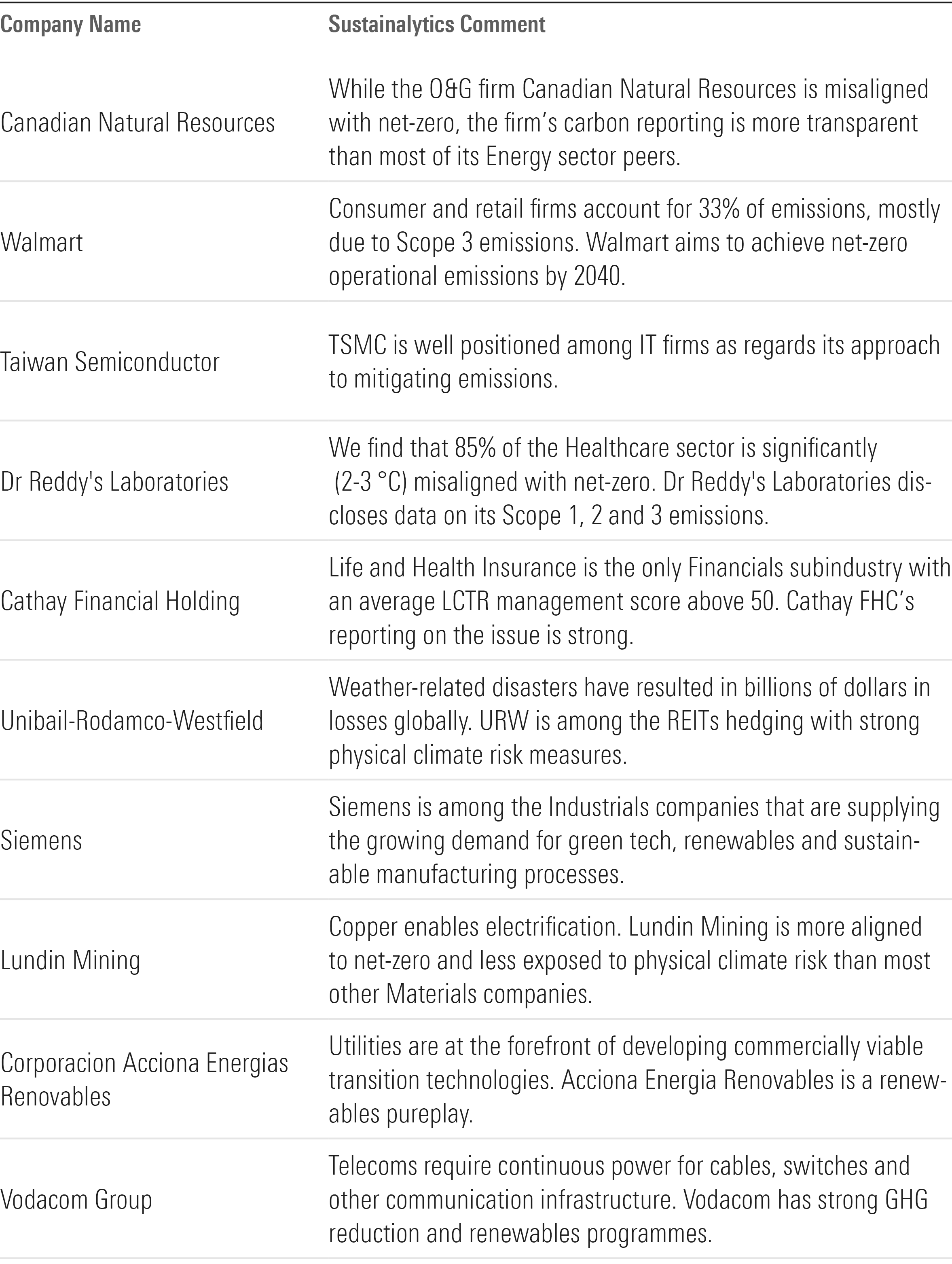

These Companies Lead Their Sectors in the Carbon Transition

Walmart and TSMC are among 10 sector leaders in the journey to net zero.

An eclectic group of 10 companies is pushing the envelope to grapple with climate change, according to a new study by Morningstar Sustainalytics. Just one of the companies, Walmart WMT, hails from the United States. The rest include Canadian Natural Resources CNQ, Taiwan Semiconductor 2330, Siemens SIE, Dr Reddy’s Laboratories 500124, Cathay Financial 2882, Unibail-Rodamco-Westfield URW, Lundin Mining LUN, Acciona Energias Renovables ANE, and Vodacom Group VOD.

