Tax-Efficient Retirement-Bucket Portfolios for Vanguard Investors

The indexing giant’s topnotch tax-managed, index, and municipal-bond funds make tax-friendly portfolios a cinch.

For retired investors in tax-deferred accounts, I’ve developed model Bucket portfolios using Vanguard’s lineup. In this portfolio series, tax efficiency takes center stage, with three bucket retirement portfolios geared toward Vanguard investors’ taxable accounts.

Many investors don’t pay too much attention to tax efficiency, assuming the taxation of their investments is out of their hands or not that big a deal; other investors operate with the assumption that limiting the drag of taxes on their investment returns is extraordinarily complicated. None of this is true. When investing inside of taxable accounts (that is, non-tax-advantaged retirement accounts), sensibly employing a few basic investment types can help limit taxable capital gains and taxable income distributions on an ongoing basis.

It’s a cinch to create model tax-efficient portfolios that use Vanguard funds. The firm boasts a low-cost, no-nonsense lineup of municipal bond funds, as well as a number of tax-efficient equity offerings: index funds, exchange-traded funds, and the fund world’s best lineup of tax-managed funds. I anchored these portfolios with tax-managed equity funds, but index funds or ETFs would contribute to a very tax-efficient portfolio, too.

About the Portfolios

For these three tax-efficient Bucket portfolios, I employed a bucket approach to their structure. Each portfolio includes a cash component to cover a retiree’s near-term expenses (bucket 1), high-quality bonds for intermediate-term spending (bucket 2), and equities for long-term growth. It’s worth noting that these portfolios omit some of the higher-risk/higher-income fixed-income types that appeared in my other portfolios—for example, high-yield and emerging-markets bonds. Because their income distributions are taxed at investors’ ordinary income tax rates, they’re a better fit for tax-sheltered accounts. These investments have risk/reward profiles that fall between equities and bonds, so it’s reasonable to nudge up the tax-efficient portfolios’ equity exposures to compensate for the fact that they’re missing here.

On the equity side, I employed tax-managed funds for U.S. equity exposure and a core index fund for non-U.S. exposure. While tax-managed funds, index funds, and exchange-traded funds are all fine options for the equity component of investors’ taxable accounts, tax-managed funds are explicitly managed to reduce the drag of taxes.

On the fixed-income side, I eschewed bond funds with higher incomes and, in turn, higher tax costs. Instead, I employed municipal-bond funds. For the cash piece—bucket one—investors should shop around for the highest safe yield they can find. Higher-income investors in higher tax brackets may be better off with a municipal money market fund.

How to Use Them

Retirees will want to be sure to “rightsize” the components of these portfolios based on their spending plans and other considerations. If they’re prioritizing withdrawals from their taxable portfolios over other account types—in line with tax-efficient withdrawal-sequencing considerations—they may want a larger cash component than is outlined here. (I typically recommend that retirees hold six months’ to two years’ worth of planned expenditures in true cash instruments.) Moreover, retirees will want to take into account their own time horizons, risk tolerance, and investment goals when setting their allocations. As with the other retiree Bucket portfolios, the asset allocations shown here assume that the retiree will spend all of their assets, which may not be the case for those who would like to leave a bequest to loved ones or charity.

Additionally, retirees will also want to assess their own tax rates to determine whether they’re better off in municipal bonds, which are included in the portfolios below, or taxable bonds once the haircut of taxes is factored in.

Withdrawal sequencing is also in the mix here, because most retirees hold their assets in both tax-deferred and taxable accounts. If required minimum distributions from IRAs (and Social Security and/or a pension) supply most of a retiree’s spending needs, the taxable portfolio could well be more aggressively positioned than what is depicted in these models.

