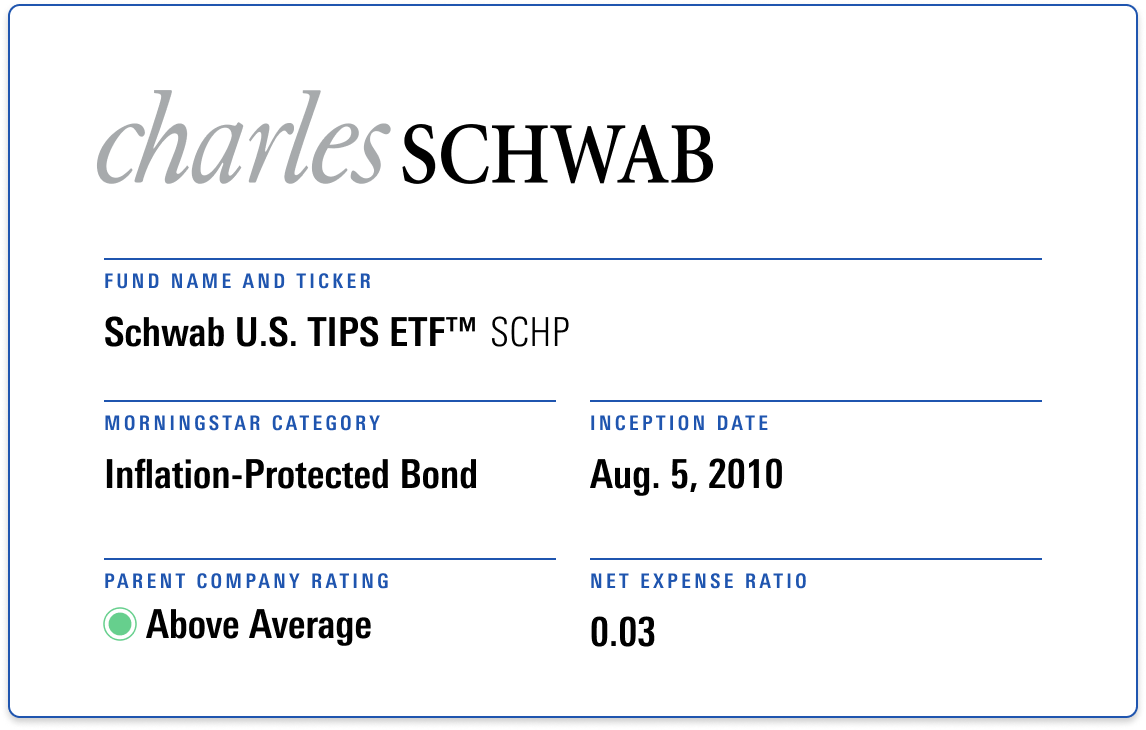

Since ETFs debuted in 1993, investors have flocked to them because they’re typically cheaper, usually more tax-efficient, and simple to buy and sell. However, their attractiveness can vary substantially depending on the specific fund, so it’s still essential to evaluate each option carefully.

This guide answers some common questions about the inner workings of ETFs, the associated costs, and how to get started investing in them.