Tax-Deferred ESG Retirement-Bucket Portfolios for Mutual Fund Investors

These portfolios are composed of mutual funds with strong ESG and investing track records.

Editor’s Note: A version of this article was published on March 8, 2023.

Younger investors may be most closely associated with wanting to invest in companies that align with their principles, but plenty of older adults are interested in doing so, too. With them in mind, I’ve created model “Bucket” portfolios featuring exposure to environmental, social, and governance funds. These portfolios are geared toward retirees’ tax-deferred accounts that they are actively drawing upon to provide them with cash flows.

About the Portfolios

These model portfolios are geared toward retired investors who are drawing upon their tax-deferred accounts to meet a portion of their living expenses. Bucket 1 of each portfolio is to provide money for cash needs for a year or two, so we’re not taking any risks with it; investors can use some combination of certificates of deposit, high-yield savings accounts, or money market mutual funds for this portion of the portfolio. (Cash investors who would like to make sure their holdings align with ESG principles might consider BlackRock Liquid Environmentally Aware LEAF, a money market fund.) Bucket 2 covers another eight or so years’ worth of cash flow needs. It’s designed to deliver slightly more income than Bucket 1, as well as a dash of inflation protection and capital appreciation; thus, it consists mainly of high-quality short- and intermediate-term bonds. Bucket 3 is the growth engine of each of the portfolios, geared toward years 11 and beyond of retirement.

The portfolios consist exclusively of funds that rate as Gold, Silver, or Bronze, meaning our analysts think they’re likely to outperform their peers over a full market cycle. I’ll make changes to the holdings only if their fundamentals change or they no longer rate as higher-conviction Morningstar Medalists.

My ESG ETF portfolios are designed to limit tracking error relative to broad market indexes. As such, they’re less “ESG-forward” than their mutual fund counterparts. With the mutual fund portfolios, I’ve focused on funds with more ESG-forward strategies. For example, the largest domestic-equity holding in the portfolios, Parnassus Core Equity PRBLX, has long been a leader in the ESG investing space and applies rigorous ESG standards to each of the holdings that comes into the portfolio. Because the mutual fund portfolios encompass a heavier ESG emphasis, I would expect them to exhibit performance that differs more meaningfully from market benchmarks than the ETF portfolios. In particular, the mutual fund portfolios tend to lean toward the growth side of the Morningstar Style Box, whereas the ETF portfolios are better balanced along the value-blend-growth spectrum. And because the mutual fund portfolios are anchored with active equity funds, their costs are obviously higher, too. I focused on funds that are widely available from major brokerage-firm platforms without a load or transaction fee. (There’s one exception: Investors will need to pay a transaction fee to buy Pimco Total Return ESG PTSAX—discussed below—on major brokerage platforms.)

How to Use Them

Note that the goal of these portfolios isn’t to generate the best returns of any retirement portfolio on record, but rather to help retirees and preretirees visualize what a long-term, strategic total-return portfolio would look like. Thus, a newly retired investor could follow the basic Bucket concept without completely upending existing favorite holdings.

Investors should take care to customize their portfolios to suit their own situations—risk tolerance and capacity, of course, but also planned spending. An investor’s own cash bucket, and in turn the allocations to the other two buckets, will depend on his or her portfolio spending rate. If an investor is using a lower starting withdrawal rate—say, 3% in the first years of retirement—Bucket 1 would accordingly be smaller (6% versus 8% in my Aggressive portfolio).

Investors who are seeking more indexlike performance and/or those who would like to lower their total costs can reasonably employ any number of fine core ESG index funds in lieu of the actively managed options featured here.

