Tax-Efficient Retirement-Saver Portfolios for Fidelity Investors

Cheap and efficient equity index funds, as well as fine municipal-bond funds, are solid building blocks.

The most successful investors are often the cheapest: They’re parsimonious about investment and tax costs.

Fidelity's lineup is a good fit for investors aiming to build low-cost, tax-efficient portfolios. While not every fund in the firm's stable is inexpensive and/or tax-efficient, Fidelity does field top-flight index and municipal-bond funds. Both sets of products tend to have low costs and keep taxable distributions to a minimum.

About the Portfolios

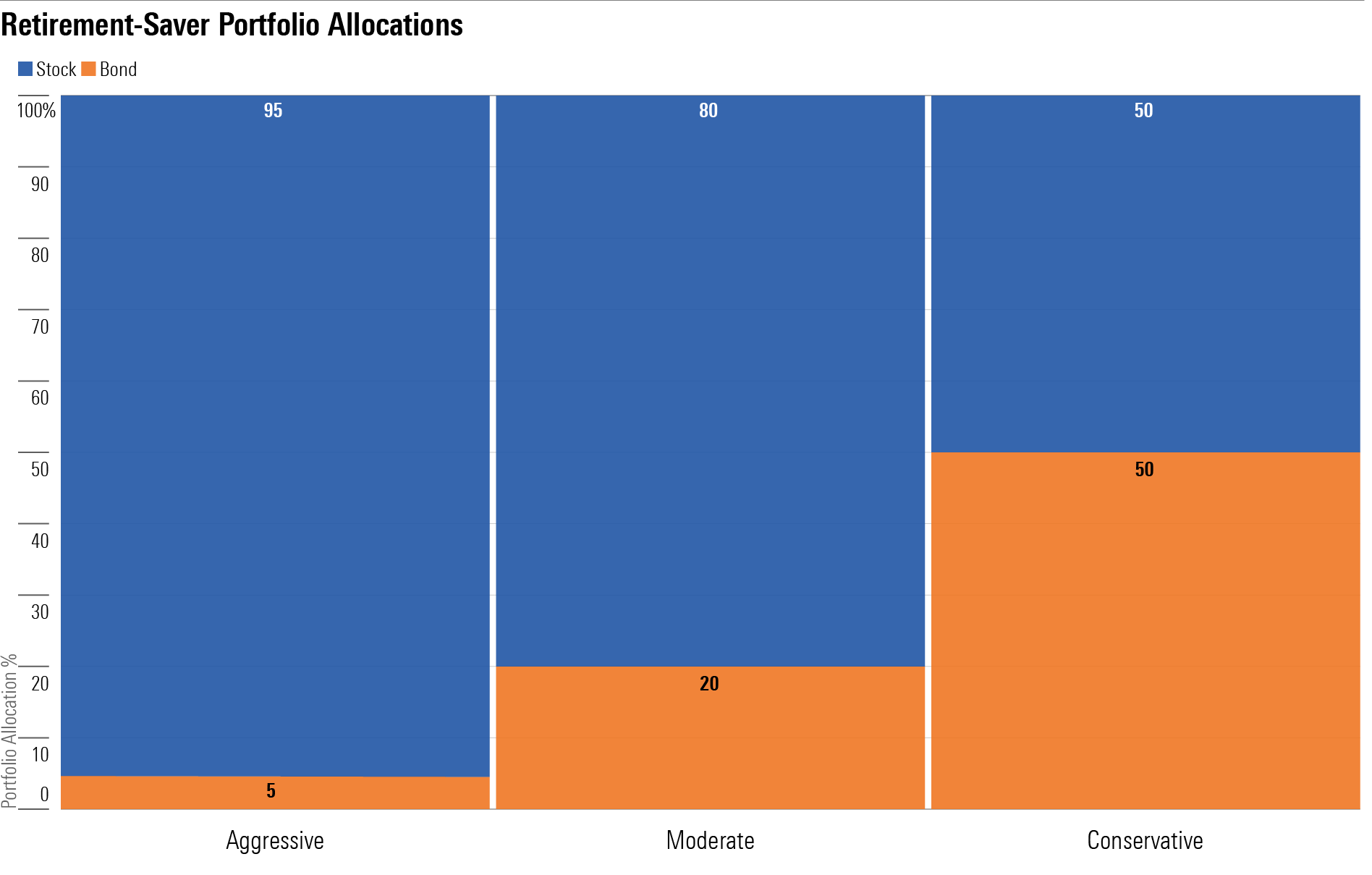

I created three tax-efficient Fidelity Saver portfolios: Aggressive, Moderate, and Conservative. I used the Morningstar Lifetime Allocation Indexes to guide their asset-class exposures. I employed Morningstar Medalist funds—Fidelity municipal-bond and indexed equity funds—to populate them. I specified the lowest-minimum share class for these portfolios, but investors should, of course, opt for the lowest-expense share class they qualify for.

These portfolios aim to limit the drag of income and capital gains taxes within investors’ taxable accounts.

How to Use Them

My key goal with these portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot out the lights with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and suballocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios. As with the Bucket portfolios, I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they no longer rate as medalists.

The portfolios vary in their amounts of stock exposure and in turn their risk levels. The Aggressive portfolio is geared toward someone with many years until retirement and a high tolerance/capacity for short-term volatility. The Conservative portfolio is geared toward people who are just a few years shy of retirement. The Moderate portfolio falls between the two in terms of its risk/return potential.