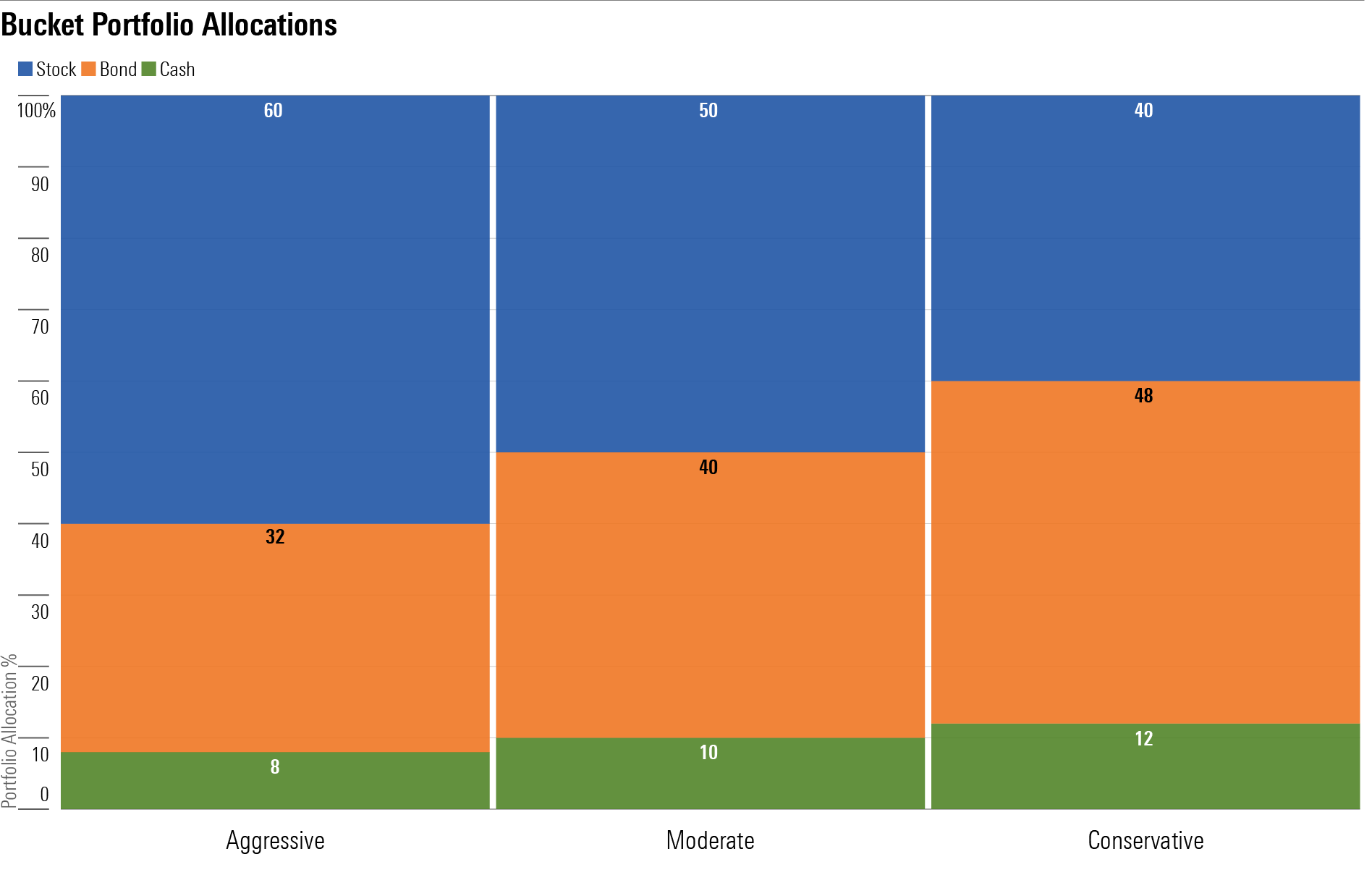

Bucket Portfolio Allocations

Aggressive Tax-Efficient Retirement-Bucket Portfolio for Vanguard Investors

Anticipated Time Horizon: 20-25 years

Risk Tolerance/Capacity: High

Target Stock/Bond/Cash Mix: 60/32/8

Bucket 1: Years 1-2

- 8%: Cash

Bucket 2: Years 3-10

Bucket 3: Years 11 and Beyond

- 30%: Vanguard Tax-Managed Capital Appreciation VTCLX

- 10%: Vanguard Tax-Managed Small Cap VTMSX

- 20%: Vanguard FTSE All World ex-US Index VFWAX

Moderate Tax-Efficient Retirement-Bucket Portfolio for Vanguard Investors

Anticipated Time Horizon: 15-plus years

Risk Tolerance/Capacity: Average

Target Stock/Bond/Cash Mix: 50/40/10

Bucket 1: Years 1-2

- 10%: Cash

Bucket 2: Years 3-10

Bucket 3: Years 11 and Beyond

- 30%: Vanguard Tax-Managed Capital Appreciation VTCLX

- 10%: Vanguard Tax-Managed Small Cap VTMSX

- 10%: Vanguard FTSE All-World ex-US VFWAX

Conservative Tax-Efficient Retirement-Bucket Portfolio for Vanguard Investors

Anticipated Time Horizon: 15-plus years

Risk Tolerance/Capacity: Average

Target Stock/Bond/Cash Mix: 40/48/12

Bucket 1: Years 1-2

- 12%: Cash

Bucket 2: Years 3-10

Bucket 3: Years 11 and Beyond

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)