Tax-Efficient Retirement-Bucket Portfolios for Mutual Fund Investors

Our model portfolios are designed to facilitate in-retirement cash flows—and to limit Uncle Sam’s take.

Savvy investors know about the importance of paying attention to all costs that they pay—investment costs, advisory fees, and tax costs, too.

Of course, an obvious way to limit taxable capital gains and income distributions is to stash investments inside of tax-sheltered accounts. That way there won’t be any taxes due until the retiree begins pulling the funds out in retirement. But once those receptacles are full, investors have no choice but to save inside of taxable accounts. And by building out assets in the three major account types—traditional tax-deferred, Roth, and taxable—a retiree can exercise at least some control over the taxes she pays in retirement.

The composition of a tax-efficient portfolio is a bit different from would be the case for a tax-sheltered accounts. Securities that kick off a lot of current income or capital gains, like higher-yielding bonds and even stocks with high dividends, aren’t a great idea for taxable accounts. On the fixed income side, municipal bonds help reduce the drag of income taxes. For equities, investors can look to tax-efficient options such as tax-managed funds and index-tracking funds, both traditional mutual funds and exchange-traded funds. Of course, investors still might owe taxes when they liquidate positions, but at least they won’t be obligated to pay taxes on distributions they didn’t initiate themselves.

About the Portfolios

For these three tax-efficient Bucket portfolios, I employed a Bucket approach to their structure. Each portfolio includes a cash component to cover a retiree’s near-term expenses (bucket 1), high-quality bonds for intermediate-term spending (bucket 2), and equities for long-term growth. It’s worth noting, however, that I avoided some of the higher-risk/higher-income fixed-income types that appeared in my other portfolios—for example, high-yield and emerging-markets bonds. Because their income distributions are taxed at investors’ ordinary income tax rates, they’re a better fit for tax-sheltered accounts.

On the equity side, I employed tax-managed funds for U.S. equity exposure and a core index fund for non-U.S. exposure. While tax-managed funds, index funds, and ETFs are all fine options for the equity component of investors’ taxable accounts, tax-managed funds are explicitly managed to reduce the drag of taxes.

On the fixed-income side, I eschewed bond funds with higher incomes and, in turn, higher tax costs. Instead, I employed municipal-bond funds—in this case, from Fidelity. For the cash piece—bucket one—investors should shop around for the highest safe yield they can find.

How to Use Them

Retirees will want to be sure to “rightsize” the components of these portfolios based on their spending plans and other considerations. If they’re prioritizing withdrawals from their taxable portfolios over other account types—in line with tax-efficient withdrawal-sequencing considerations—they may want a larger cash component than is outlined here. (I typically recommend that retirees hold six months’ to two years’ worth of planned expenditures in true cash instruments.) Moreover, retirees will want to take into account their own time horizons, risk tolerance, and investment goals when setting their allocations. As with the other retiree Bucket portfolios, the asset allocations shown here assume that the retiree will spend all of their assets, which may not be the case for those who would like to leave a bequest to loved ones or charity.

Additionally, retirees will also want to assess their own tax rates to determine whether they’re better off in municipal bonds, which are included in the portfolios below, or taxable bonds once the haircut of taxes is factored in.

