Tax-Efficient Retirement-Bucket Portfolios for Minimalist Investors

These streamlined portfolios are geared toward retirees who are actively tapping their taxable assets for living expenses.

The classic minimalist portfolio consists of three funds: one broad-market U.S. stock index fund, one broad-market international-stock index fund, and a total bond market index fund. Such a portfolio is cheap, well-diversified, and low-maintenance.

But as effective as it is, such a portfolio is not necessarily tax-efficient, especially for investors in higher tax brackets who have significant allocations to bonds and hold the funds in a taxable (that is, nonretirement) account. That’s because even though index funds (including exchange-traded funds) do a good job of limiting taxable capital gains, any income distributions from bonds or bond funds you hold inside your taxable account are what they are; they’re taxed at your ordinary income tax rate. That’s true even if you reinvest them back into your holdings rather than spend them.

Managing for tax efficiency is especially important for more-affluent retirees for several reasons. First and most obviously, higher-income people pay taxes at a higher rate than lower-income folks. In addition, high earners are more likely to have significant assets in taxable (nonretirement) accounts. They’ve often made the maximum allowable contributions to IRAs and 401(k)s and still have assets to set aside for savings; the only real landing place for those assets is in taxable accounts. Finally, those supersavers often find their tax bills are somewhat out of their control once required minimum distributions commence at age 73; managing taxable assets for maximum tax efficiency is a way to reduce the drag of taxes on that portion of the portfolio, at least.

About the Portfolios

This suite of model portfolios is designed with such investors in mind. The portfolios are also meant to be as streamlined as they can be while also offering diversification. And because taxable assets are often a smaller portion of investors’ portfolios than their tax-sheltered accounts, these portfolios are designed to require little to no oversight on an ongoing basis, save for potential tweaks to asset allocation to account for planned spending or rebalancing in line with asset-class targets.

Finding tax-efficient equity funds is a cinch: ETFs that track broadly diversified indexes of U.S. stocks fit the bill nicely. Because total market index funds have ultralow turnover, usually in the low single digits, they tend to make few capital gains distributions; to the extent shareholders owe taxes on such holdings, it’s because of dividend distributions. ETFs have more tools in their toolkits to keep a lid on taxable capital gains than traditional index funds, so I’ve used them to supply equity exposure. Traditional index funds tend to be pretty tax-efficient, too, so they can be solid choices for investors who prefer the format.

For broad bond market exposure, I employed one of Fidelity’s solid core municipal-bond funds; municipal-bond income isn’t taxed at the federal level. And because these portfolios are designed for people who are actively tapping their portfolios, I’ve also included a cash component to serve as a short-term parking place for near-term expenditures.

How to Use Them

Investors should use their spending plans for their taxable assets to help identify an appropriate asset allocation. With the Aggressive portfolio, for example, the assumption is that the investor would consume about 4% of their portfolio per year; it includes an allocation to cash amounting to two years’ worth of portfolio withdrawals. The Conservative portfolio, by contrast, is designed for older investors who are using a higher spending rate of 6% per year.

While these portfolios should require little in the way of ongoing maintenance, they’ll require at least some oversight to ensure that their asset allocations are tracking with your goals. It’s also wise to factor in your own tax rate to determine the appropriateness of municipal versus taxable bonds. Investors in lower tax brackets may be better off with taxable bonds, even on an aftertax basis, than they will with munis.

