Tax-Deferred Retirement-Bucket Portfolios for Vanguard Investors

Designed for retirees in tax-deferred accounts, these portfolios blend index and active funds.

Creating in-retirement model portfolios consisting exclusively of Vanguard funds isn’t a heavy lift. Because the firm’s funds have ultralow costs and its lineup is widely diversified, the firm is a natural one-stop shop for many investors.

These model portfolios are designed for Vanguard investors who are actively drawing upon their portfolios for living expenses. They’re geared toward tax-deferred accounts like IRAs, which means that they’re not managed for tax efficiency on an ongoing basis.

About the Portfolios

These model portfolios are geared toward retired investors who are drawing upon their tax-deferred accounts to meet a portion of their living expenses. Bucket 1 of each portfolio is to provide money for cash needs for a year or two, so we’re not taking any risks with it; investors can use some combination of certificates of deposit, high-yield savings accounts, or money market mutual funds for this portion of the portfolio. Bucket 2 covers another eight years’ worth of cash flow needs. It’s designed to deliver slightly more income than Bucket 1, as well as a dash of inflation protection; thus, it consists mainly of high-quality short- and intermediate-term bonds. Bucket 3 is the growth engine of each of the portfolios, geared toward years 11 and beyond of retirement.

The portfolios consist exclusively of funds that rate as Morningstar Medalists, meaning our analysts think they’re likely to outperform their peers over a full market cycle. While Vanguard is best known for its index funds and exchange-traded funds, these portfolios feature a healthy dose of actively managed funds. However, index enthusiasts could easily mirror the portfolio’s asset-class exposures using all index funds or ETFs. I’ll make changes to the holdings only if their fundamentals change or they no longer rate as medalists.

How to Use Them

Note that the goal of these portfolios isn’t to generate the best returns of any retirement portfolio on record, but rather to help retirees and pre-retirees visualize what a long-term, strategic total-return portfolio would look like. Thus, a newly retired investor could follow the basic Bucket concept without completely upending existing favorite holdings.

Investors should take care to customize their portfolios to suit their own situations—risk tolerance and capacity, of course, but also planned spending. An investor’s own cash bucket, and in turn the allocations to the other two buckets, will depend on his or her portfolio spending rate. If an investor is using a lower starting withdrawal rate—say, 3% in the first years of retirement—Bucket 1 would accordingly be smaller (6% versus 8% in my Aggressive portfolio).

