We Expect GDP Growth to Weaken Until Fed Starts Cutting Interest Rates

Our economic forecast is optimistic in the long run thanks to labor supply and productivity expansion.

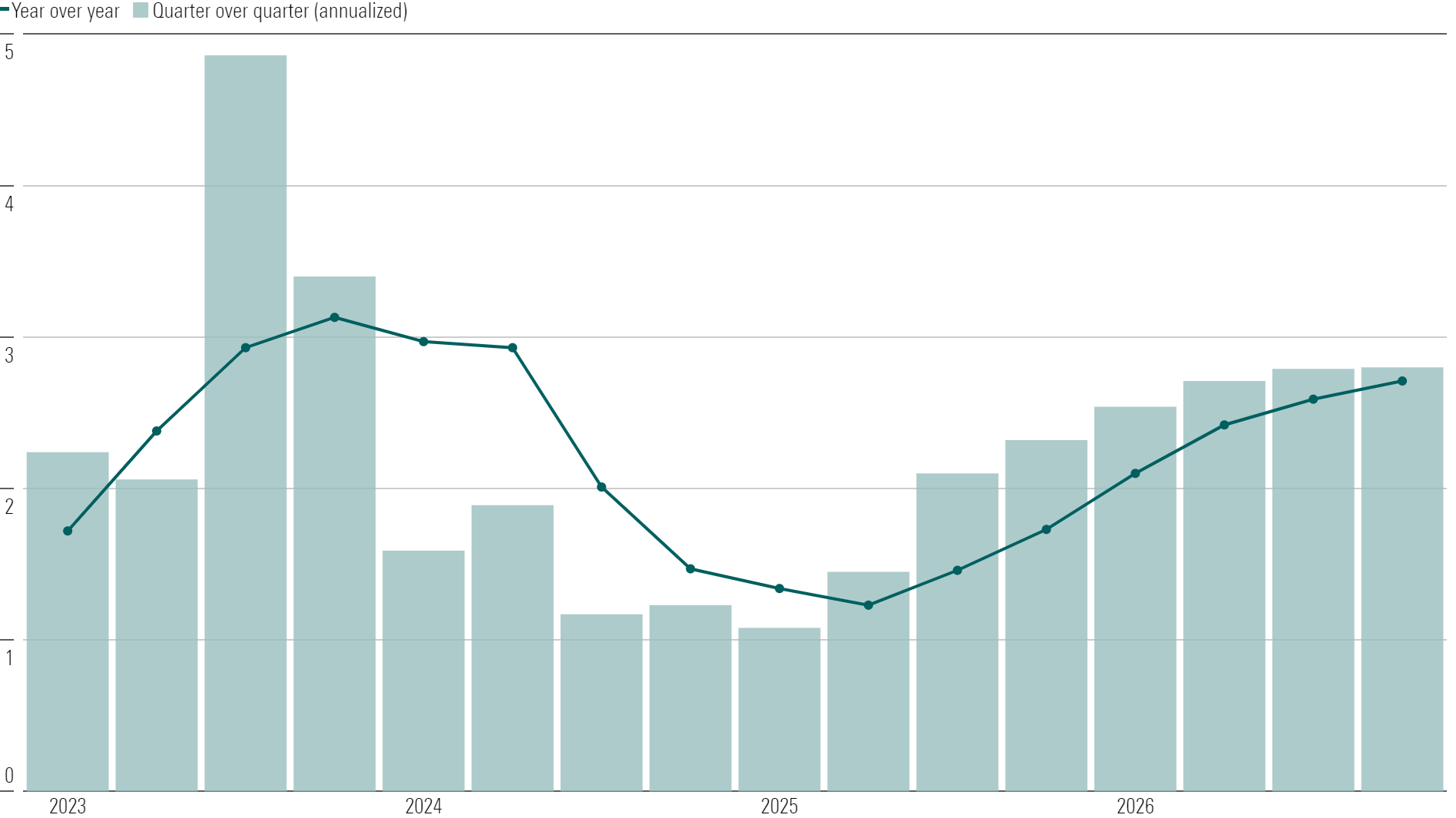

We expect gross domestic product growth to weaken over the next year before beginning to reaccelerate in the second half of 2025 on the back of Fed rate cuts. Growth will be weaker than normal, but still positive, thus avoiding a recession. This period of weaker growth should cool off the economy and ensure inflation returns to the Fed’s 2% target.

