Tax-Deferred Retirement-Bucket Portfolios for Minimalist Investors

These portfolios use index funds as building blocks—as well as a little bit of cash.

Just as a decluttered household is easier to clean, streamlining your portfolio makes it simpler to manage. That’s especially true in retirement, when you’re necessarily trying to figure out how to extract some of your living expenses from your investments and also attending to other issues, such as figuring out your Social Security claiming date.

If you stick with very basic investment building blocks for your portfolio, it will be simple to view and adjust your portfolio’s asset allocation as the years go by. You’ll also be able to readily determine how to source your cash flow needs on an ongoing basis.

Before I go any further, I’ll acknowledge that the idea for a minimalist portfolio isn’t a new one. The Bogleheads have long enthused about a simple, three-fund portfolio composed of total-market index funds, and Taylor Larimore, one of the lead Bogleheads, wrote a book about the three-fund portfolio.

About the Portfolios

Yet as simple and elegant as a two- or three-fund portfolio is, my view is that retired investors should consider adding a fourth investment to their portfolios: cash. Setting liquid assets aside to meet near-term living expenses is the focus of the Bucket approach to retirement portfolio management. The principle is that the long-term investments—bond and stock holdings in Buckets 2 and 3, respectively—in the portfolio can and will move up, down, and sideways. But if a retiree knows that she has enough cash set aside in Bucket 1 to match living expenses that are coming right up, she can make peace with those gyrations.

To populate the portfolios below, I’ve employed Vanguard Total Market Index funds as building blocks. The funds are available as exchange-traded funds or traditional index funds; the format is a matter of individuals’ own preferences. However, it’s worth noting that an investor could readily replicate a nearly identical portfolio using holdings from other firms. Schwab, Fidelity, and iShares all offer fine, low-cost index funds that provide “total market” exposure to the core asset classes. The products are largely fungible; go with the provider you like best.

It’s also important to note that I’ve crafted the portfolios without regard for tax efficiency—in other words, I’m assuming that investors will hold them within the confines of a tax-sheltered portfolio like an IRA.

How to Use Them

While the portfolios below include percentage allocations to each of the asset classes, they’re primarily for illustration purposes. My hope is that retirees will think through their own situations and planned withdrawals when allocating to each of the buckets.

By using portfolio withdrawals as the starting point, retirees can readily “rightsize” their allocations to each of the asset classes. For example, a retiree who’s using a 4% initial withdrawal might steer 8% of his portfolio to cash (two years’ worth of withdrawals), another 30% or so to bonds, and the remainder to stocks. Meanwhile, the (increasingly rare) retiree who’s withdrawing just 2% of her portfolio per year because she has a pension could have smaller stakes in safe assets: 4% in cash, another 16% or so in bonds, and the remainder in stocks. (Of course, that assumes she can live with the swings that would accompany such an equity-heavy portfolio.)