Aggressive Tax-Deferred Retirement-Bucket Portfolio for Vanguard Investors

Anticipated Time Horizon in Retirement: 25-plus years

Risk Tolerance/Capacity: High

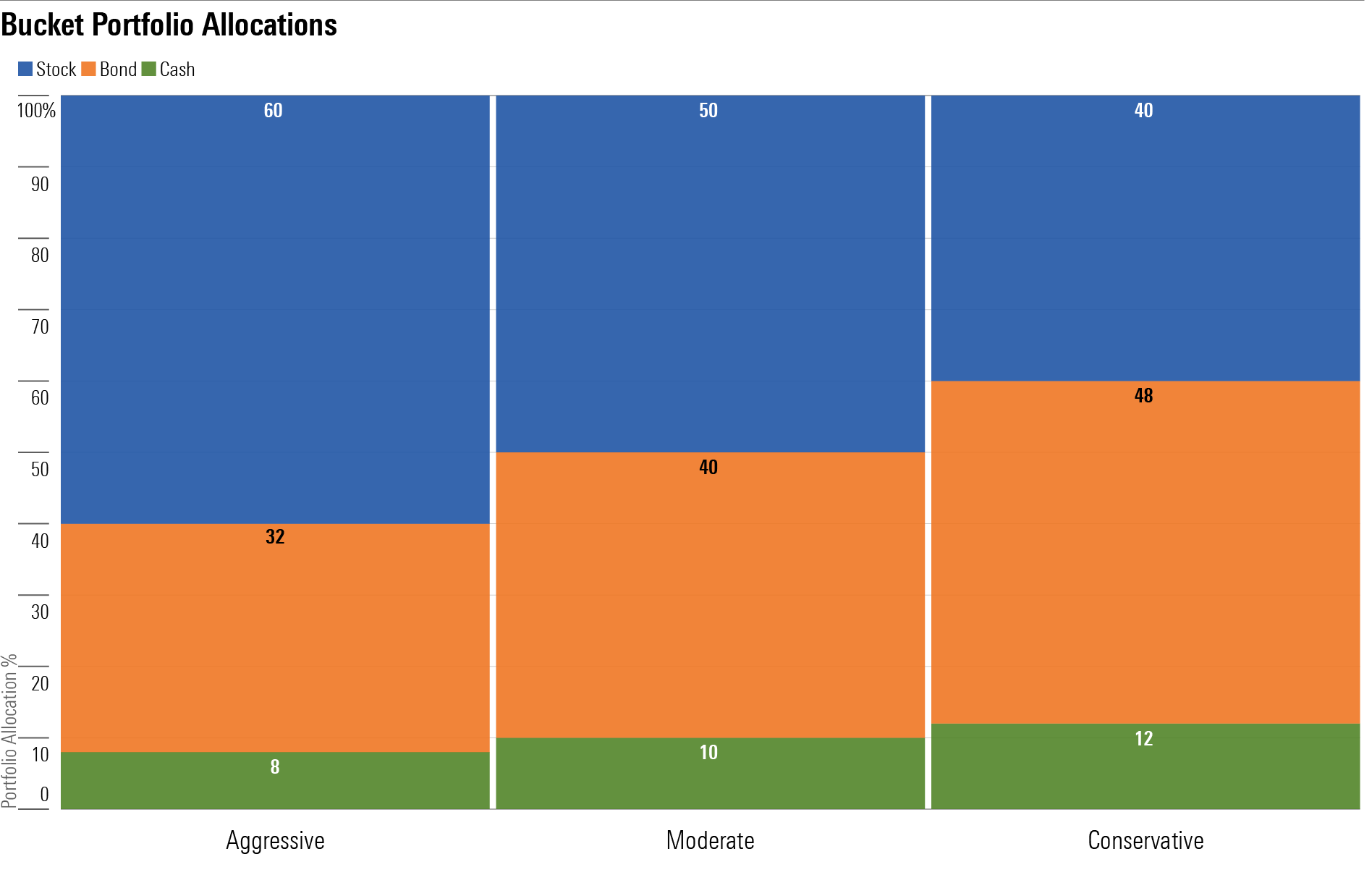

Target Stock/Bond/Cash Mix: 60/32/8

Bucket 1

- 8%: Cash

Bucket 2

- 8%: Vanguard Short-Term Bond Index VBIRX

- 7%: Vanguard Short-Term Inflation-Protected Securities Index VTAPX

- 10%: Vanguard Total Bond Market Index VBTLX

- 7%: Vanguard Wellesley Income VWIAX

Bucket 3

- 25%: Vanguard Dividend Appreciation Index VDADX

- 15%: Vanguard Total Stock Market Index VTSAX

- 20%: Vanguard FTSE All-World ex-US Index VFWAX

Moderate Tax-Deferred Retirement-Bucket Portfolio for Vanguard Investors

Anticipated Time Horizon in Retirement: 15-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond/Cash Mix: 50/40/10

Bucket 1

- 10%: Cash

Bucket 2

- 10%: Vanguard Short-Term Bond Index VBIRX

- 10%: Vanguard Short-Term Inflation-Protected Securities Index VTAPX

- 12%: Vanguard Total Bond Market Index VBTLX

- 8%: Vanguard Wellesley Income VWIAX

Bucket 3

- 25%: Vanguard Dividend Appreciation Index VDADX

- 10%: Vanguard Total Stock Market Index VTSAX

- 15%: Vanguard FTSE All-World ex-US Index VFWAX

Conservative Tax-Deferred Retirement-Bucket Portfolio for Vanguard Investors

Anticipated Time Horizon in Retirement: Less than 15 years

Risk Tolerance/Capacity: Low

Target Stock/Bond/Cash Mix: 40/48/12

Bucket 1

- 12%: Cash

Bucket 2

- 10%: Vanguard Short-Term Bond Index VBIRX

- 10%: Vanguard Short-Term Inflation-Protected Securities Index VTAPX

- 15%: Vanguard Total Bond Market Index VBTLX

- 8%: Vanguard Wellesley Income VWIAX

- 5%: Vanguard High-Yield Corporate VWEAX

Bucket 3

- 20%: Vanguard Dividend Appreciation Index VDADX

- 8%: Vanguard Total Stock Market Index VTSAX

- 12%: Vanguard FTSE All-World ex-US Index VFWAX

A version of this article published on Sept. 24, 2018.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)