Tax-Efficient Retirement-Saver Portfolios for T. Rowe Price Investors

Despite the firm’s lineup of fine actively managed funds, equity index funds are a more tax-friendly choice.

T. Rowe Price is widely known for its actively managed funds, including standouts like T. Rowe Price Capital Appreciation PRWCX and T. Rowe Price Equity Income PRFDX.

Its equity index funds? Not so much. Savvy investors know that index funds are a commodity, so low costs separate the good ones from the also-rans. While T. Rowe Price's index funds aren't in the category of egregiously expensive, investors can readily find much cheaper options at Vanguard, Fidelity, and iShares, among others.

So, why on earth would we recommend retirement-saver portfolios for taxable accounts that are anchored in index funds? In a word, taxes. Because their turnover is minuscule, broad-market index funds do a much better job of limiting tax costs than do active funds. On the bond side, I’ve also used T. Rowe’s excellent municipal-bond funds.

About the Portfolios

I’ve used the Morningstar Lifetime Allocation Indexes to inform the portfolios’ asset allocations and the exposures to subasset classes. To populate the portfolios, I employed no-load, open mutual funds that received Morningstar Medalist ratings from our analyst team. Most of the funds earned Morningstar Analyst Ratings of Gold, though I’ve used Silver- and Bronze-rated funds in cases when suitable Gold-rated, no-load options that are accepting new investments are unavailable.

How to Use Them

My key goal with these portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot out the lights with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and suballocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios. As with the Bucket portfolios, I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they no longer rate as medalists.

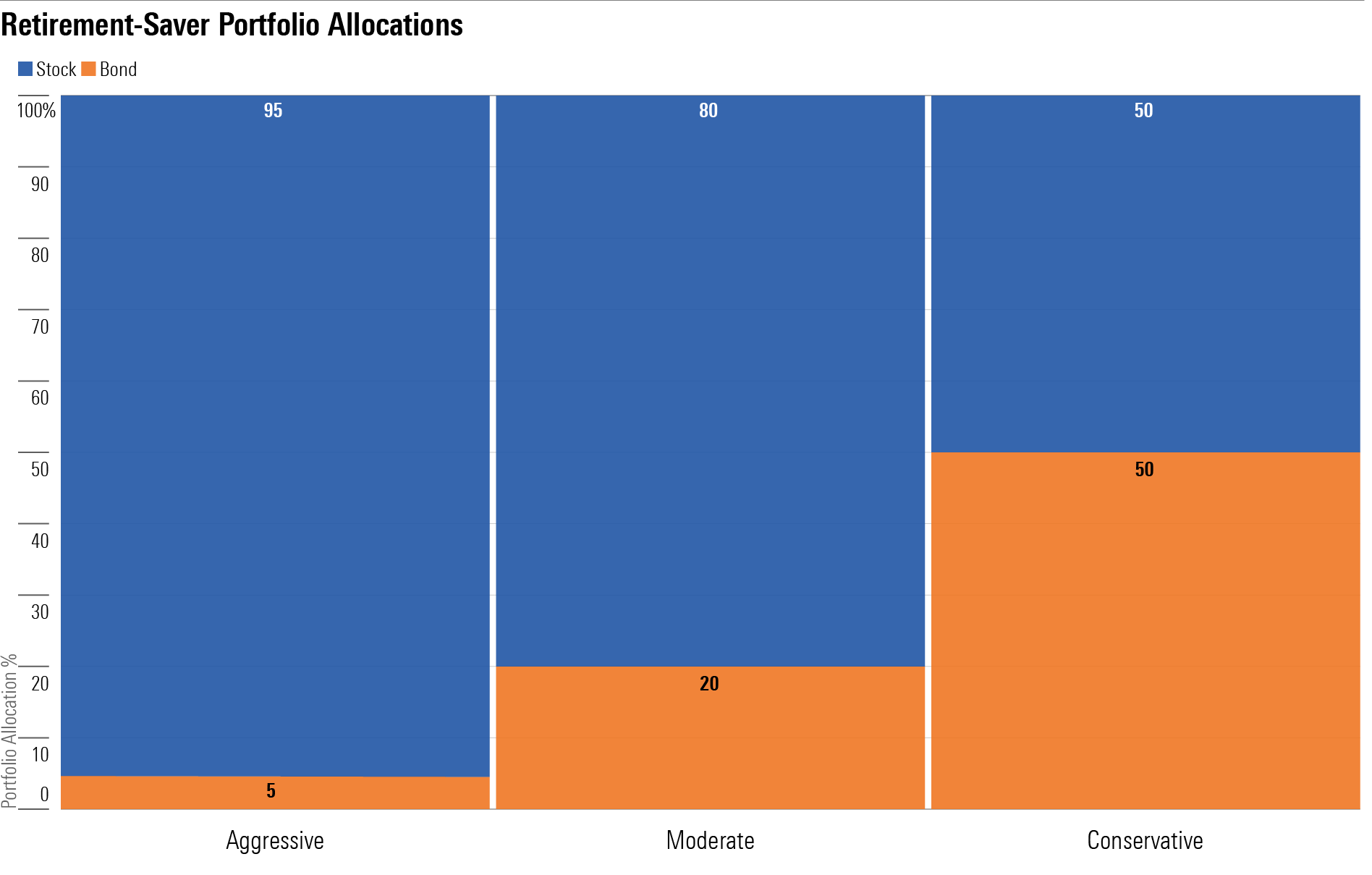

The portfolios vary in their amounts of stock exposure and in turn their risk levels. The Aggressive Portfolio is geared toward someone with many years until retirement and a high tolerance/capacity for short-term volatility. The Conservative portfolio is geared toward people who are just a few years shy of retirement. The Moderate portfolio falls between the two in terms of its risk/return potential.

Investors will, of course, want to bear their own situations and anticipated drawdown needs in mind before adopting any of these portfolios’ allocations as their own. For example, if an individual is closing in on retirement but will be able to rely on a pension to meet their income needs in retirement, the Conservative portfolio featured here may, in fact, be too bond-heavy for their needs. On the flip side, a younger investor who is earmarking part of a taxable portfolio for a remodeling project in five years shouldn’t run with the Aggressive portfolio; its 95% equity weighting could drop at an inopportune time, reducing the amount that’s available to fund near-term goals.

Investors who are in the 0% capital gains bracket could reasonably use T. Rowe’s actively managed equity funds in place of the index products featured here. Meanwhile, investors who are in lower tax brackets might earn a better take-home yield with taxable bonds than munis.

Aggressive Tax-Efficient Retirement-Saver Portfolio for T. Rowe Price Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 55%: T. Rowe Price Total Equity Market Index POMIX

- 40%: T. Rowe Price International Equity Index PIEQX

- 5%: T. Rowe Price Summit Municipal Income PRINX

Moderate Tax-Efficient Retirement-Saver Portfolio for T. Rowe Price Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 48%: T. Rowe Price Total Equity Market Index POMIX

- 32%: T. Rowe Price International Equity Index PIEQX

- 20%: T. Rowe Price Summit Municipal Income PRINX

Conservative Tax-Efficient Retirement-Saver Portfolio for T. Rowe Price Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

- 35%: T. Rowe Price Total Equity Market Index POMIX

- 15%: T. Rowe Price International Equity Index PIEQX

- 30%: T. Rowe Price Summit Municipal Income PRINX

- 20%: T. Rowe Price Tax-Free Short-Intermediate PRFSX

A version of this article published on Sept. 6, 2018.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)