These Companies Lead Their Sectors in the Carbon Transition

Investor Concerns About Global Warming Intensify

The study, titled “Navigating Material Climate Risks in the Global Equities Market,” evaluates how companies are doing in the transition toward a low-carbon economy, given “intensifying concerns” about global warming and the rise of carbon dioxide and other greenhouse gas emissions.

Global warming is a major threat to the financial system, posing financially relevant risks for companies in all sectors and all manner of investments. Thus, nations aim to limit global warming to well below 2.0 degrees Celsius and preferably at 1.5 degrees Celsius compared with preindustrial levels, as negotiated in the 2015 Paris Agreement. That would involve adopting goals to hit net zero greenhouse gas emissions by 2050, with a 45% reduction in emissions by 2030. [For a primer on net zero and other climate terms, read this.]

Climate Change a ‘Threat Multiplier’ for Investments

A growing number of financial institutions are prioritizing climate change in their investment strategies, writes a team of analysts at Morningstar Sustainalytics. Increasingly, climate change is viewed as a “threat multiplier” that can intensify the impacts of a wide range of hazards facing people’s occupations, livelihoods, and portfolios.

Meanwhile, investors and companies are all facing pressure to meet emissions targets amid tightening regulations, political debates, and the physical impacts of climate change. All these pose risks but also opportunities. The new study integrates the Sustainalytics Low Carbon Transition Rating, Physical Climate Risk Metrics, ESG Risk Ratings, and Morningstar equity research. (The transition rating expresses a company’s alignment with a net zero economy as the temperature increase above preindustrial levels that would occur if the entire global economy were as misaligned as this company. For example, firms between 3°C and 4°C are considered highly misaligned.)

The study looks at 3,373 companies for which Sustainalytics provides a Low Carbon Transition Rating and which are in the Morningstar Global Markets Large-Mid Cap Index. It also assesses the companies using Sustainalytics’ Physical Climate Risk Metrics.

Virtually all the companies are “to some extent misaligned” with net zero targets, the study found. Meanwhile, companies generally underreported carbon emissions, especially the scope 3 emissions that aren’t in their direct control. And while physical climate risks “vary widely,” companies in most sectors face estimated losses of between 1% and 5% of their operating cash flow annually.

Leading the Carbon Transition

Still, the analysts identified 10 companies that lead their sectors. We list them in the table below, as well as relevant metrics if you’d like to research them further as investments.

10 Companies Leading Their Sectors in the Climate Transition

1. Vodacom Group

- Quantitative Morningstar Rating: 3 stars

- Quantitative Morningstar Uncertainty Rating: Very High

- Morningstar Capital Allocation Rating: None

- Industry: Telecom Services

2. Canadian Natural Resources

- Quantitative Morningstar Rating: None

- Quantitative Morningstar Uncertainty Rating: None

- Morningstar Capital Allocation Rating: None

- Industry: Oil & Gas E&P

3. Unibail-Rodamco-Westfield

Analyst: Alexander Prineas

- Morningstar Rating: 4 stars

- Morningstar Uncertainty Rating: High

- Morningstar Capital Allocation Rating: Standard

- Industry: REIT—Retail

Unibail-Rodamco-Westfield was formed in 1968, acquiring several large malls through to 1995 and offices thereafter. In 2000, it launched a conventions and exhibitions business and is now a European leader in the sector. In 2007, Unibail merged with Rodamco, becoming the largest retail REIT in continental Europe.

Alexander Prineas writes in a recent report, “The group’s assets remain high quality, owning centers that are among the best in Europe and the US. Its iconic assets include the Carrousel du Louvre in Paris, Westfield Mall of Scandinavia in Stockholm, Westfield centers at Stratford and Shepherd’s Bush in London, the Westfield World Trade Center in New York, and many flagship malls throughout California. We expect URW’s malls to perform strongly, particularly as rival low-quality malls in the US close their doors. However, URW’s large debt load puts the balance sheet under pressure. URW was able to issue debt during the covid-19 crisis at cheap prices but needs to reduce debt.”