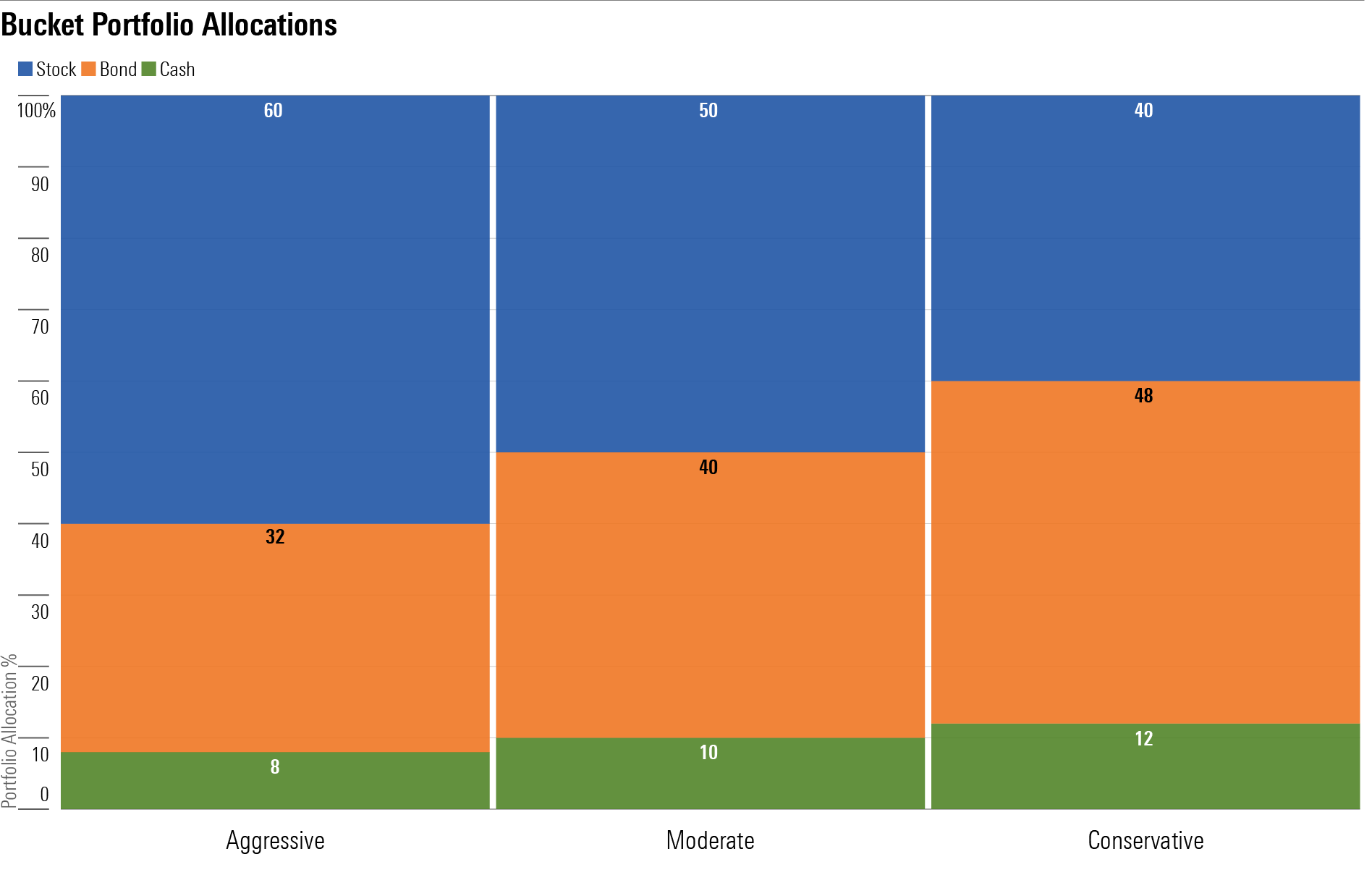

Bucket Portfolio Allocations

Aggressive Tax-Efficient Retirement-Bucket Portfolio for Mutual Fund Investors

Anticipated Time Horizon: 20-25 years

Risk Tolerance/Capacity: High

Target Stock/Bond/Cash Mix: 60/32/8

Bucket 1: Years 1-2

- 8%: Cash (online savings account)

Bucket 2: Years 3-10

Bucket 3: Years 11 and Beyond

- 30%: Vanguard Tax-Managed Capital Appreciation VTCLX

- 10%: Vanguard Tax-Managed Small Cap VTMSX

- 20%: Vanguard FTSE All-World ex-US VFWAX

Moderate Tax-Efficient Retirement-Bucket Portfolio for Mutual Fund Investors

Anticipated Time Horizon: 15-plus years

Risk Tolerance/Capacity: Average

Target Stock/Bond/Cash Mix: 50/40/10

Bucket 1

- 10%: Cash

Bucket 2

Bucket 3

- 25%: Vanguard Tax-Managed Capital Appreciation VTCLX

- 10%: Vanguard Tax-Managed Small Cap VTMSX

- 15%: Vanguard FTSE All-World ex-US VFWAX

Conservative Tax-Efficient Retirement-Bucket Portfolio for Mutual Fund Investors

Anticipated Time Horizon: 15 years or fewer

Risk Tolerance/Capacity: Low

Target Stock/Bond/Cash Mix: 40/48/12

Bucket 1

- 12%: Cash

Bucket 2

Bucket 3

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-25-2024/t_f8ae5dc770f14b3d8f21379e20cb1857_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)