GDP measures the size of an economy, specifically the total value of goods and services produced in a given period. The GDP growth rate indicates how fast the country’s economic output is growing.

US real GDP growth accelerated in 2023 despite facing the largest federal-funds rate hikes in four decades. But the contractionary effects of Fed rate hikes have yet to fully play out, and this and other headwinds should cause growth to slow in 2024 and 2025. In terms of annual average numbers, we expect growth to trough in 2025.

U.S. Real GDP Growth (%)

Over 2026-28, we expect GDP growth to rebound at a brisk rate. But this shouldn’t generate renewed inflationary pressures thanks to strong supply-side expansion.

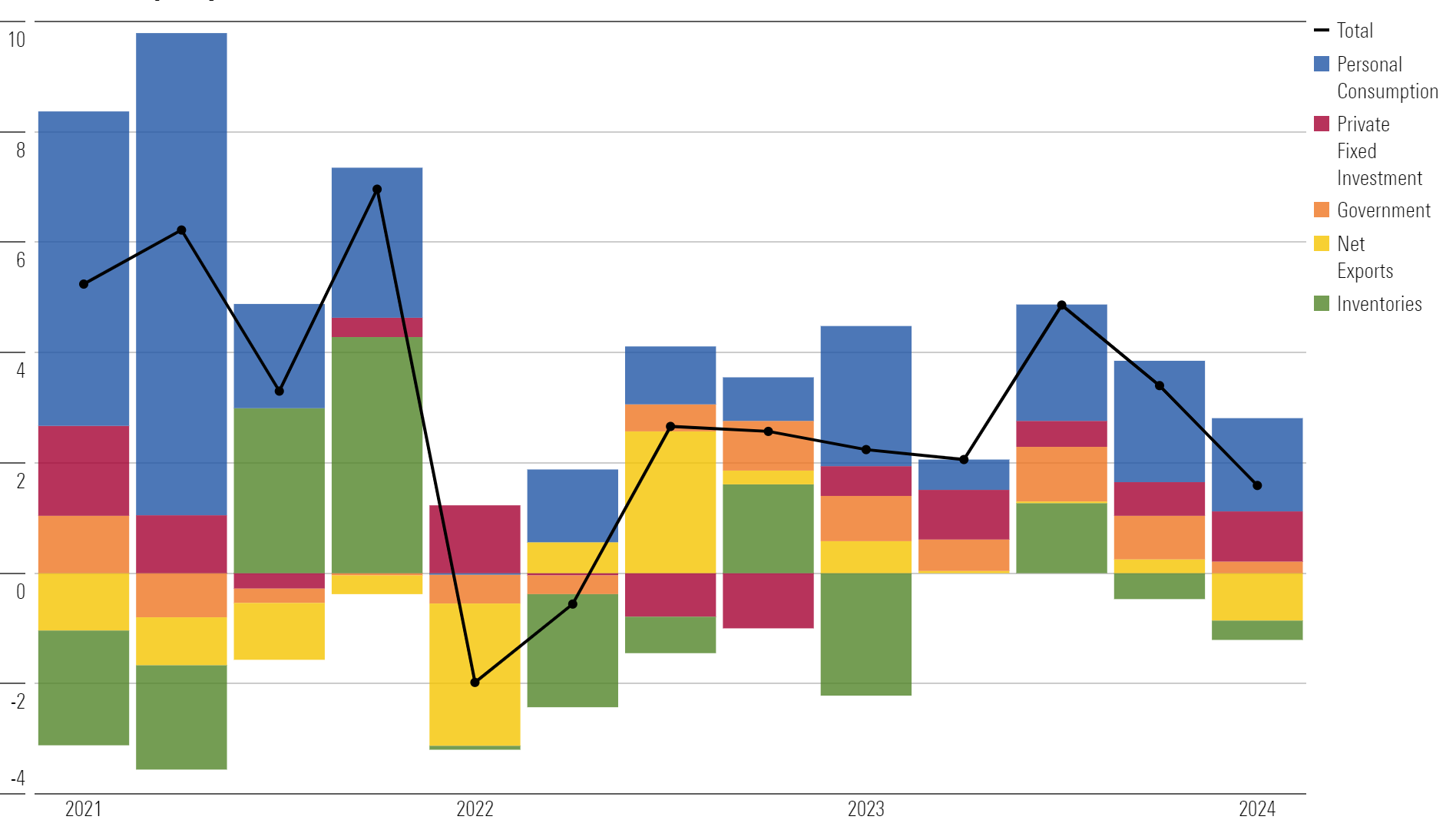

Growth Has Remained Strong in Recent Quarters, But We Expect It to Slow Soon

US real GDP growth averaged a very strong 4.1% in the second half of 2023 (in quarter-over-quarter, annualized terms). At first glance, the drop in growth to 1.6% in the first quarter of 2024 represents our forecast slowdown playing out, but this is not really the case yet. Net exports and inventories subtracted 1.2 percentage points from first quarter GDP growth; these two categories are statistically noisy, so quarter-to-quarter fluctuations aren’t a good signal of the underlying trend.

Excluding net exports and inventories categories, growth was a strong 2.8%, driven by solid growth (2.5%) in consumption and a 5.3% jump in private fixed investment. We can also observe that real GDP growth was up 3% in year-over-year terms in the first quarter. Therefore, the strong trend in GDP growth continues as of the first quarter of 2024.

Real GDP by Expenditure, % Quarter-Over-Quarter Growth (Annualized)

But we expect growth to slow quarter-over-quarter for the rest of 2024 stretching into early 2025.

Key factors to drive slower growth include:

- The delayed effect of tight monetary policy, which includes the ongoing slowdown in credit growth.

- The depletion in household excess savings, which should constrain consumption.

- Government spending growth should slow as state and local surpluses have been spent down. Also, federal spending growth is limited by budget agreements.

- The boom in building of manufacturing structures that was spurred by federal subsidies, especially semiconductors and electric vehicles, should level off.

GDP Growth, Quarterly Forecast

Contingent on our expectation of aggressive Fed rate cuts playing out, the economy should rebound strongly in the second half of 2025 with robust growth from 2026 to 2028. If the Fed waits too late to cut, it could cause a recession, but we think the Fed will move fast enough.

