Small-Cap and Value Stocks Are Undervalued

And four more market trends from Q1 2024.

The first quarter of 2024 was not short on storylines.

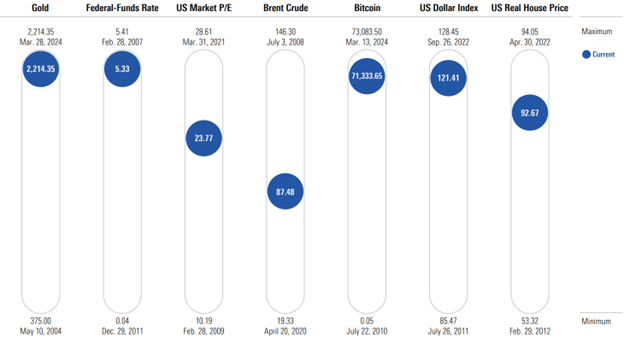

Stocks rallied against the backdrop of interest-rate cut expectations, artificial intelligence optimism, and a resilient US economy. In bonds, US high-yield and emerging-markets saw slight gains, but US Treasuries and investment-grade credit lagged amid continued inflation concerns. Commodities rebounded and gold prices hit 20-year highs by quarter’s end. Here’s where markets stand after an eventful quarter.

Market Thermometer

Elsewhere, quiet but important trends emerged.

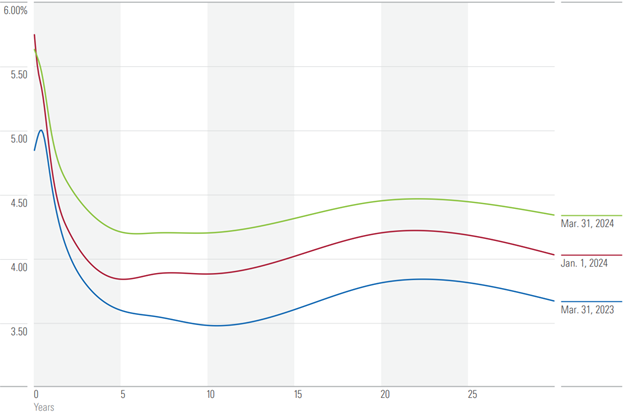

Bond investors pared rate-cut expectations by quarter-end as economic data remains robust. Most still predict modest cuts by the end of the year, but those probabilities are evaporating quickly. Preston Caldwell, Morningstar’s senior US economist, projects rates to fall more than the consensus.

Across the funds landscape, active ETFs continued to gather momentum despite assets in passively managed funds surpassing those in actively managed ones. And on Jan. 11, spot bitcoin ETFs made their highly anticipated debut and haven’t looked back since.

Every quarter, Morningstar’s research team reviews the most recent US market trends and evaluates the performance of individual asset classes. We then share our findings in the Morningstar Markets Observer, a publication that draws on careful research and market insights.

Interested readers can download the report here. Morningstar Direct and Office clients can also access the report on Direct Compass.

Here are some other interesting findings from our latest quarterly market review.

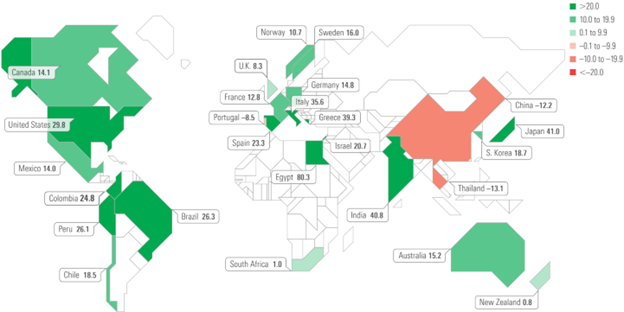

Japanese Stocks Lead the Way

Equity markets continued their strong growth from 2023 into the first quarter of 2024. Japan had a great year, as investors are excited about the possibility of the country’s deflationary environment finally coming to an end. Egyptian equities led the way, rising more than 80% over the year, but much of that was due to the depreciating Egyptian pound. On the other hand, a handful of countries saw losses, such as Portugal, where equities fell due to political uncertainty and reduced growth expectations.