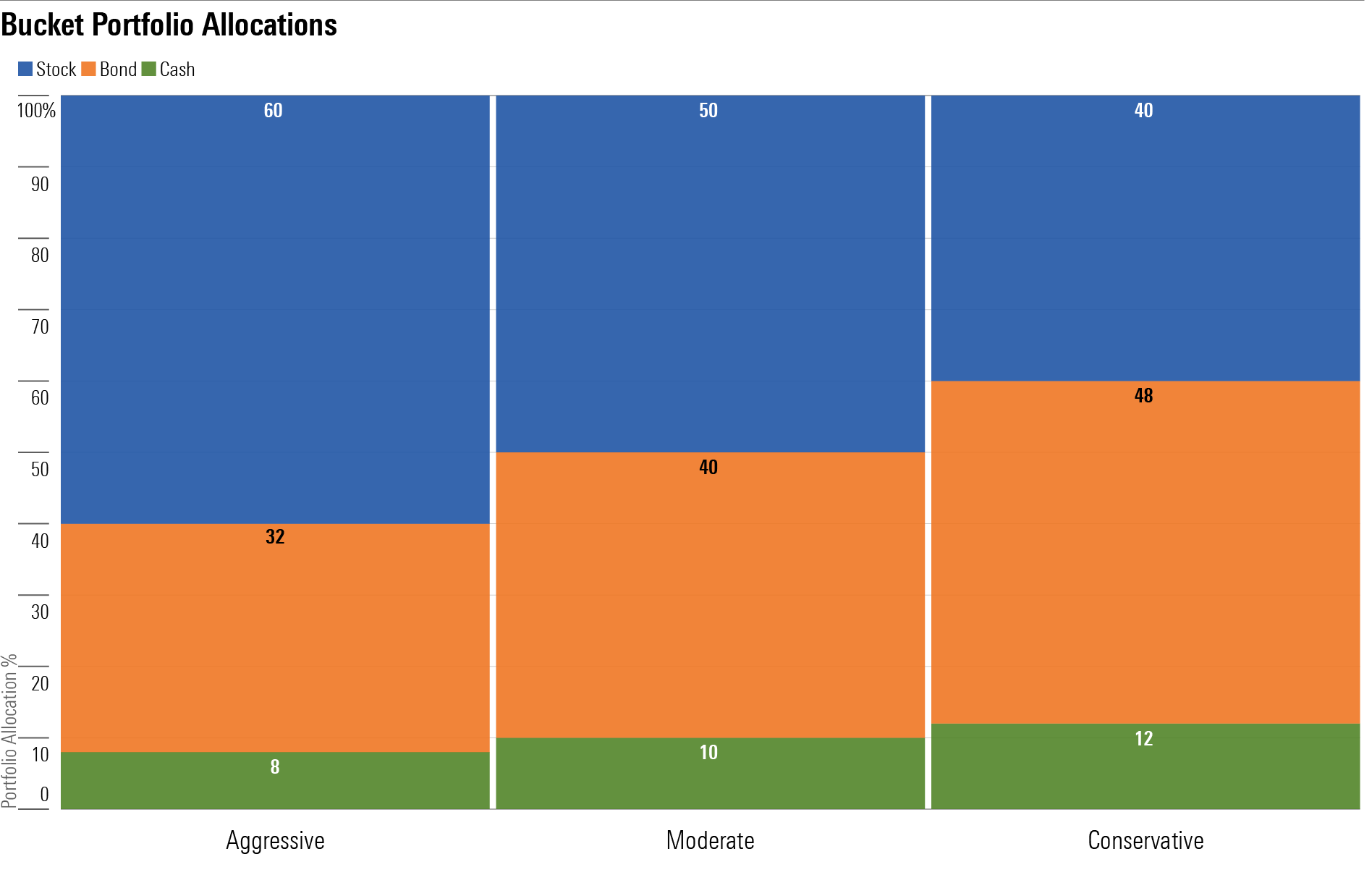

Bucket Portfolio Allocations

Aggressive Tax-Deferred ESG Retirement-Bucket Portfolio for Mutual Fund Investors

Anticipated Time Horizon in Retirement: 25-plus years

Risk Tolerance/Capacity: High

Target Stock/Bond/Cash Mix: 60/32/8

Bucket 1

- 8% cash

Bucket 2

- 8%: Vanguard Short-Term Federal VSGDX

- 8%: Vanguard Short-Term Inflation-Protected Securities Index VTAPX

- 16%: Pimco Total Return ESG PTSAX

Bucket 3

- 15%: Parnassus Core Equity PRBLX

- 8%: Calvert US Large Cap Value Responsible Index CFJAX

- 5%: Brown Advisory Sustainable Growth BIAWX

- 7%: Parnassus Mid-Cap PARMX

- 5%: Boston Trust Walden Small Cap BOSOX

- 20%: Fidelity International Sustainability Index FNIDX

Moderate Tax-Deferred ESG Retirement-Bucket Portfolio for Mutual Fund Investors

Anticipated time horizon in retirement: 15–25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond/Cash Mix: 50/40/10

Bucket 1

- 10%: Cash

Bucket 2

- 10%: Vanguard Short-Term Federal

- 10%: Vanguard Short-Term Inflation-Protected Securities Index

- 20%: Pimco Total Return ESG

Bucket 3: Years 11 and beyond

- 12%: Parnassus Core Equity

- 7%: Calvert US Large Cap Value Responsible Index

- 5%: Brown Advisory Sustainable Growth

- 8%: Parnassus Mid-Cap

- 3%: Boston Trust Walden Small Cap

- 15%: Fidelity International Sustainability Index

Conservative Tax-Deferred ESG Retirement-Bucket Portfolio for Mutual Fund Investors

Anticipated time horizon in retirement: Fewer than 15 years

Risk Tolerance/Capacity: Low

Target stock/bond/cash mix: 40%/48%/12%

Bucket 1

- 12%: Cash

Bucket 2

- 10%: Vanguard Short-Term Federal

- 10%: Vanguard Short-Term Inflation-Protected Securities Index

- 28%: Pimco Total Return ESG

Bucket 3

- 10%: Parnassus Core Equity

- 10%: Calvert US Large Cap Value Responsible Index

- 5%: Parnassus Mid-Cap

- 3%: Boston Trust Walden Small Cap

- 12%: Fidelity International Sustainability Index

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)