4. Cathay Financial Holding

- Quantitative Morningstar Rating: 3 stars

- Quantitative Morningstar Uncertainty Rating: Very High

- Morningstar Capital Allocation Rating: None

- Industry: Insurance—Life

5. Siemens

Analyst: Matthew Donen

- Morningstar Rating: 3 stars

- Morningstar Uncertainty Rating: Medium

- Morningstar Capital Allocation Rating: Exemplary

- Industry: Specialty Industrial Machinery

Siemens is a disparate portfolio of high-quality businesses in different sectors. The spinoff of its cyclical energy and wind turbine divisions has enhanced the group’s return profile and provides more durable returns than in the past. Further deconsolidation appears unlikely. All its businesses have strong product portfolios to compete in long-term attractive end markets that benefit from the secular growth trends of digitalization and the energy transition.

In a recent report, equity analyst Matthew Donen writes, “Siemens entered its 2024 financial year with a healthy order backlog, which, combined with robust demand for electrical products within its smart infrastructure segment, supports our 4% organic revenue growth forecast for 2024, offsetting short-cycle weakness in automation. Our slight downward revision to fiscal 2024 organic revenue is driven by the ongoing destocking for automation products, particularly in China. We forecast annualized organic revenue growth of 5% during our five-year forecast.”

6. Corporacion Acciona Energía Internacional

Analyst: Tancrede Fulop, CFA

- Morningstar Rating: 4 stars

- Morningstar Uncertainty Rating: Medium

- Morningstar Capital Allocation Rating: Standard

- Industry: Utilities—Renewable

A renewables developer, Acciona Energia was spun off from Spain industrial conglomerate Acciona in July 2021. The floating share is 17.3%. The rationale of the IPO was to revive capacity growth that had been subdued since a 2013 regulatory change in Spain drove a sharp cut in renewables’ returns.

Equity analyst Tancrede Fulop notes in a recent report that “70% of Acciona Energia’s capacity is onshore wind, 7% hydro dams, 18% solar photovoltaic, and 2% is battery. 44% of its capacity is in Spain. The three biggest markets outside Spain are the US, Mexico, and Australia.”

Fulop adds that “The firm targets an internal rate of return 200-300 basis points above its weighted average cost of capital. We surmise it will achieve the lower end of the range.”

7. Lundin Mining

- Quantitative Morningstar Rating: 3 stars

- Quantitative Morningstar Uncertainty Rating: High

- Morningstar Capital Allocation Rating: None

- Industry: Copper

Analyst: Phelix Lee

- Morningstar Rating: 3 stars

- Morningstar Uncertainty Rating: Medium

- Morningstar Capital Allocation Rating: Exemplary

- Industry: Semiconductors

Taiwan Semiconductor Manufacturing is the world’s largest dedicated contract chip manufacturer, or foundry. It makes integrated circuits for customers based on their proprietary IC designs. The firm has long benefited from semiconductor firms around the globe transitioning from integrated device manufacturers to fabless designers.

Morningstar equity analyst Phelix Lee, in describing the bulls’ perspective, recently wrote, “TSMC should consistently earn higher gross margins than competitors thanks to its economies of scale and premium pricing justified by cutting-edge process technologies.”

9. Walmart

Analyst: Noah Rohr

- Morningstar Rating: 2 stars

- Morningstar Uncertainty Rating: Medium

- Morningstar Capital Allocation Rating: Standard

- Industry: Discount Stores

Writes Morningstar analyst Noah Rohr: “Wide-moat Walmart’s unrivaled scale relative to its brick-and-mortar retail peers provides the firm with the rare ability to formidably adapt to a dynamic retail landscape. Walmart benefits from an expansive physical footprint and entrenched position in the communities it serves, putting the retailer in close proximity to the vast majority of US consumers. The firm’s unique promise of a wide assortment of goods at low prices has allowed Walmart to retain its status as the nation’s preeminent retailer for over 30 years.

“We believe Walmart boasts a solid financial position as its $9 billion of cash on hand, $15 billion of undrawn lines of credit, modest amount of outstanding debt, and history of positive operating cash flows enable the firm to continue reinvesting in the business while making shareholder distributions.”

10. Dr Reddy’s Laboratories

- Quantitative Morningstar Rating: 2 stars

- Quantitative Morningstar Uncertainty Rating: High

- Morningstar Capital Allocation Rating: Standard

- Industry: Drug Manufacturers—Specialty & Generic

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWOIHC3SK5CHJPXXNSL3RJ7VPQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OLSBU7KPNJAZRHYGNJDLIQOVZY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)