Tax-Efficient Retirement-Saver Portfolios for Mutual Fund Investors

We’ve designed these portfolios to maximize returns while limiting Uncle Sam’s take.

Tightening up all of the costs in a portfolio is one of the best ways to enhance your take-home return. That’s one of the reasons Morningstar often discusses the importance of selecting low-cost investments and limiting trading costs, and it’s also a key reason we pay so much attention to tax efficiency. In addition to taking full advantage of their tax-sheltered wrappers, such as IRAs and 401(k)s, investors can reduce the drag of taxes by paying close attention to how they manage their taxable accounts.

In general, patience should be the watchword: Not only should investors limit the trading they do in their taxable portfolios, with an eye toward limiting taxable capital gains distributions, but they should also seek out stock funds that employ patient, low-turnover strategies. Exchange-traded funds, index funds, and tax-managed funds all tend to have very low turnover and, in turn, do a good job reducing the tax collector’s cut of their portfolios’ returns.

About the Portfolios

For these three tax-efficient portfolios, I employed the same general asset-allocation parameters that I used with the other Bucket portfolios. Specifically, I relied on the Morningstar Lifetime Allocation Indexes to help guide the long-term portfolios' exposures.

To populate the portfolios, I focused on Morningstar Medalist tax-managed and index funds for equity exposure. To be sure, broad-market index exchange-traded funds—and to a lesser extent, traditional index funds—tend to have very low turnover and, therefore, distribute few taxable capital gains on an ongoing basis. They can be fine options for taxable accounts. One reason I like tax-managed funds is that they might be able to adjust their strategies to conform to the prevailing tax regime. For example, if dividends were once again taxed at investors’ ordinary income tax rates, the tax-managed fund could change its strategy to suppress dividend-payers. Because Vanguard no longer offers a tax-managed international fund, I employed an ultra-low-cost foreign-stock index fund, which also features very strong tax efficiency.

On the fixed-income side, I employed municipal-bond funds—in this case, from Fidelity. Because the moderate and aggressive portfolios assume long time horizons of 20 years or more, I stuck with an intermediate-term fund for the fixed-income piece. Such a fund may have more interest-rate-related volatility than a short-term fund, but its higher yield will help make up for the greater short-term volatility.

How to Use Them

These portfolios are designed for educational purposes and to help investors benchmark their own portfolios. Accumulators will want to be sure to “rightsize” the components of these portfolios based on their human capital, their risk capacity, and the complexion of their tax-sheltered portfolios, however. For example, a 50-year-old who is focusing on equity funds within her 401(k) because her plan doesn’t offer many decent bond options may want a higher bond allocation in her taxable portfolio. And because these portfolios aren’t geared toward investors who are actively tapping their principal, I didn’t include a cash component. But investors who are using their taxable account to house their emergency reserves should definitely hold cash in lieu of bonds.

Aggressive Tax-Efficient Retirement-Saver Portfolio for Mutual Fund Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

