Tax-Deferred Retirement-Saver Portfolios for Vanguard Investors

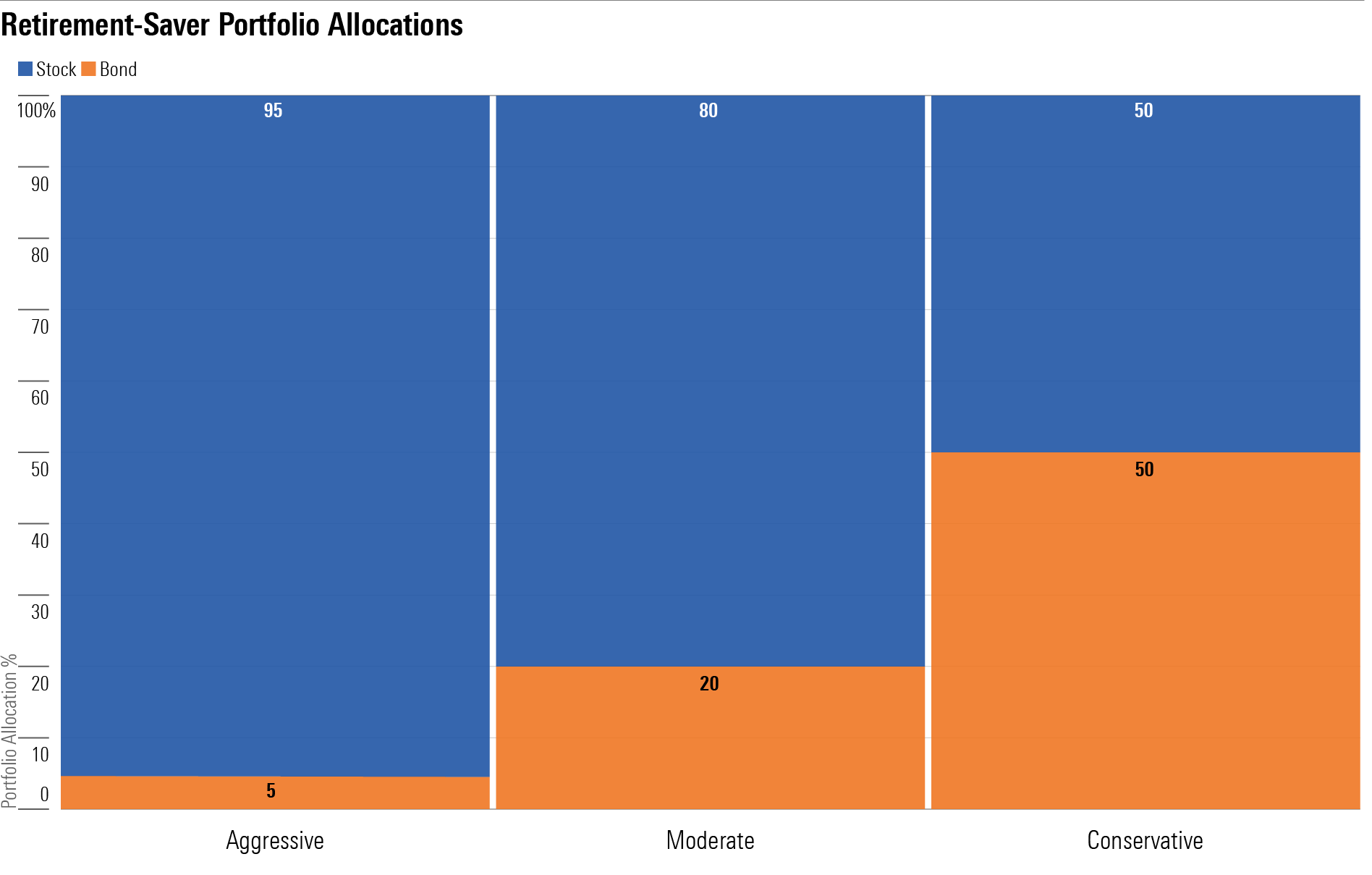

Sample allocations and holdings for aggressive, moderate, and conservative accumulators.

Creating in-retirement model portfolios consisting exclusively of Vanguard funds isn’t a heavy lift. Because the firm’s funds have ultralow costs and its lineup is widely diversified, the firm is a natural one-stop shop for many investors.

These model portfolios are designed for Vanguard investors who are still working and investing for retirement. They’re geared toward tax-deferred accounts like IRAs, which means that they’re not managed for tax efficiency on an ongoing basis.

About the Portfolios

I’ve used Morningstar’s Lifetime Allocation Indexes to inform the portfolios’ asset allocations and the exposures to subasset classes. To populate the portfolios, I employed no-load, open mutual funds that received Morningstar Medalist ratings from Morningstar’s analyst team. Most of the funds earned Gold ratings, though I’ve used Silver- and Bronze-rated funds in cases when suitable Gold-rated, no-load options that are accepting new investments are unavailable.

The portfolios are geared toward investors’ tax-sheltered accounts, so I didn’t consider holdings tax efficiency when populating the portfolios.

How to Use Them

My key goal with these portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot out the lights with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and sub-allocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios. As with the Bucket portfolios, I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they no longer rate as Morningstar Medalists.

The portfolios vary in their amounts of stock exposure and in turn their risk levels. The Aggressive portfolio is geared toward someone with many years until retirement and a high tolerance/capacity for short-term volatility. The Conservative portfolio is geared toward people who are just a few years shy of retirement. The Moderate portfolio falls between the two in terms of its risk/return potential.

Aggressive Tax-Deferred Retirement-Saver Portfolio for Vanguard Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 30%: Vanguard Total Stock Market Index VTSAX

- 10%: Vanguard Equity-Income VEIRX

- 5%: Vanguard Mid Cap Growth VMGMX

- 5%: Vanguard Selected Value VASVX

- 5%: Vanguard Small Cap Value Index VSIAX

- 20%: Vanguard International Growth VWILX

- 20%: Vanguard International Value VTRIX

- 5%: Vanguard Total Bond Market Index VBTLX

Moderate Tax-Deferred Retirement-Saver Portfolio for Vanguard Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 25%: Vanguard Total Stock Market Index VTSAX

- 8%: Vanguard Equity-Income VEIRX

- 5%: Vanguard Mid Cap Growth VMGMX

- 5%: Vanguard Selected Value VASVX

- 5%: Vanguard Small Cap Value Index VSIAX

- 17%: Vanguard International Growth VWILX

- 15%: Vanguard International Value VTRIX

- 20%: Vanguard Total Bond Market Index VBTLX

Conservative Tax-Deferred Retirement-Saver Portfolio for Vanguard Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

- 20%: Vanguard Total Stock Market Index VTSAX

- 10%: Vanguard Equity-Income VEIRX

- 5%: Vanguard Small Cap Value Index VSIAX

- 10%: Vanguard International Growth VWILX

- 5%: Vanguard International Value VTRIX

- 30%: Vanguard Total Bond Market Index VBTLX

- 10%: Vanguard Short-Term Bond Index VBIRX

- 10%: Vanguard Short-Term Inflation-Protected Securities VTAPX

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)