Global Market Barometer

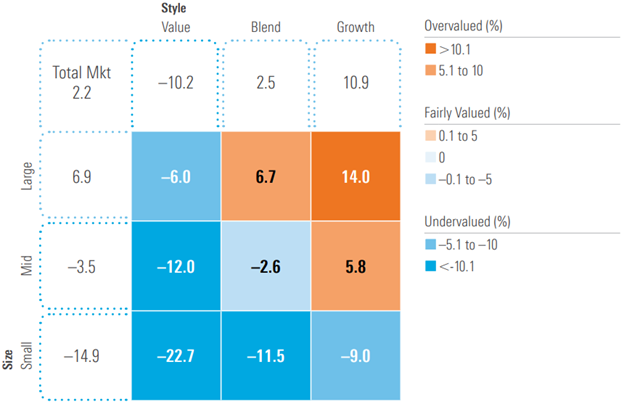

Small-Cap and Value Stocks Are Undervalued

The large gains of many mega-cap stocks over the past year have led to the large-growth and large-blend sections of the Morningstar Style Box being overvalued. On the other hand, opportunities remain in small-cap and value stocks as they remain undervalued. While narrow and no-moat stocks continue to trade below their fair value, wide-moat stocks are trading at a premium. Overall, equities look slightly overvalued.

Morningstar Price/Fair Value, US Equity Style Box

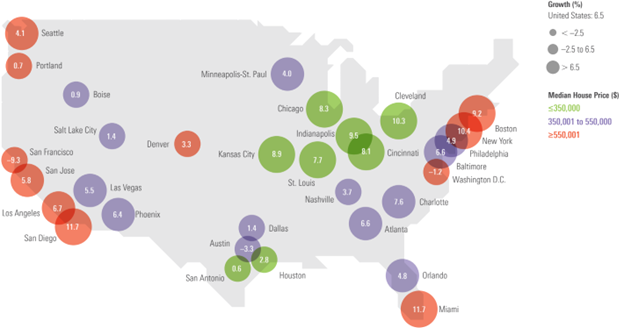

US Home Prices Regain Momentum

Nationwide, home price appreciation accelerated in 2023 compared with 2022. Many metro areas, which saw a sharp correction in prices in 2022, saw a rebound in 2023, such as Los Angeles, Las Vegas, and Denver. Price appreciation has been weaker in metros like Boise and Austin, where prices spiked during the pandemic, but housing supply is now expanding briskly thanks to minimal restrictions on building.

Year-Over-Year Price Growth, Q4 2023

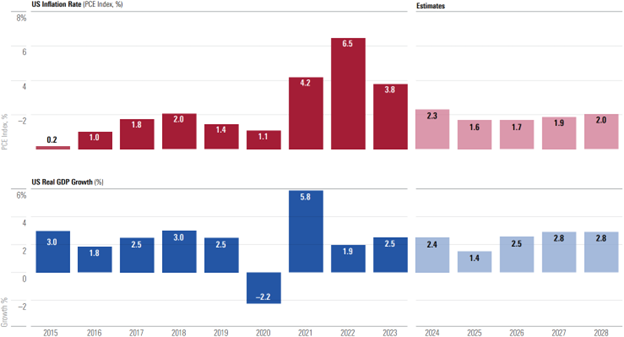

No Recession on the Horizon

We expect US gross domestic product growth to slow over the next year, owing to delayed effects of monetary tightening along with the depletion of household excess savings. The alleviation of supply constraints along with cooling demand is pushing inflation down, and we expect inflation to be in line with the Fed’s 2% target in 2024 and following years. This will allow the Fed to begin cutting rates aggressively, triggering a GDP growth rebound in 2026 and beyond.

US GDP Growth Will Trough in 2025 Before Recovering

Yield Curve Remains Inverted as Long Rates Rise

Following the strong Treasuries rally, which saw yields plummet in November and December 2023, long rates moved significantly higher in parallel fashion while short rates were unchanged during the last three months. The yield curve has remained inverted since 2022 and reached its deepest level during the banking crisis in March 2023, but it stands less inverted today.

US Treasury Yield Curve

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-08-2024/t_faa4cc76d44c4a4592915852ca96bed4_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RMBMMBAVABHL5O5JI2WDI44I3U.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)