Real Estate: Interest Rate Movements Drive Performance

Our top picks in this sector include Ventas, Kilroy, and Realty Income.

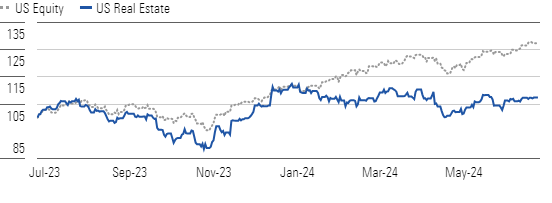

The Morningstar US Real Estate Index only rose 7.4% over the trailing 12 months, well below the 27.3% gain seen by the broader US equity market. The sector also underperformed in the second quarter of 2024, down 2.7% compared with the 3.4% gain in the broader market.

Real Estate Performance Has Been Flat, Trailing the Broader US Equity Market

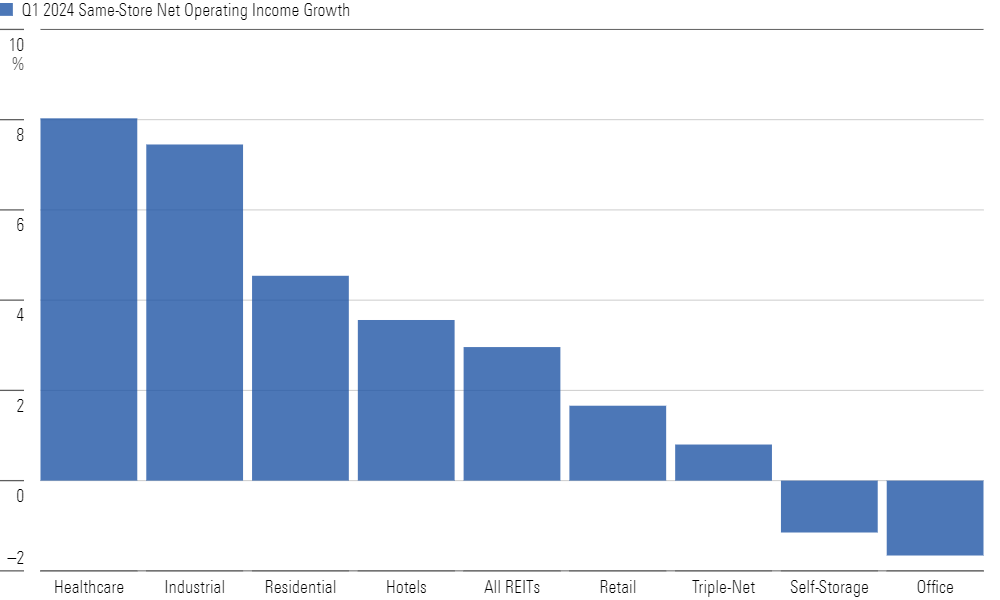

Same-store net operating income growth continues to decelerate across most real estate subsectors from the historic highs seen in 2022, though many are still producing growth at or above their long-term historical average. While management teams generally guided for low growth in 2024 on their fourth-quarter earnings calls, on their first-quarter earnings reports, many raised guidance for the full year on a stronger outlook for the second half.

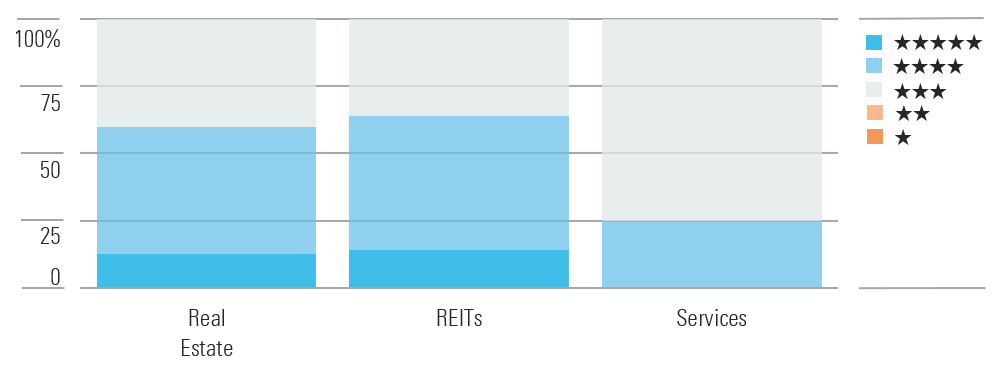

Real Estate Sector Currently Trading at Significant Discount to Fair Value

The average real estate stock currently trades at a 15% discount to our fair value estimate, which is in line with or better than most other North American sectors. Currently, 12.5% of the sector is trading in the 5-star range, 47.5% is trading in the 4-star range, 40% is trading in the 3-star range, and none of the companies under our coverage are rated 2 stars or lower.

UST Rate Movements Have Been the Driving Factor Behind REIT Performance

The sector’s performance is negatively correlated with interest rate movements, so the Real Estate Index has moved inversely to the 10-year US Treasury. Additionally, while same-store net operating income growth is decelerating for most sectors, REITs on average reported growth around the historical average of 3%. While self-storage and office saw declines in same-store performance, the low retail and triple-net figures aligned with their historical averages. Meanwhile, healthcare and industrials continue to produce very strong growth.

Several REIT Sectors Produced Above-Average Same-Store NOI Growth In Q1

Top Real Estate Sector Picks

Kilroy Realty

- Fair Value Estimate: $59.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

Shares of Kilroy KRC have corrected by more than 55% since the onset of the covid-19 pandemic, even as the company’s NOI has increased materially due to the completion of development properties and acquisitions. We recognize the uncertainty surrounding the future of office real estate, and we believe the environment will remain challenging for office owners in the near-to-medium term. But we also believe the selloff has been overdone and the market is not recognizing the value of the firm’s nonoffice-related assets and land bank. Kilroy has a high-quality portfolio, with an average building age of 11 years, compared with 34 years for other office REIT peers, and it should thus benefit from the flight-to-quality trend in offices.

Ventas

- Fair Value Estimate: $69.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Ventas’ VTR portfolio of senior housing assets should produce double-digit net operating income growth for the next several years, given strong demand growth combined with limited supply growth. Additionally, the company’s medical office and life science portfolios should provide recession-resistant revenue. The firm’s development pipeline should also produce yields above its cost of capital even amid high interest rates, producing more cash flow growth for shareholders. Ventas sold off due to rising interest rates, but we believe this provides an attractive entry point for shareholders looking for a REIT with a strong growth story.

Realty Income

- Fair Value Estimate: $76.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Low

Realty Income’s O portfolio should provide stable rental payments in nearly any economic environment. The company’s assets are mostly leased to defensive retail tenants, like pharmacies and gas stations, which generally produce stable sales even in economic recessions. Additionally, the firm’s high coverage ratio helps tenants maintain rent payments even if they experience a slowdown in sales. The stock has sold off, as its value is sharply inversely correlated to rising interest rates, given its high dividend payments and reliance on debt-funded acquisitions for growth. However, we believe the current market-implied cap rate undervalues Ventas’ portfolio of stable assets.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-02-2024/t_6b25eabdd47c4e2bb51fbb816a658179_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)