Tax-Deferred Retirement-Bucket Portfolios for Schwab Supermarket Investors

These portfolios feature some of the best no-load, No Transaction Fee funds on Schwab’s platform.

Most brokerage firms allow investors to pick and choose funds from various mutual fund providers, just as they can pick and choose individual stocks; investors may also be able to trade in certain funds without paying loads or transaction fees.

But Charles Schwab created the first mutual fund supermarket, and it’s still the big kahuna in this space. While the firm has its own lineup of funds—including a solid suite of low-cost index funds and exchange-traded funds—investors know it as a way to buy funds from smaller shops without having to maintain many small accounts.

About the Portfolios

These model portfolios are geared toward investors who wish to build a portfolio on the Schwab platform. For these portfolios, I’ve employed only no-load, No Transaction Fee funds that are available on Schwab’s OneSource Mutual Fund platform. However, it’s worth noting that for buy-and-hold investors, paying a transaction fee may sometimes be cost-effective. Yes, the investor has to pay $75 to initiate a position in a non-NTF fund, but that cost can be quickly recouped if the non-NTF fund is cheaper than a similar fund that’s available without a transaction fee.

These portfolios employ a bucket strategy, pioneered by financial-planning guru Harold Evensky. The central premise is that the retiree holds a cash bucket (Bucket 1) alongside his or her long-term assets, both stocks and bonds. If the long-term components of the portfolio, especially stocks, hit a rough patch, the cash bucket ensures that the retiree has enough liquid assets to use for living expenses. Bucket 2 covers another eight years’ worth of cash flow needs. It’s designed to deliver slightly more income than Bucket 1, as well as a dash of inflation protection and capital appreciation; thus, it consists mainly of high-quality short- and intermediate-term bonds. Bucket 3 is the growth engine of each of the portfolios, geared toward years 11 and beyond of retirement.

The portfolios are designed to be strategic—that is, they’re meant to be bought, held, and rebalanced—rather than tactical. I’ll make changes only when there’s a meaningful negative development in one of our holdings, or if another investment that I like better becomes available. In short, I expect to make very few changes to these portfolios over time, because many retirees don’t want to have to make frequent trades in their portfolios, either.

How to Use Them

The goal of the portfolios isn’t to outperform every other retirement portfolio or strategy ever devised. Rather, the objective is to illustrate sound portfolio-construction and cash-flow-generation principles. Nor do retirees need to completely upend their portfolios in order to implement a similar bucket strategy. Assuming they have solid core building blocks—both stock and bond holdings—they have most of the raw ingredients needed for a Bucket portfolio.

Investors should take care to customize their portfolios to suit their own situations—risk tolerance and capacity, of course, but also planned spending. An investor’s own cash bucket, and in turn the allocations to the other two buckets, will depend on his or her portfolio spending rate. If an investor is using a lower starting withdrawal rate—say, 3% in the first years of retirement—Bucket 1 would accordingly be smaller (6% versus 8% in my Aggressive portfolio).

