Stellantis Stock Is Undervalued, Even as It Catches Up in the Electric Vehicle Market

The company is planning an aggressive EV push, including for its popular Ram trucks.

Quick: What was the top-selling plug-in hybrid vehicle in America last year?

If you named a Toyota or Ford model, you’d be wrong. The answer is the Jeep Wrangler.

But your incorrect guess also points to one reason why Jeep parent Stellantis STLA trades at such a steep discount to its peers.

The world’s fourth-largest automaker, Stellantis is the product of the 2021 merger of Fiat Chrysler and Peugeot. It sold more than 6 million cars last year, including legendary makes like Alfa Romeo and Maserati. In the United States, it counts Ram trucks as among its best-known offerings.

As automakers around the globe have accelerated their push into electric vehicles, Stellantis has been a laggard. But that’s changing. The company’s luxury marques will soon have fully electric lineups, and beginning in 2026, all of Stellantis’ new cars in Europe will be fully electric.

Stellantis has big plans for the U.S., too. This year, Dodge unveils its first electric muscle car, which will hit the streets in 2024. Next year, Stellantis plans to unveil a fully electric Jeep, first of a comprehensive roster of electric SUVs. Amazon.com AMZN will be the first commercial customer for the RAM ProMaster EV, which it helped Jeep design.

“They were pretty far behind the rest of the automakers in developing EVs,” says Morningstar senior analyst Richard Hilgert, who follows Stellantis. “They’re catching up.”