Aggressive Tax-Efficient Retirement-Bucket Portfolio for Minimalist Investors

Anticipated time horizon in retirement: 25-plus years

Risk tolerance/capacity: High

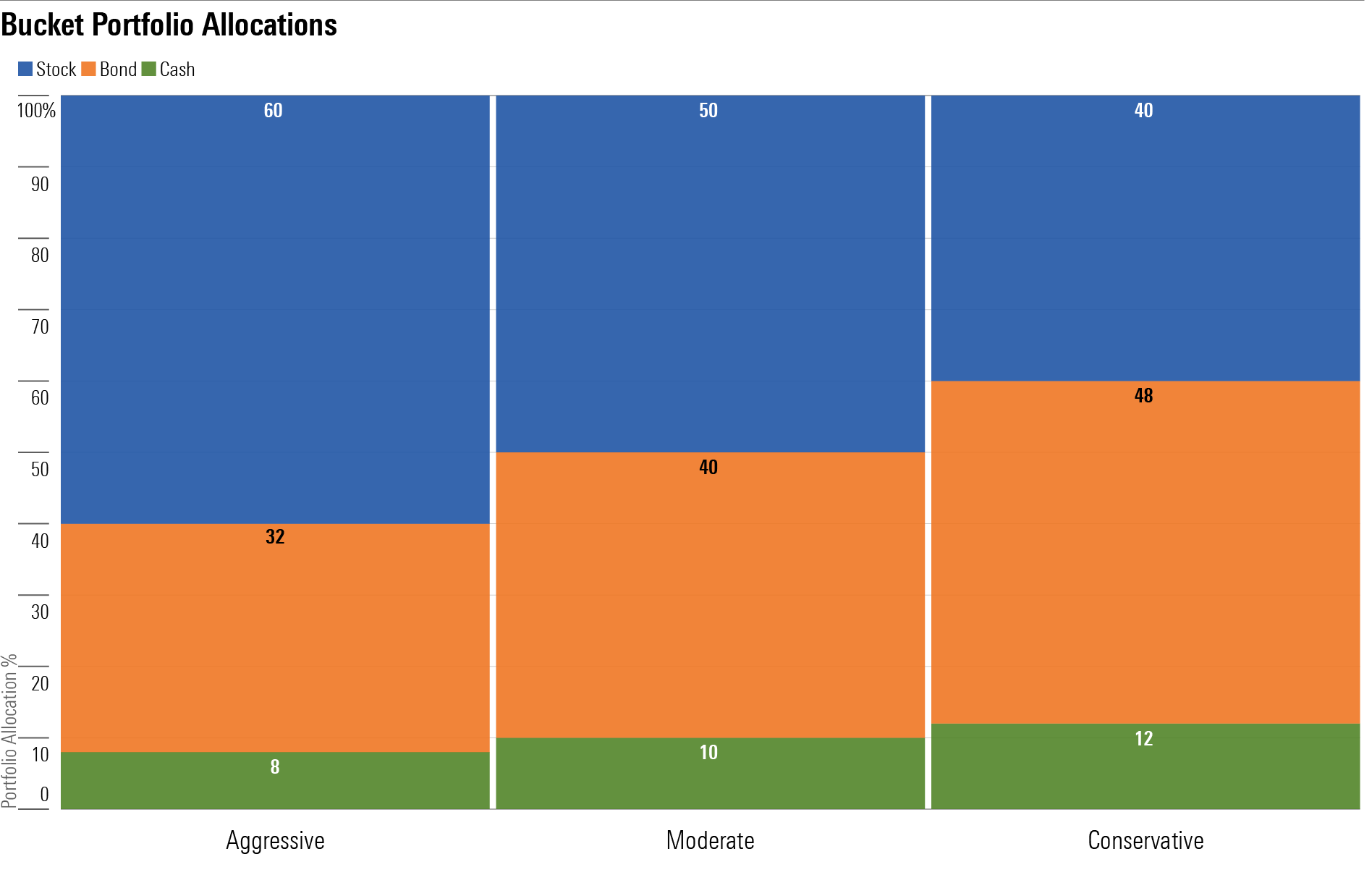

Target stock/bond/cash mix: 60/32/8

Bucket 1

- 8%: Cash

Bucket 2

- 32%: Fidelity Intermediate Municipal Income FLTMX

Bucket 3

Moderate Tax-Efficient Retirement-Bucket Portfolio for Minimalist Investors

Anticipated time horizon in retirement: 15-25 years

Risk tolerance/capacity: Moderate

Target stock/bond/cash mix: 50/40/10

Bucket 1

10%: Cash

Bucket 2

40%: Fidelity Intermediate Municipal Income FLTMX

Bucket 3

35%: Vanguard Total Stock Market ETF VTI

15%: Vanguard Total International Stock ETF VXUS

Conservative Tax-Efficient Portfolio for Minimalist Retirees

Anticipated time horizon in retirement: Fewer than years

Risk tolerance/capacity: Low

Target stock/bond/cash mix: 40/48/12

Bucket 1

- 12%: Cash

Bucket 2

- 48%: Fidelity Intermediate Municipal Income FLTMX

Bucket 3

A version of this article was published on April 8, 2019.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)