What Your Net Worth Statement Is Telling You

A summary of all your assets and liabilities is a crucial first step toward getting a better handle on your finances.

Compiling a net worth statement might seem like a tedious task. You’ll need to gather as much information as you can about all of your assets (including taxable accounts, tax-deferred accounts, real estate, and personal property) and liabilities (including mortgages and car loans). But it’s also one of the best ways to get a clear snapshot of your financial health.

In this article, I’ll walk through a hypothetical net worth statement and discuss how to interpret what it’s telling you.

Sample Net Worth Statement

To put together a net worth spreadsheet, you can find many free templates online to use as a starting point. If you’re more of a pen-and-paper person, you can use our printable PDF to get started. As mentioned above, you’ll want to gather as much information as you can before beginning.

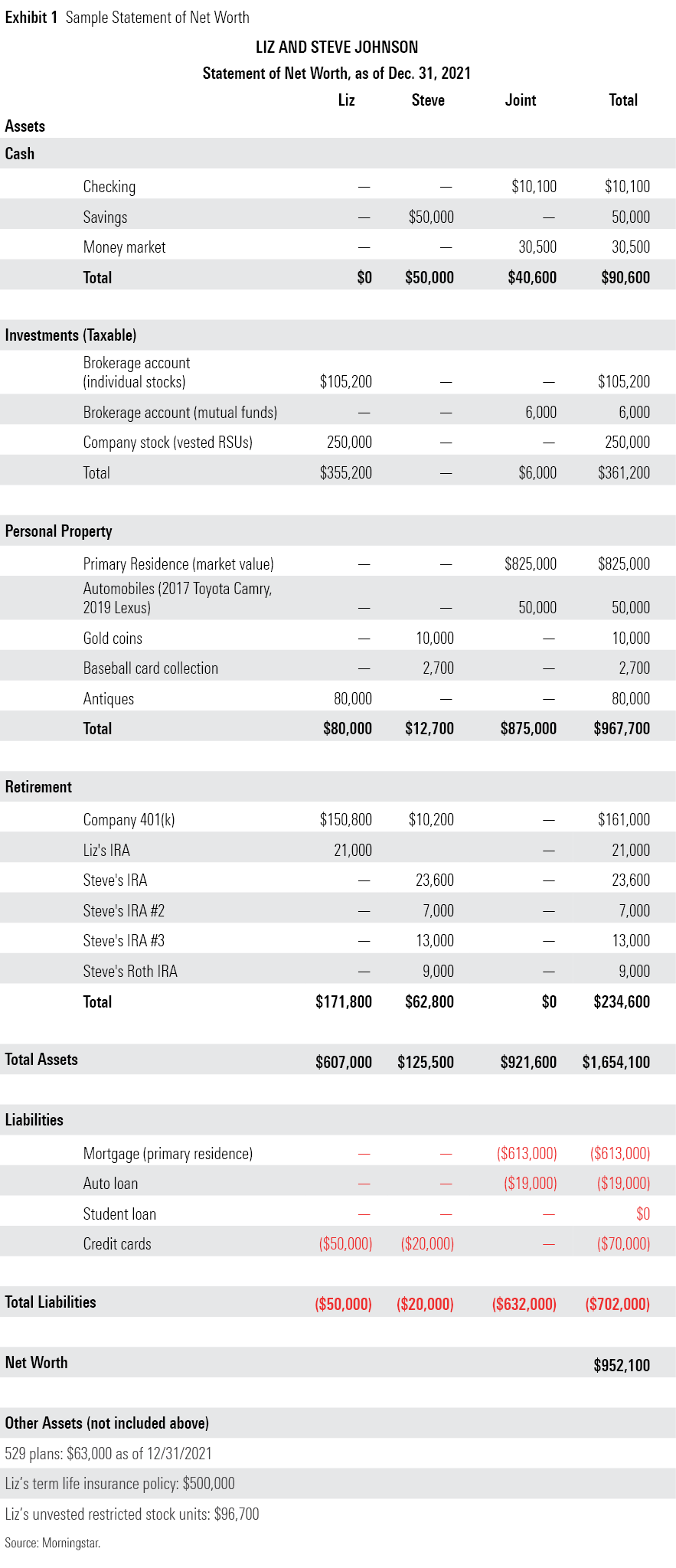

The net worth statement below is based on a fictional couple, Liz and Steve Johnson. Liz is a successful corporate attorney, and Steve worked as a programmer before stepping away from his career to become a stay-at-home dad. They’ve been married for 10 years and enjoy spending time with their two young children.