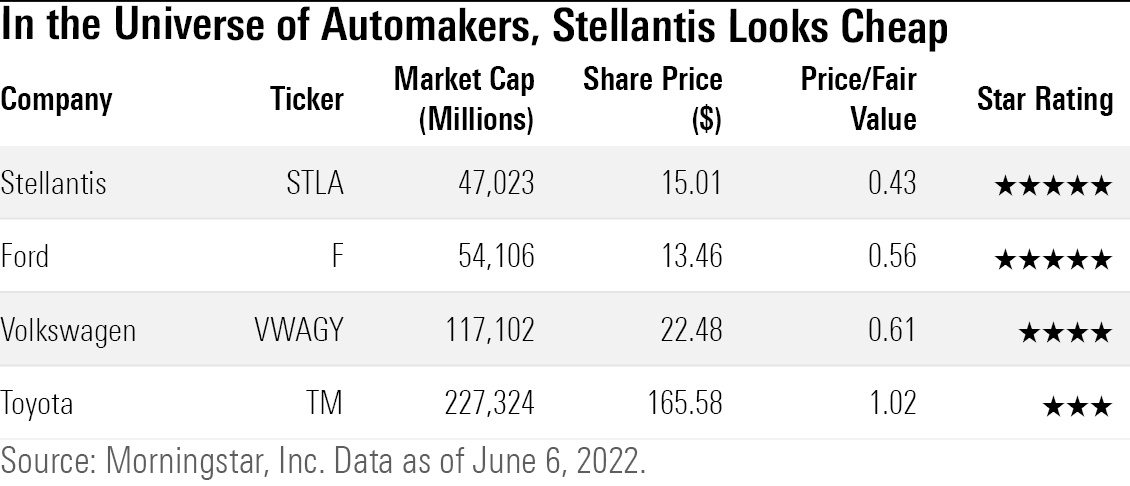

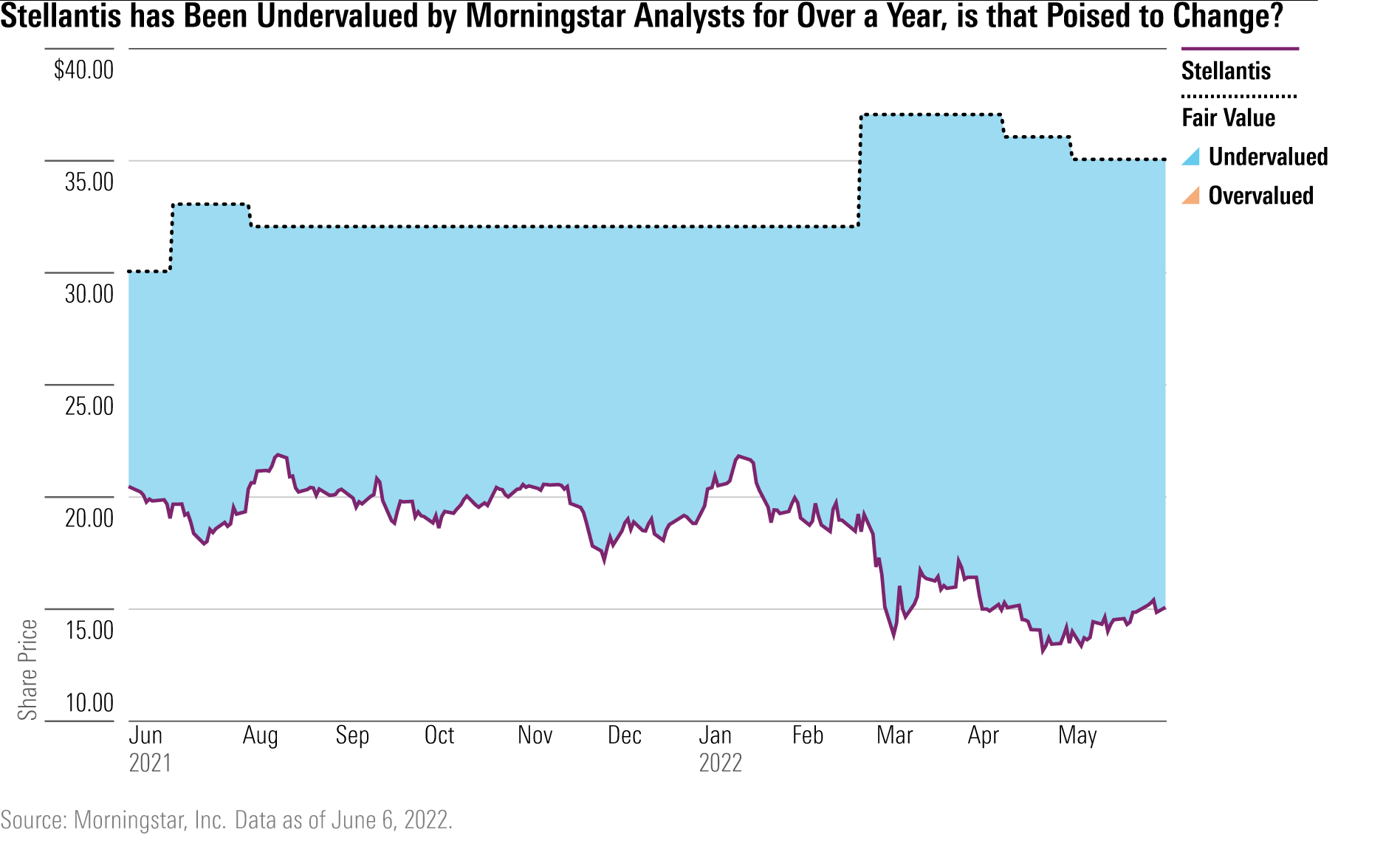

Changing hands $15 per share, Stellantis’ Morningstar Rating is 5 stars, trading at a 57% discount to Hilgert’s $35 fair value estimate for the company. That’s a hair cheaper than Ford Motor F and General Motors GM. Toyota TM, one of the leaders in electric vehicle sales in the U.S. market, trades in line with its fair value estimate.

To catch up with leading EV automakers such as Tesla TSLA, Ford, and Toyota, Stellantis will require an aggressive EV push.

Stellantis plans to launch EVs only for all its luxury brands beginning in 2024, for all its premium brands beginning in 2025, and for all brands in Europe beginning in 2026. In the U.S., beginning in 2024, all new launches will include an EV version, including RAM commercial vans and Chrysler family cars. Stellantis hasn’t set a date for when it will stop making internal combustion engines in North America but says 50% of its new vehicles in North America will be electric in 2030.

“Their overall EV strategy is a good strategy, and they’re aggressively hitting the market with models,” says Hilgert.

And even though Ford and GM’s electric pickups will come to market before Stellantis’, Hilgert says, loyalty for the RAM is high among customers after the model won awards. “Not having an electric model in the U.S. first isn’t something that will be a serious setback,” he says.

According to Goldman Sachs analyst George Galliers, Stellantis “has outlined a clear battery electric vehicle roadmap, with the second-largest commitment to electrification after Volkswagen.”

At the same time, Stellantis plans to become “a sustainable mobility tech company,” under which it would achieve four core targets by 2030: slashing carbon emissions in half, be well underway to achieving carbon net zero by 2038, achieving 100% battery electric vehicle sales in Europe and 50% in the U.S., and doubling revenue while sustaining double-digit operating margins.

