Tax-Efficient Retirement-Saver Portfolios for Minimalist Investors

These streamlined portfolios are designed to reduce investors’ oversight responsibilities and the drag of taxes.

While investors are often urged to focus on their tax-sheltered accounts for their retirement savings, there are many good reasons to stash assets in a taxable account, too.

A key reason to do this is if you’re a supersaver who has maxed out the available tax-sheltered vehicles and still have assets to invest. Once you’ve made all of those 401(k) and IRA contributions, investing in a taxable account may be your only option. (Just be sure to investigate whether health savings accounts and/or aftertax 401(k) contributions might be an avenue, too.)

You’ll also want to employ a taxable account if you expect to tap the account prior to retirement. Whereas tax-sheltered retirement-savings vehicles generally carry at least some strictures to pulling your money out early (save for withdrawals of Roth IRA contributions, which are always tax- and penalty-free), you can come and go as you please in a taxable account. You may pay transaction costs and capital gains taxes as you trade, but there are no penalties for early withdrawals.

No matter, there’s a strong case to be made for building a taxable portfolio that’s both streamlined and tax-efficient. After all, your taxable holdings aren’t likely the largest component of your retirement portfolio, so it doesn’t make sense to overcomplicate it with too many holdings. And by ensuring that your streamlined portfolio is also tax-efficient, you’ll improve your take-home returns.

About the Portfolios

These portfolios are geared toward people who are building up their retirement nest eggs within the confines of taxable accounts. As such, the portfolios aim to limit income and capital gains distributions. To help reduce the drag of taxes on an ongoing basis and obtain broad market exposures with as few holdings as possible, the portfolios are anchored by equity exchange-traded funds that track broad-market indexes. They employ municipal-bond funds for fixed-income exposure. All of the holdings in the portfolios earn Morningstar Medalist ratings from our analyst team.

The portfolios' allocations are loosely based on the Morningstar Lifetime Allocation Indexes. I'll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I'll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they no longer rate as medalists.

How to Use Them

My key goal with these model portfolio is to depict sound asset-allocation and portfolio-management principles rather than to shoot out the lights with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and suballocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios.

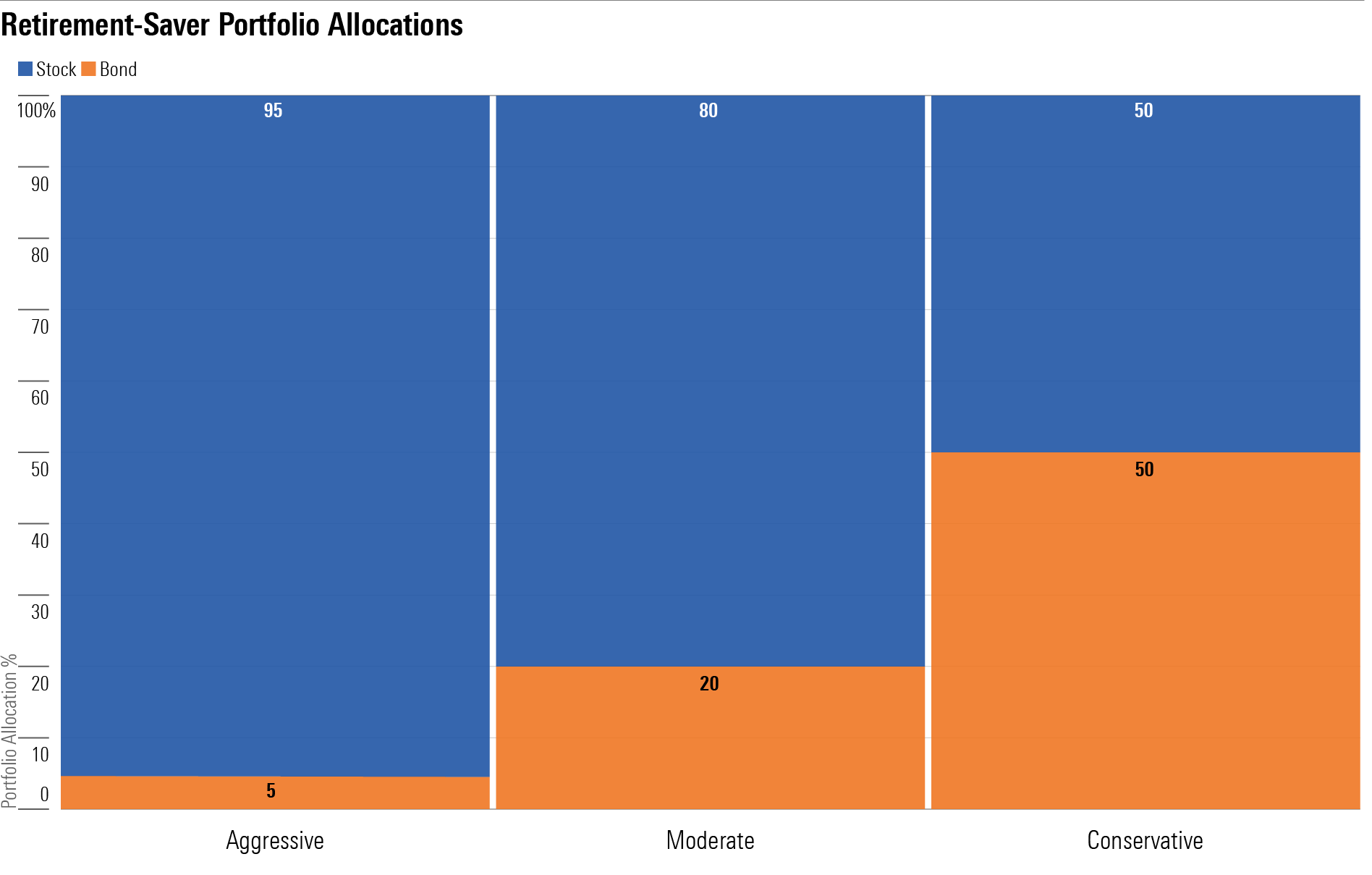

The portfolios vary in their amounts of stock exposure and in turn their risk levels. The Aggressive Portfolio is best suited for a younger investor with many years until retirement, whereas the Conservative portfolio is geared toward still-working individuals who expect to retire within the next few years. The Moderate portfolio falls between the two.

While the Morningstar Lifetime Allocation Indexes can provide a good starting point for determining appropriate asset-class exposures for different time horizons until retirement, I’d recommend that investors take into account their own situations when setting their asset allocations or work with a financial advisor to help them do so. For example, investors who are close to retirement but expect to derive most of their needed income from Social Security and/or a pension are apt to find the Conservative portfolio too meek for their needs.

Because many people use taxable accounts for near-term spending needs as well as a retirement-funding vehicle, the asset allocation of that account may be a bit of a barbell—very safe assets as well as longer-term assets earmarked for retirement. The right amount to hold in safe securities is highly individualized; it depends on your desired emergency-fund size as well as any planned near-term outlays, such as the property-tax bill that’s due next month or the amount that you’re saving for a new car.

Aggressive Tax-Efficient Retirement-Saver Portfolio for Minimalist Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 55% Vanguard Total Stock Market ETF VTI

- 40% Vanguard Total International Stock ETF VXUS

- 5% Fidelity Intermediate Municipal Income FLTMX

Moderate Tax-Efficient Retirement-Saver Portfolio for Minimalist Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 48% Vanguard Total Stock Market ETF VTI

- 32% Vanguard Total International Stock ETF VXUS

- 20% Fidelity Intermediate Municipal Income FLTMX

Conservative Tax-Efficient Retirement-Saver Portfolio for Minimalist Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)