Tax-Deferred Retirement-Saver Portfolios for ETF Investors

These three portfolios are geared toward the tax-deferred accounts of people who are still working and saving for retirement.

When it comes to saving and investing for retirement, investors can’t go far wrong by keeping it simple. A quality target-date fund or a simple index-fund portfolio—plus a solid savings plan, of course—can do the job very effectively.

This series of model portfolios is geared toward still-working people who want to keep it simple but also exert a bit of control over their portfolios’ asset-class exposures. To that end, they include a dash of small-cap value exposure, which has historically helped deliver a small return edge relative to the broad market, as well as discrete positions in emerging- and developed-markets stocks to facilitate rebalancing between the two asset types.

About the Portfolios

These portfolios are geared toward people who are building up their retirement nest eggs within the confines of tax-sheltered accounts—for example, an IRA or 401(k). In other words, the portfolios don’t aim to limit income or capital gains distributions because investors in those types of accounts aren’t subject to taxes unless they take funds out of their accounts.

The portfolios’ allocations are loosely based on the Morningstar Lifetime Allocation Indexes, and their holdings are composed entirely of exchange-traded funds that have Morningstar Medalist Ratings of Gold, Silver, or Bronze. Most of the funds earn Medalist Ratings of Gold, though I use Silver- and Bronze-rated funds in cases when suitable Gold-rated options are not available.

I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they no longer rate as medalists.

How to Use Them

My key goal with these model portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot out the lights with performance. That means investors can use them to help size up their own portfolios’ asset allocations and suballocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios.

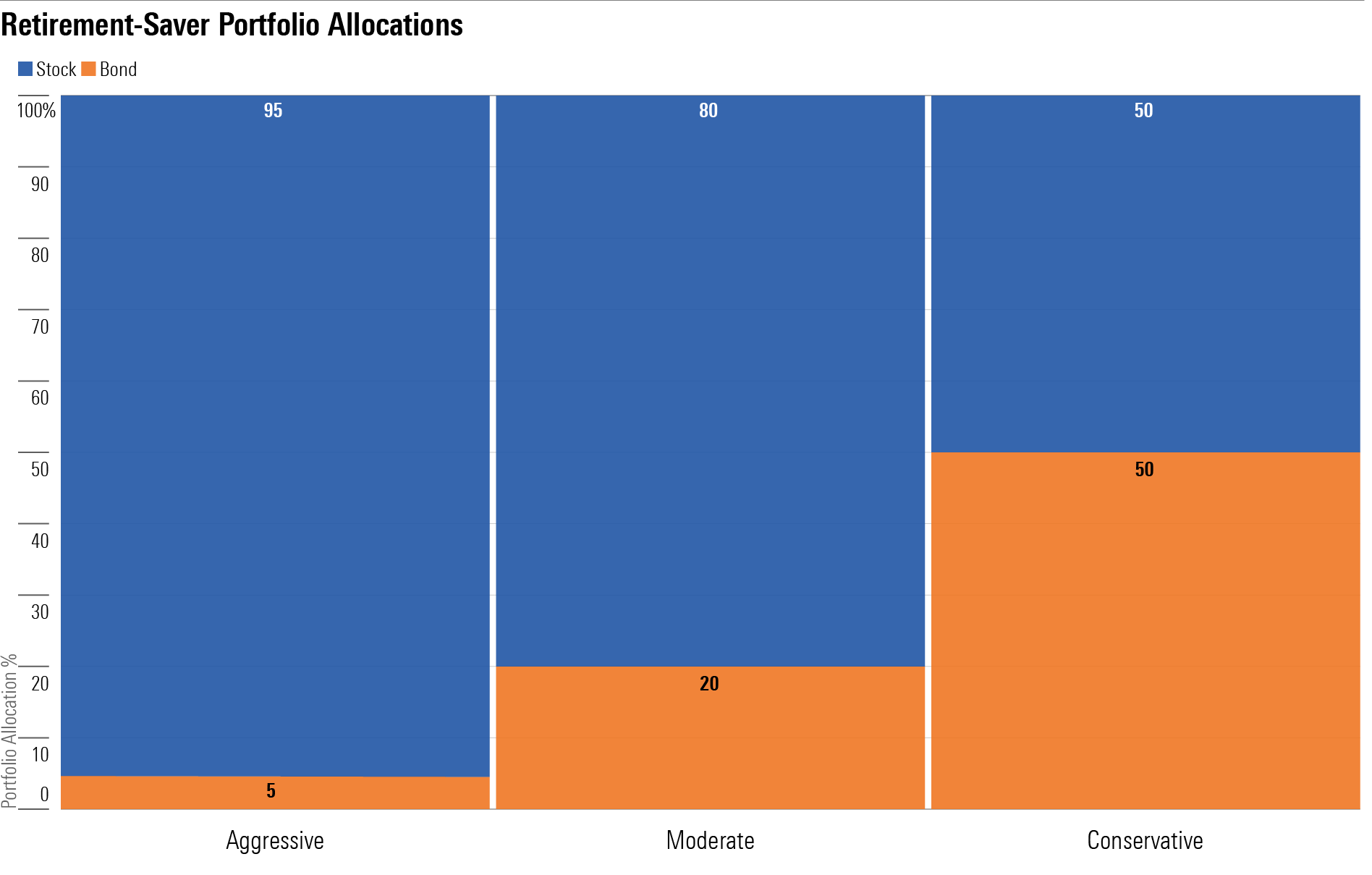

The portfolios vary in their amounts of stock exposure and in turn their risk levels. The Aggressive portfolio is best suited to a younger investor with many years until retirement, whereas the Conservative portfolio is geared toward still-working individuals who expect to retire within the next few years. The Moderate portfolio falls between the two.

Aggressive Tax-Deferred Retirement-Saver Portfolio for ETF Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 40%: Vanguard Total Stock Market ETF VTI

- 10%: Vanguard Small-Cap Value ETF VBR

- 35%: Vanguard FTSE Developed Markets ETF VEA

- 10%: Vanguard FTSE Emerging Markets ETF VWO

- 5%: iShares Core Total USD Bond Market ETF IUSB

Moderate Tax-Deferred Retirement-Saver Portfolio for ETF Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 40%: Vanguard Total Stock Market ETF

- 8%: Vanguard Small-Cap Value ETF

- 25%: Vanguard FTSE Developed Markets ETF

- 7%: Vanguard FTSE Emerging Markets ETF

- 20%: iShares Core Total USD Bond Market

Conservative Tax-Deferred Retirement-Saver Portfolio for ETF Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

- 30%: Vanguard Total Stock Market ETF

- 5%: Vanguard Small-Cap Value ETF

- 12%: Vanguard FTSE Developed Markets ETF

- 3%: Vanguard FTSE Emerging Markets ETF

- 30%: iShares Core Total USD Bond Market ETF

- 10%: Vanguard Short-Term Inflation-Protected Securities ETF VTIP

- 10%: Vanguard Short-Term Bond ETF BSV

A version of this article was published on March 8, 2023.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)