This marks quite a change from the previous Fiat Chrysler, which took a wait and see attitude toward EVs.

Even worse, it was implicated in the emissions scandal of the last decade that began with Volkswagen. This month, Fiat Chrysler’s U.S. auto business agreed to pay $300 million in a plea agreement to resolve a multiyear U.S. Justice Department diesel emissions fraud probe into its alleged efforts to evade emissions requirements for older Ram pickups and Jeep SUVs. The unit previously paid a $311 million civil penalty and paid over $183 million in compensation to over 63,000 people as part of a class-action diesel lawsuit. It will be on probation for three years.

Says Morningstar Sustainalytics associate director Driss Lembachar: The fine “is of no help to the company. The money could have been better spent.” Sustainalytics rates Stellantis as Medium Risk.

Another reason Stellantis trades at a discount: the perceived lack of an independent board. The Agnelli family controls 14%, the Peugeot family controls 7.2%, and the French government owns 6.2%.

Agnelli scion John Elkann is board chair, and Robert Peugeot is vice chair. Add “governance, diesel emissions, and fines, and possibly business ethics—those things all contribute to the higher risk,” says Hilgert.

The EV rollout and planned emissions cuts will lend a hand. Meanwhile, Stellantis is wringing costs from the 2021 merger. In February, Stellantis announced it achieved EUR 3.2 billion of synergies in 2021, above expectations. That will help because a key priority is to lower the cost of EVs. Stellantis chief executive Carlos Tavares says the company’s purchasing and supply chain team is focused on lowering those costs by 40%.

Investors haven’t realized the full potential of combining the Fiat Chrysler and Peugeot companies, Hilgert says. Model development and power train design take years. Once that investment has been made, manufacturing them will be cheaper. To support the EV rollout, Stellantis plans to build five battery gigafactories in North America and Europe.

There will also be new revenue streams. For example, digitization makes possible products like in-car subscriptions. By 2030, Stellantis reckons, software and services will account for 20% of revenues. Apart from digital revenues, Stellantis has an array of growth initiatives, including e-commerce, financial services, and commercial vehicles.

In 2021, Stellantis earned EUR 14.2 billion, or EUR 4.51 per share, on revenue of EUR 149.4 billion. According to FactSet, analysts on average believe that Stellantis will earn EUR 4.66 per share on revenue of EUR 179.4 billion in 2022, rising to EUR 4.80 per share on revenue of EUR 191.7 billion in 2023 and then EUR 5.18 per share on revenue of EUR 200.7 billion in 2024. FactSet sees Stellantis’ revenues rising to EUR 300 billion by 2030.

Then there’s management. Tavares is the former chief operating officer of Renault and is viewed as a turnaround expert who restored Peugeot and GM’s European operation to profitability .

Named CEO last year, Tavares claims Stellantis will produce “sustained” double-digit operating income margins.

In 2021, it had an operating margin of 10.1%. But Morningstar’s Hilgert uses a 7% operating margin assumption in his own forecasts and in his estimate of the company’s fair value, partly because most automakers post high-single-digit profit margins. “If Stellantis can actually pull this off and demonstrate to Wall Street that they are capable of generating that kind of margin, I think the stock will react very positively,” says Hilgert.

One bright spot: Stellantis might be more attractive to investors interested in sustainability, in large part because of its commitment to net-zero carbon emissions by 2038. The company hopes that, along with the commitment to EVs, could lead to upgrades from environmental, social, and governance rating agencies. Fiat Chrysler had an abysmal ESG rating, while Peugeot’s was superior.

Stellantis has been in conversations with rating agencies to explain its story and its thesis that the rating should be upgraded. “We hope we will have an upgrade within 2022,” says Valerie Lachouque, a spokesperson for Stellantis. That may be followed by demand for the stock from European asset managers complying with EU regulations requiring them to declare what percentage of their portfolios are green.

Consider that Toyota Motor trades at 10.5 times current earnings, Ford at 4.7 times, and GM at 6.4 times. Tesla, even after its steep drop this year, trades at 104 times. Meanwhile, Stellantis trades at 3.4 times earnings.

“Given Stellantis’ execution and performance, we find its valuation discount to peers increasingly unjustified,” wrote Goldman’s Galliers.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWOIHC3SK5CHJPXXNSL3RJ7VPQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)