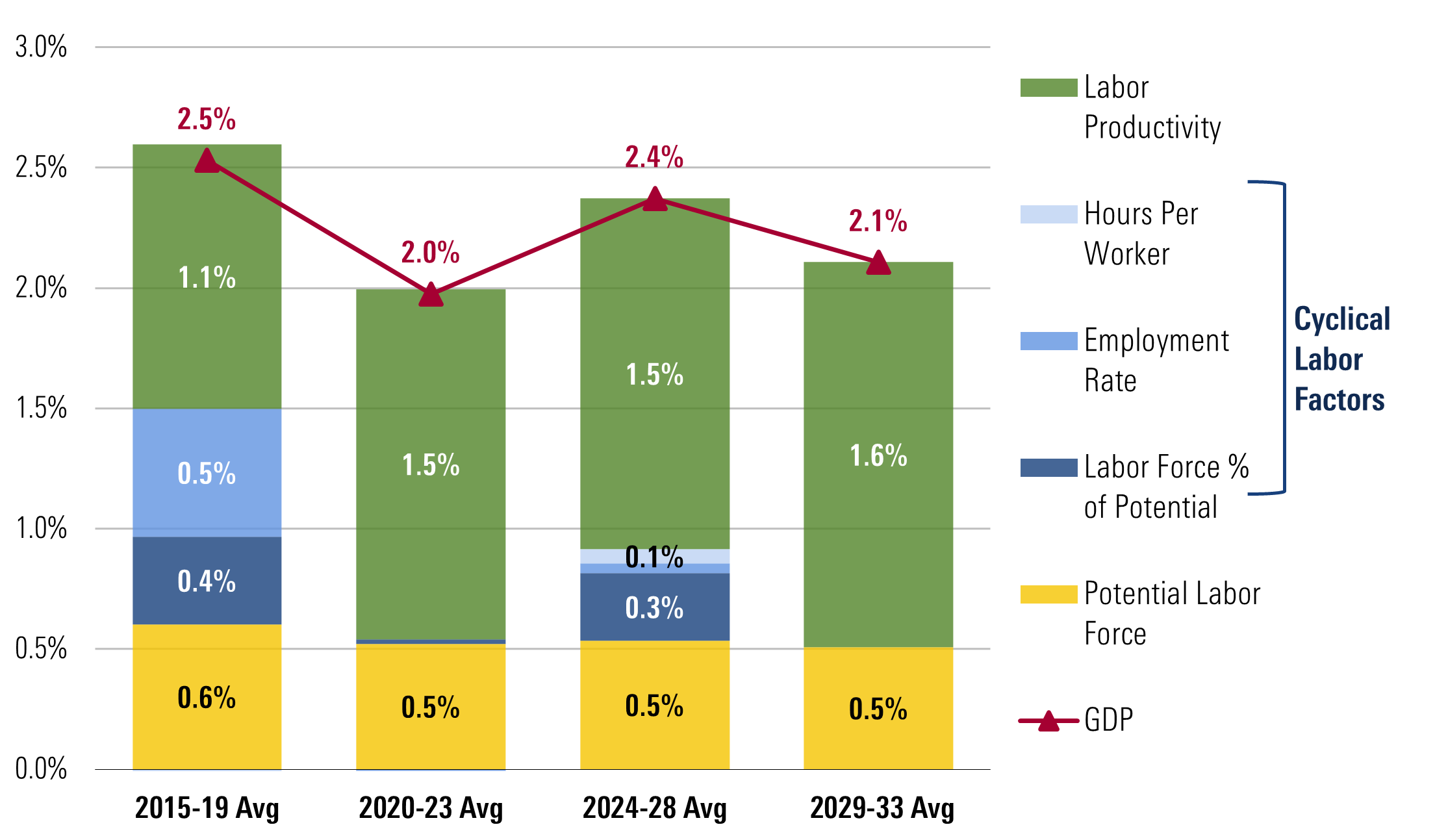

Our Supply-Side View Drives Our Bullish Long-Run GDP Forecast

Despite our somewhat bearish near-term views, over 2024-28 as a whole we’re bullish on GDP growth, expecting a cumulative 2 percentage points more growth than consensus estimates, owing to our optimism on labor supply and productivity.

On a five-year time horizon, our GDP forecasts are driven by our views on the supply side of the economy. This is because we assume the Fed will fulfill its goals of hitting its 2% inflation target and achieving full employment, which entails that the economy operates at full capacity (but no higher).

In terms of labor supply, we expect labor force participation (adjusted for demographics) to recover ahead of prepandemic rates as widespread job availability pulls in formerly discouraged workers.

We also expect productivity growth to maintain the solid performance demonstrated on average since the start of the pandemic. We expect productivity growth to average 1.4% from 2024 to 2028, in line with the 1.4% average over 2020-23.

US Real GDP Growth: Supply-Side Decomposition

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XF7WENSYN5BFBFLPPFH7BJYUHE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)