Tax-Efficient Retirement-Bucket Portfolios for Fidelity Investors

Featuring solid muni funds and index equity offerings, these portfolios are appropriate for investors’ taxable accounts.

Many retirees hold additional assets in taxable accounts, and prioritizing tax efficiency there can help plump their take-home returns. Fidelity’s lineup lends itself well to managing a tax-efficient portfolio of cash, bonds, and stocks; several of its best funds, in fact, are also quite tax-friendly. The firm’s municipal-bond lineup has long been one of Morningstar’s favorites, featuring reasonable costs, experienced management, and strong analytics. Meanwhile, the firm’s equity-index offerings are reasonably tax-efficient alternatives with exceptionally low costs.

About the Portfolios

For these three tax-efficient Bucket portfolios, I employed a Bucket approach to their structure. Each portfolio includes a cash component to cover a retiree’s near-term expenses (bucket 1), high-quality bonds for intermediate-term spending (bucket 2), and equities for long-term growth. It’s worth noting that I avoided some of the higher-risk/higher-income fixed-income types that appeared in my other portfolios—for example, high-yield and emerging-markets bonds. Because their income distributions are taxed at investors’ ordinary income tax rates, they’re a better fit for tax-sheltered accounts. These investments have risk/reward profiles that fall between equities and bonds, so it’s reasonable to nudge up the tax-efficient portfolios’ equity exposures to compensate for the fact that they’re missing here.

On the equity side, I employed index-tracking funds. On the fixed-income side, I eschewed bond funds with higher incomes and, in turn, higher tax costs. Instead, I employed municipal-bond funds. For the cash piece—bucket one—investors should shop around for the highest safe yield they can find. Investors in high tax brackets might consider a municipal money market, the income from which will escape federal tax.

How to Use Them

Retirees will want to be sure to “rightsize” the components of these portfolios based on their spending plans and other considerations. If they’re prioritizing withdrawals from their taxable portfolios over other account types—in line with tax-efficient withdrawal-sequencing considerations—they may want a larger cash component than is outlined here. (I typically recommend that retirees hold six months’ to two years’ worth of planned expenditures in true cash instruments.) Moreover, retirees will want to take into account their own time horizons, risk tolerance, and investment goals when setting their allocations. As with the other retiree Bucket portfolios, the asset allocations shown here assume that the retiree will spend all of their assets, which may not be the case for those who would like to leave a bequest to loved ones or charity.

Additionally, retirees will also want to assess their own tax rates to determine whether they’re better off in municipal bonds, which are included in the portfolios below, or taxable bonds once the haircut of taxes is factored in.

Aggressive Tax-Efficient Retirement-Bucket Portfolio for Fidelity Investors

Anticipated Time Horizon: 20-25 years

Risk Tolerance/Capacity: High

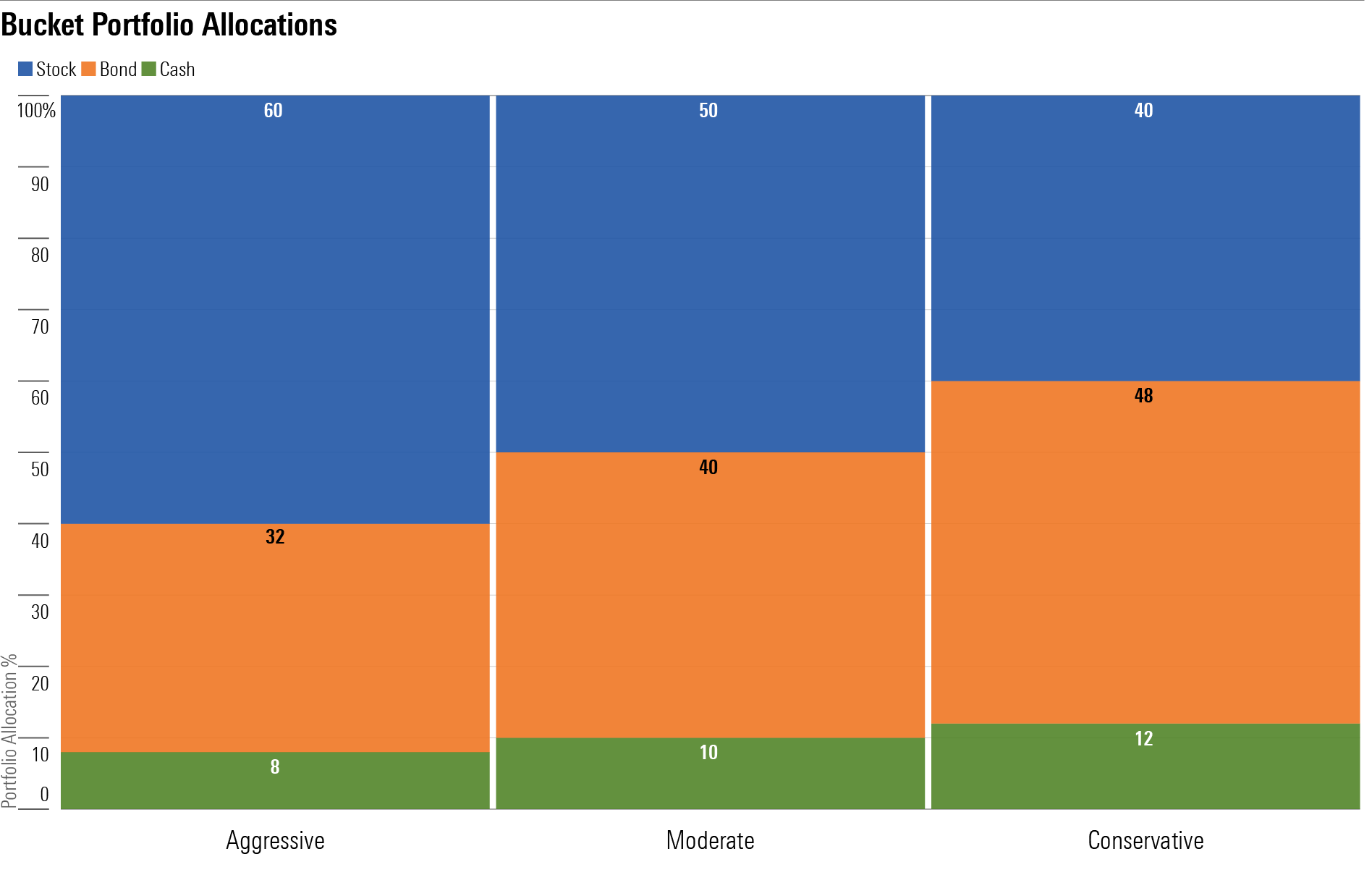

Target Stock/Bond/Cash Mix: 60/32/8

Bucket 1: Years 1-2

- 8%: Cash

Bucket 2: Years 3-10

Bucket 3: Years 11 and Beyond

Moderate Tax-Efficient Retirement-Bucket Portfolio for Fidelity Investors

Anticipated Time Horizon: 15-plus years

Risk Tolerance/Capacity: Average

Target Stock/Bond/Cash Mix: 50/40/10

Bucket 1: Years 1-2

- 10%: Cash

Bucket 2: Years 3-10

Bucket 3: Years 11 and Beyond

Conservative Tax-Efficient Retirement-Bucket Portfolio for Fidelity Investors

Anticipated Time Horizon: 15 years or fewer

Risk Tolerance/Capacity: Low

Target Stock/Bond/Cash Mix: 40/48/12

Bucket 1: Years 1-2

- 12%: Cash

Bucket 2: Years 3-10

Bucket 3: Years 11 and Beyond

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)