Overall net worth (assets minus liabilities): From a big-picture perspective, the ultimate insight from a net worth statement is exactly what it says: the net worth number, which is simply assets minus liabilities. The number in isolation doesn't tell you too much, but it is a useful benchmark to track over time. A negative net worth figure would obviously indicate room for improvement.

Debt ratio: To calculate your debt ratio, you’ll need to add up all required monthly debt payments, including mortgage payments, student loans, auto loans, and credit card debt. Then take the total and divide it by your monthly gross (pretax) income. Lower is better for this number, and any number greater than 43% will likely create problems in obtaining or refinancing a mortgage. Liz and Steve have a fair amount of debt, so focusing on paying off loans with higher interest rates will free up more cash flow that they can funnel toward other goals, such as retirement.

Emergency fund: Most financial advisors recommend keeping at least three to six months' worth of monthly living expenses in cash or other low-risk, highly liquid assets to cover a sudden job loss or other unforeseen events, such as car repairs, appliance replacement, or other home repairs. Some investors may want to keep closer to 12 months' worth of expenses in cash if variable pay makes up a significant portion of their total compensation. With about $181,000 in total cash assets, Liz and Steve are in decent shape here, although they could consider transferring Steve's savings balance to a joint account so both members of the couple can easily tap into emergency funds if needed.

Division of assets between partners: This question normally comes up in the context of divorce, but it can be worth considering for couples who plan to remain married, as well. Depending on your state’s estate-tax limits (and potential future changes to federal estate-tax laws), it can be beneficial for couples to try to balance out the assets owned by each individual. It’s also important for each member of a couple to have their own retirement assets. Fortunately, both Liz and Steve have retirement assets, although Steve isn’t currently accumulating assets as a stay-at-home parent. To address this, the couple could contribute to a spousal IRA for Steve. There’s no specific account type for a spousal IRA; it just refers to contributions to a Roth or traditional IRA for a nonearning spouse.

Allocation of assets among taxable, tax-deferred, and real estate holdings: Long before the advent of modern asset-allocation models, Talmudic law counseled keeping assets divided in three equal portions: “Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep by him in reserve.” Adapting this to modern portfolios might suggest keeping roughly equal allocations in residential real estate, taxable investments, and tax-deferred holdings, although those guidelines may not apply to every investor.

There’s no particular reason why the allocations need to be exactly one third each, but this principle helps avoid assets that are out of balance in any particular area. In particular, it’s wise to avoid an overly large concentration in residential real estate because it’s not particularly liquid. Investors should generally direct most of their savings toward tax-deferred retirement accounts, but once those have accumulated a healthy balance, it can make sense to steer some savings toward taxable accounts.

Single-company risk: If any one stock accounts for a large share of your net worth, that might be cause for concern. That’s particularly true in the case of employer stock because it means that your human capital (your ability to generate income and earn a living) and financial capital both depend on the fortunes of one company. Liz’s hefty stake in employer stock represents a risk because it accounts for nearly one third of the couple’s financial assets. The most conservative approach is to sell off employer stock until it consumes a smaller percentage of your total assets, although that usually means paying taxes on realized capital gains.

Liquidity and valuation issues: For most assets, valuation is straightforward. But things get a bit trickier for collectibles, such as antiques and baseball cards. The couple could consult an appraiser, especially if they plan to sell these assets at some point in the future. Valuation of the gold coins should be relatively easy to update, but Liz and Steve should make sure all of these assets are both securely stored and itemized on their homeowners' insurance policy.

Number of accounts: Life is complicated enough without having a bunch of financial accounts scattered across different institutions. It’s easy to accumulate multiple accounts if you changed jobs and never moved assets from a previous employer’s plan or set up different IRAs at different times. But the hassle of keeping track of account numbers, passwords, and updated account balances may not be worth it. That’s particularly true for investors approaching age 72 when required minimum distributions kick in. Investors don’t have to take RMDs from each account but will need to base their withdrawals on the account totals in every covered account. Having a limited number of accounts to deal with also makes things easier for family members if you die or become incapacitated.

Conclusion

A net worth statement doesn’t tell you everything you need to know about your financial situation. For example, Liz and Steve would need to do more analysis to figure out if they’re on track for future obligations, such as funding their retirement and college costs for their kids. But a net worth statement is a crucial starting point to get a better handle on your current financial picture.

A version of this article was previously published on Dec. 29, 2022.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZLDA7BGZZFCDHCDRMM4AZLHG4A.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)