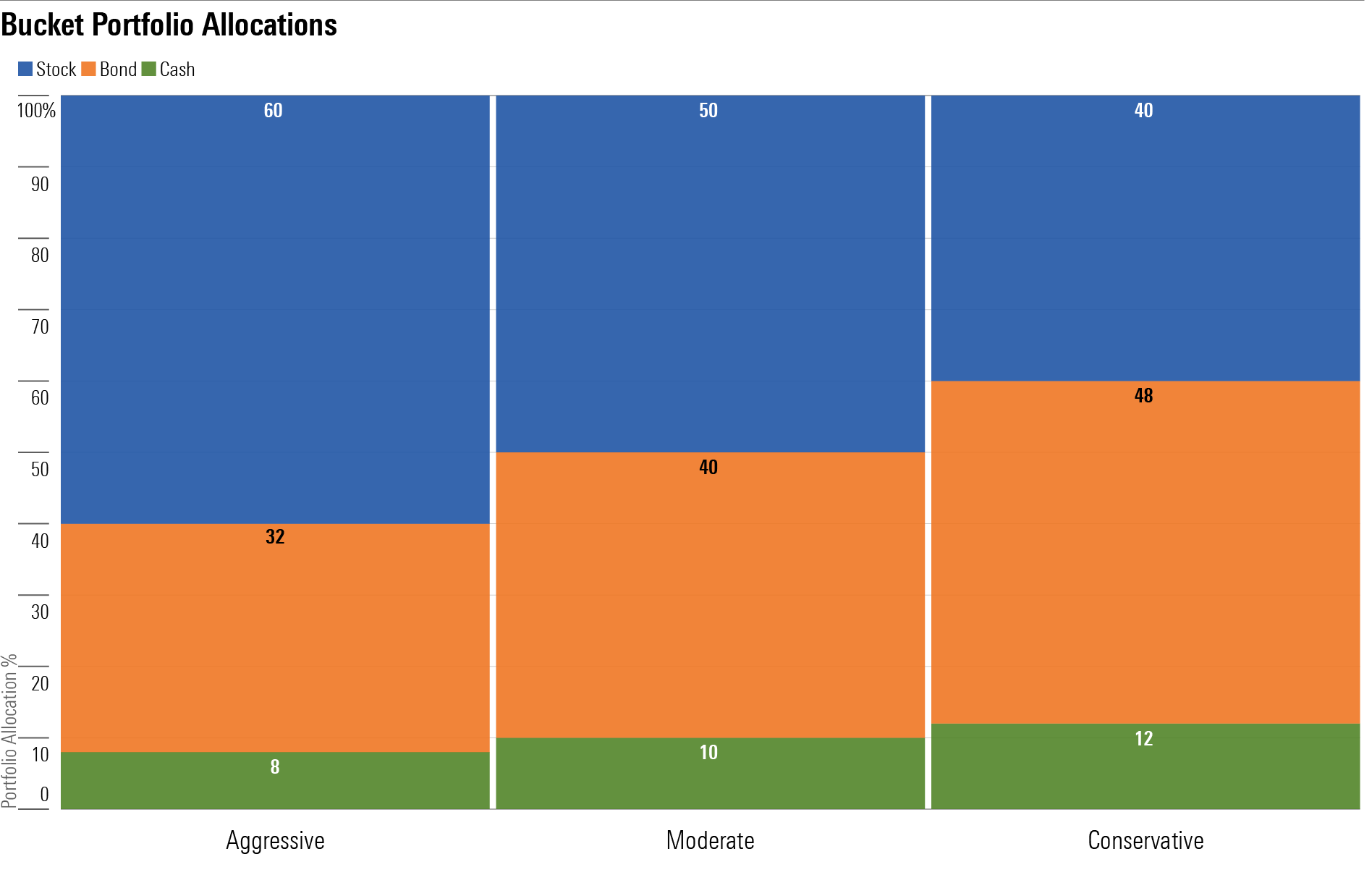

Bucket Portfolio Allocations

Aggressive Tax-Deferred Retirement-Bucket Portfolio for Minimalist Investors

Anticipated time horizon in retirement: 20-25 years

Risk Tolerance/Capacity: High

Target Stock/Bond/Cash Mix: 60/32/8

Bucket 1

- 8%: Cash

Bucket 2

Bucket 3

- 40%: Vanguard Total Stock Market Index/ETF VTSAX VTI

- 20%: Vanguard Total International Stock Index/ETF VTIAX VXUS

Moderate Tax-Deferred Retirement-Bucket Portfolio for Minimalist Investors

Anticipated time horizon in retirement: 15-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond/Cash Mix: 50/40/10

Bucket 1

- 10%: Cash

Bucket 2

Bucket 3

- 35%: Vanguard Total Stock Market Index/ETF VTSAX VTI

- 15%: Vanguard Total International Stock Index/ETF VTIAX VXUS

Conservative Tax-Deferred Retirement-Bucket Portfolio for Minimalist Investors

Anticipated time horizon in retirement: Less than 15 years

Risk Tolerance/Capacity: Low

Target stock/bond/cash mix: 40/48/12

Bucket 1

- 12%: Cash

Bucket 2

Bucket 3

- 28%: Vanguard Total Stock Market Index/ETF VTSAX VTI

- 12%: Vanguard Total International Stock Index/ETF VTIAX VXUS

A version of this article was published on March 21, 2019.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)