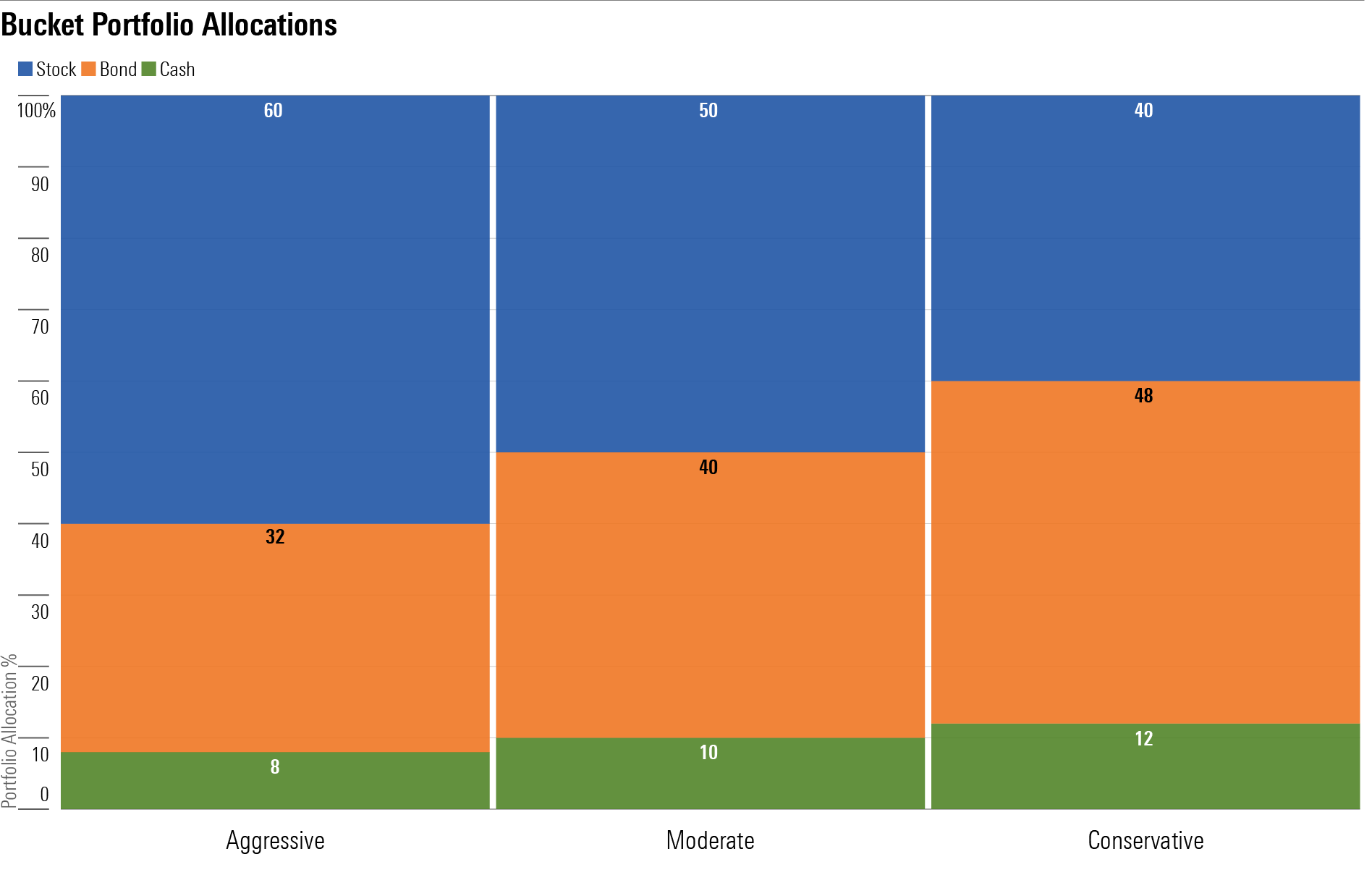

Bucket Portfolio Allocations

Aggressive Tax-Deferred Retirement-Bucket Portfolio for Schwab Supermarket Investors

Anticipated Time Horizon in Retirement: 25-plus years

Risk Tolerance/Capacity: High

Target Stock/Bond/Cash Mix: 60/32/8

Bucket 1: Years 1 and 2

- 8%: Cash

Bucket 2: Years 3-10

- 8%: Baird Short-Term Bond BSBSX

- 7%: Schwab Treasury Inflation Protected Securities Index SWRSX

- 10%: Metropolitan West Total Return Bond MWTRX

- 7%: Loomis Sayles Bond LSBDX

Bucket 3: Years 11 and beyond

- 20%: Oakmark OAKMX

- 20%: Schwab Total Stock Market Index SWTSX

- 20%: American Funds International Growth and Income IGIFX

Moderate Tax-Deferred Retirement-Bucket Portfolio for Schwab Supermarket Investors

Anticipated Time Horizon in Retirement: 15-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond/Cash Mix: 50/40/10

Bucket 1: Years 1-2

- 10%: Cash

Bucket 2: Years 3-10

- 10%: Baird Short-Term Bond BSBSX

- 10%: Schwab Treasury Inflation Protected Securities Index SWRSX

- 15%: Metropolitan West Total Return Bond MWTRX

- 5%: Loomis Sayles Bond LSBDX

Bucket 3: Years 11 and Beyond

- 20%: Oakmark OAKMX

- 15%: Schwab Total Stock Market Index SWTSX

- 15%: American Funds International Growth and Income IGIFX

Conservative Tax-Deferred Retirement-Bucket Portfolio for Schwab Supermarket Investors

Anticipated Time Horizon in Retirement: Less than 15 years

Risk Tolerance/Capacity: Low

Target Stock/Bond/Cash Mix: 40/48/12

Bucket 1: Years 1-2

- 12%: Cash

Bucket 2: Years 3-10

- 10%: Baird Short-Term Bond BSBSX

- 10%: Schwab Treasury Inflation Protected Securities Index SWRSX

- 23%: Metropolitan West Total Return Bond MWTRX

- 5%: Loomis Sayles Bond LSBDX

Bucket 3: Years 11 and Beyond

- 15%: Oakmark OAKMX

- 13%: Schwab Total Stock Market Index SWTSX

- 12%: American Funds International Growth and Income IGIFX

A version of this report was published on Aug. 31, 2018.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)