The Uncertainty Rating represents Morningstar equity analysts’ ability to pinpoint a stock’s fair value estimate. The Uncertainty Rating interacts with the Morningstar Fair Value Estimate to produce the Morningstar Rating for stocks.

Uncertainty Rating

What is the Uncertainty Rating?

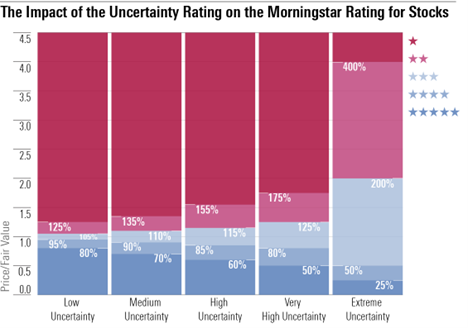

The Uncertainty Ratings are Low, Medium, High, Very High, and Extreme. The recommended margin of safety—the discount to fair value demanded before Morningstar would recommend buying or selling a stock—widens as the uncertainty of the fair value estimate increases.

The more uncertain Morningstar’s analysts are about the value of the stock, the more discounted the stock needs to be for Morningstar to recommend buying shares. For example, a stock with a Low Uncertainty Rating is considered a “buy” when its price drops below 95% of its fair value estimate. For a stock with an Extreme Uncertainty Rating, its price would have to be 50% of its fair value estimate for an analyst to recommend buying it.