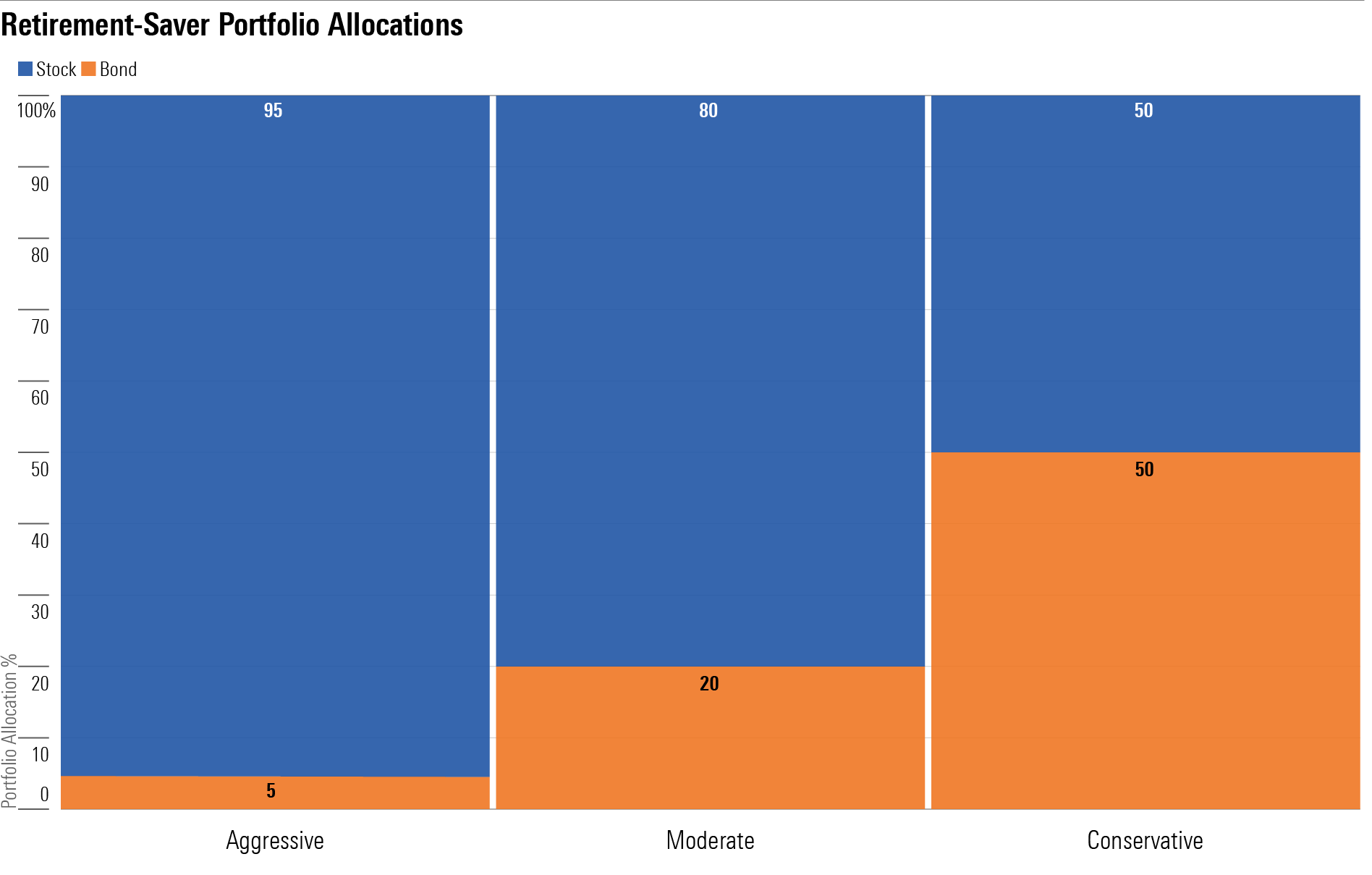

Target Stock/Bond Mix: 95/5

- 45%: Vanguard Tax-Managed Capital Appreciation VTCLX

- 10%: Vanguard Tax-Managed Small Cap VTMSX

- 40%: Vanguard FTSE All-World ex-US Index VFWAX

- 5%: Fidelity Intermediate Municipal Income FLTMX

Moderate Tax-Efficient Retirement-Saver Portfolio for Mutual Fund Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Medium

Target Stock/Bond Mix: 80/20

- 40%: Vanguard Tax-Managed Capital Appreciation VTCLX

- 8%: Vanguard Tax-Managed Small Cap VTMSX

- 32% Vanguard FTSE All-World ex-US Index VFWAX

- 20%: Fidelity Intermediate Municipal Income FLTMX

Conservative Tax-Efficient Retirement-Saver Portfolio for Mutual Fund Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)