Investors should be sure to keep asset-location and time-horizon considerations in mind when deciding what to put into their taxable portfolios. Because equities tend to be more tax-efficient than taxable bonds, conventional wisdom holds that accumulators should maintain an equity-heavy stance in their taxable accounts while holding more bonds in their tax-sheltered accounts. In fact, a 30-something could reasonably hold all of their bond funds (presumably a modestly sized stake) in his IRA and 401(k), while holding only stocks inside of the taxable account. But time-horizon considerations might suggest they do just the opposite: If they’re saving for shorter-term, nonretirement goals in those accounts, they’d likely want to hold more cash and bonds than are depicted in these portfolios.

Aggressive Tax-Efficient Retirement-Saver Portfolio for Fidelity Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 55%: Fidelity Total Market Index FSKAX

- 40%: Fidelity Total International Index FTIHX

- 5%: Fidelity Intermediate Municipal Income FLTMX

Moderate Tax-Efficient Retirement-Saver Portfolio for Fidelity Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 48%: Fidelity Total Market Index FSKAX

- 32%: Fidelity Total International Index FTIHX

- 20%: Fidelity Intermediate Municipal Income FLTMX

Conservative Tax-Efficient Retirement-Saver Portfolio for Fidelity Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

- 35%: Fidelity Total Market Index FSKAX

- 15%: Fidelity Total International Index FTIHX

- 30%: Fidelity Intermediate Municipal Income FLTMX

- 20%: Fidelity Limited Term Municipal Income FSTFX

Because the bond piece of this portfolio is larger than is the case with the Moderate portfolio, it’s also more diversified. While younger accumulators can get away with a single well-diversified bond fund—in this case, Fidelity Intermediate Municipal Income—people closing in on retirement will want to start diversifying their fixed-income exposure. Thus, I added a position in a short-term bond fund. With retirement 10 years into the future, it’s too early to start raising cash for in-retirement living expenses; at today’s very low yields, the opportunity cost of doing so is simply too great. But preretirees might consider steering part of their fixed-income sleeves to a short-term bond fund that could be readily converted into cash. After all, having sufficient short-term assets in the portfolio can help mitigate sequencing risk—the chance that a retiree could encounter a lousy market right out of the box.

A version of this article published on Sept. 12, 2018.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)