Technology: Strength Continues, With Software Presenting the Best Buying Opportunities

Our top picks for the technology sector are Adobe, Fortinet, and STMicroelectronics.

After a strong 2023, tech continued to perform well in the second quarter of 2024. Even as semiconductor companies remain pressured from a results standpoint, software and services generally reported solid results. However, software stocks have pulled back as the Fed disappointed investors with no interest rate cuts thus far in 2024. On the flip side, semiconductor stocks have performed well. We see no consistent performance differentiation among market capitalization tranches. We remain confident in secular tailwinds in the sector, such as cloud computing, artificial intelligence, and the long-term expansion of semiconductor demand. Still, after a strong run for technology stocks since the beginning of 2023, we see pockets of opportunities.

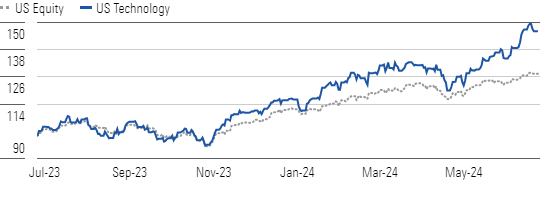

Tech Continues to Outperform Into June

The most important force we see across technology revolves around generative artificial intelligence. Software companies are developing and incorporating next-generation AI capabilities into their solutions, cloud providers are introducing new services and ramping capacity, and semiconductor firms, notably Nvidia NVDA, are experiencing surging demand for AI and data center chip applications.

The US Technology Index is up 41% on a trailing 12-month basis, compared with the US equity market being up 26%. Over the past quarter, the US equity market was up 1%, while tech was up 6%.

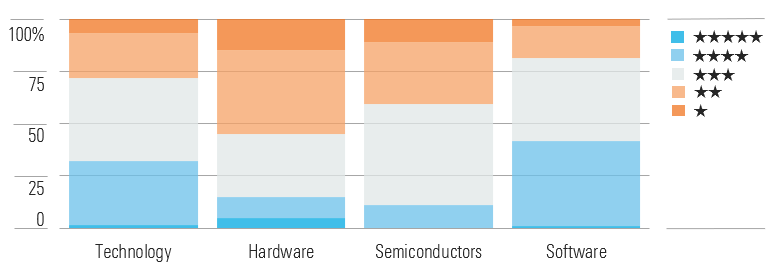

Technology Star Rating Distribution by Industry

While the median US technology stock is fairly valued, the overall tech sector trades at a 10% premium, as the high valuations on several mega-cap tech stocks skew the overall sector’s valuation. We see semis and hardware as the most overvalued, with software skewing toward undervalued.

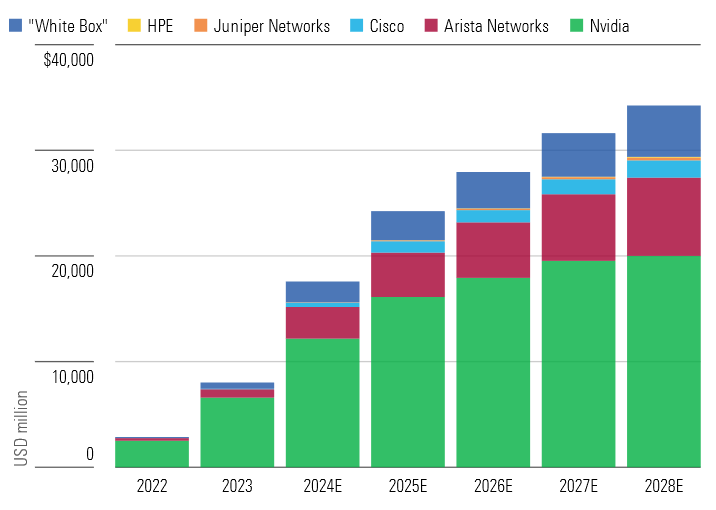

We See 34% Growth In Gen AI Networking Gear Spending Through 2028

Investors are excited about generative AI and have been searching for stocks within this theme. We think there are opportunities beyond Microsoft MSFT and Nvidia, and we expect networking investment in generative AI to grow in line with investment in GPUs, representing a derivative investment avenue. We view this opportunity as durable and long-lasting, even if we see most of the best-positioned networking stocks as fairly valued or overvalued today.

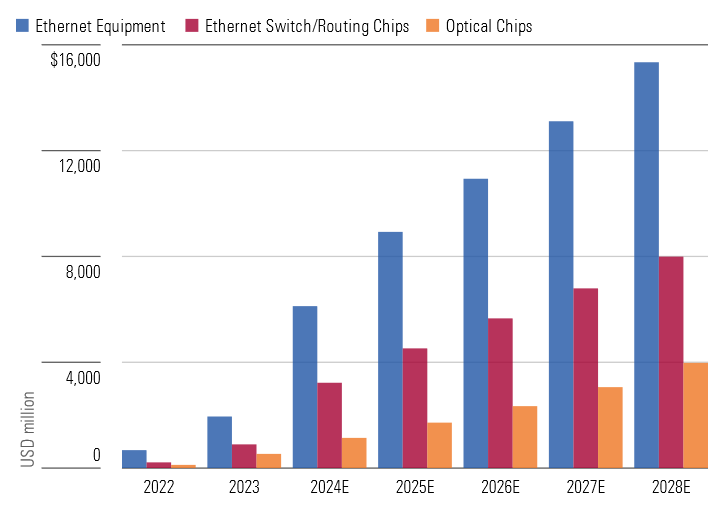

Chips and Networking Gear for Gen AI Usage Should Grow Together

Top Technology Sector Picks

Adobe

- Fair Value Estimate: $635.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

Adobe ADBE has come to dominate content creation software with its iconic Photoshop and Illustrator solutions, both of which are contained in the broader Creative Cloud, which is the clear leader for software for creative professionals. Adobe Express is widening the funnel for new customers, which we think bodes well for growth over the next several years. We also see Firefly generative AI models as an important growth driver. Overall, we see plenty of momentum within product innovation, client interest, and revenue creation, and we are encouraged by strong second-quarter results after a slight hiccup on the March earnings call. We continue to see valuation as attractive.

Fortinet

- Fair Value Estimate: $77.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

We expect a modest recovery in firewall spending in the back half of 2024, which should quell some apocalyptic concerns about firewall spending. We also think investors are overly pessimistic about Fortinet’s FTNT newer security forays into SecOps and SASE, where we believe the firm’s expansion will continue to bear fruit, with a greater portion of sales/billings being driven by these new verticals. So far, the firm’s recent investments in SASE and SecOps are tracking along nicely and allowing for upsell from the firewall-installed base. We also think Fortinet will benefit from the trend toward vendor consolidation over the next several years. Shares are attractive, in our view.

STMicroelectronics

- Fair Value Estimate: $60.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

STMicroelectronics STM is one of our top picks in the sector, as our fair value estimates of $60 offer an attractive margin of safety for long-term, patient investors. We continue to like the long-term secular tailwinds in the automotive end market, as ST should profit from increased chip content per car, especially in electric vehicles. The company has also achieved nice gross margin expansion in recent years, and we foresee it maintaining these margins in the long run.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/d10o6nnig0wrdw.cloudfront.net/07-02-2024/t_6b25eabdd47c4e2bb51fbb816a658179_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)